SOYBEANS

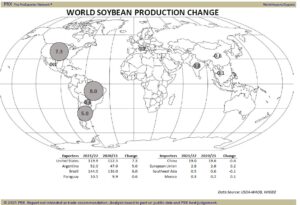

What a week. SN trading range was 15.96 to 16.77. SMN 423 to 456. BON 66.10 to 72.32. Trade was long going Into USDA May report. Most understood that USDA feels US 2020/21 soybean carryout cannot go down below 120 mil bu. Some thought they could increase US 2021/22 soybean crush due to higher biofuel soyoil demand and print a US 2021/22 soybean carryout closer to 100 versus the 10 they released. Some feel China will import more than 100 mt soybeans this year and 103 next year. Funs liquidated longs after a neutral report. Talk that navigation could be slow US barges to the gulf triggered new selling that hit sell stops below the market. There is no change in the fundamentals. US 2020/21 soybean supply should tighten due to strong crush margins. US 2021/22 soybean outlook also looks tight if US acres do not increase, yield is not near record and soybean demand does not increase as much as feared.

CORN

Corn futures also had a wild weekly ride. Trade was long going into USDA May report. Most could see USDA lower their US 2020/21 corn carryout due to higher exports, lower Brazil corn crop and raise China corn imports. At the same time they did not drop US 2021/22 carryout as much as hoped. CN weekly range was 7.17 to 7.71. Fundamentals have not changed. Corn prices could still trend higher if US corn acres do not increase, yield is not near record and US corn demand does not increase. Most still feel final Brazil corn crop could drop below 90 mmt which should increase US export demand and lower the carryout closer to 1,100. Some of the selling was also linked to the potential that 771 barges could be stopped above of weakened bridge near Memphis. Most now feel the river could reopen as soon as tonight or Saturday morning. Key now is weather. US north plains and PNW could remain dry. US Midwest 2 week forecast looks favorable for finishing US corn plantings and early growth. Key is summer weather. USDA estimates World 2021 corn crop near a record 1,189 mmt versus 1,128 this year. Domestic use at a record 1,181 versus 1,149 this year, trade at a record 197 mmt versus 186 this year and carryout at 292 mmt versus 283 this year. All good numbers for May.

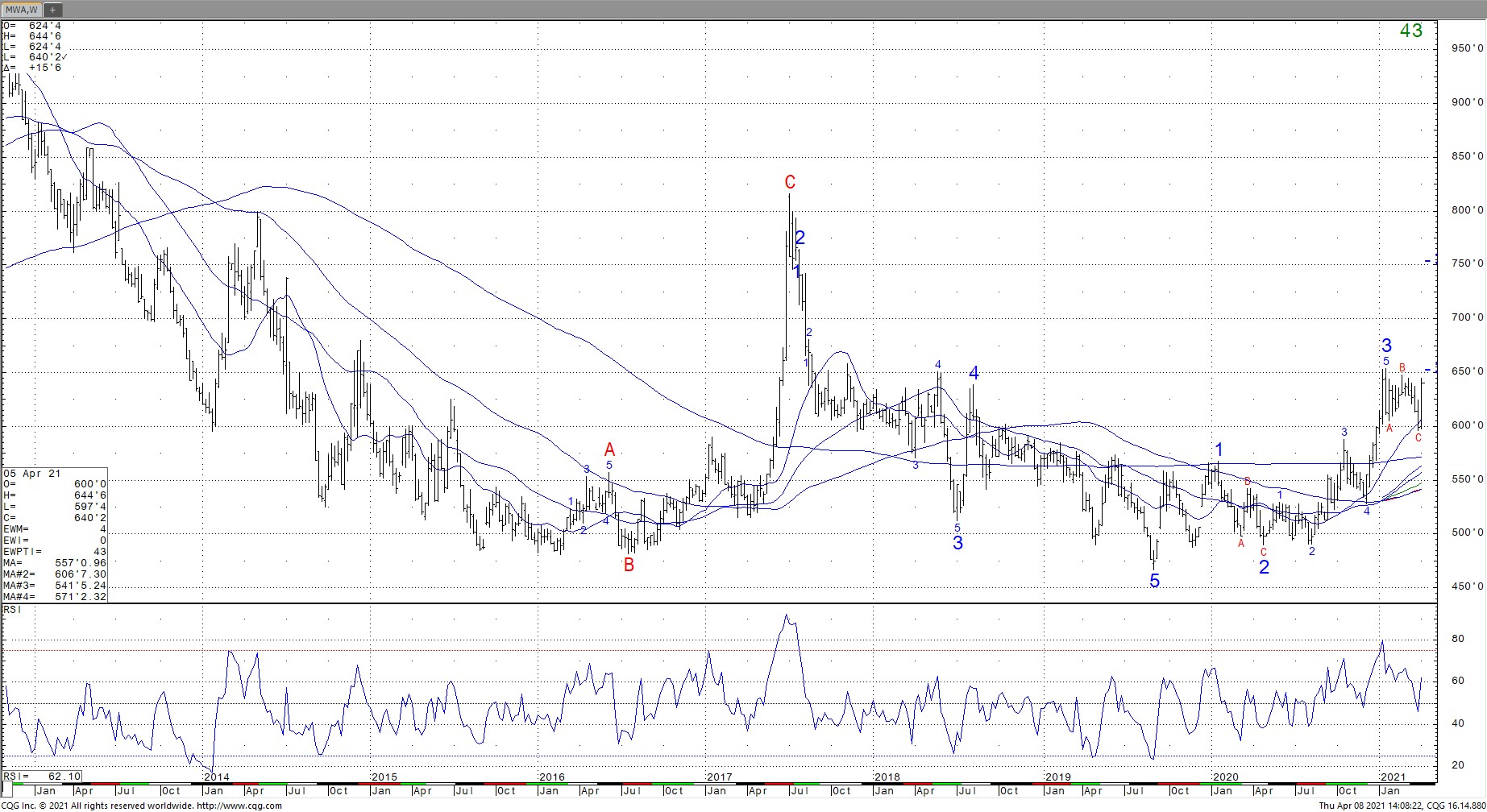

WHEAT

Wheat futures remain a follower to corn. For the moment Europe and Black Sea weather is ok. Wheat prices cannot drop below corn due to lack of supplies for increase feeding USDA is already estimating a record World 2021/22 wheat feeding estimate of 158 mmt vs157 last year and 139 the previous year. China wheat feeding is est near 35 mmt versus 40 this year and 19 the previous year. USDA estimates World 2021 wheat crop near a record 788 mmt versus 776 this year. Domestic use at a record 788 versus 780 this year, trade at a record 202 mmt versus 199 this year and carryout at 295 mmt versus 294 this year. All good numbers for May. They estimate Russia crop at 85 mmt versus 85 this year and exports at a record 40 mmt versus 39 this year, Interesting that USDA Russia Ag Attache est the crop near 77 mmt, exports 40 and end stocks 5 mmt vs USDA 15.

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice.

ADM Investor Services International Limited, registered in England No. 2547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG.

A subsidiary of Archer Daniels Midland Company.

© 2021 ADM Investor Services International Limited.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.