SOYBEANS

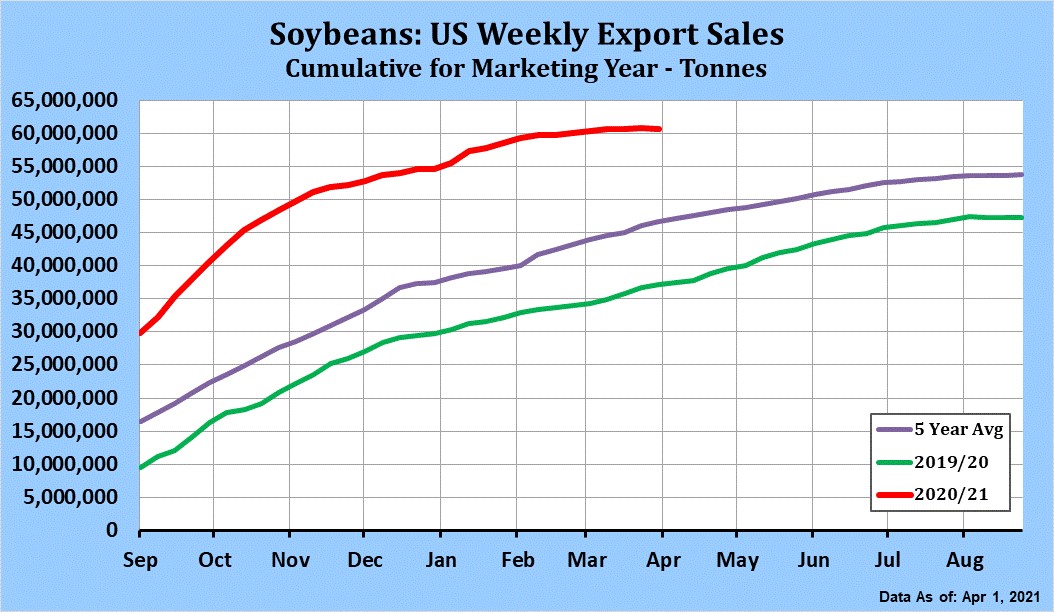

Soybean traded higher. Strong US cash basis helped rally prices from overnight lows. Fact USDA may be forced to lower US 2021/22 soybean demand to get a minimum pipeline 120 mil bu US 2021/22 soybean Carryout may have also supported SX to near new highs. Some feel China could take 40 mmt US soybean in 2021/22 versus 35 this year and US crush may need to be near 2,400 to meet potential new soyoil jet fuel demand. USDA Outlook yield and March acres could suggest a US 2021/22 soybean carryout of 25 mil bu unless USDA drops demand guess below most estimates. As always trade will be a lot smarter after USDA 11:00 numbers. Interesting to note that China COFEED will suspend data release, This could make it harder to gauge China crush and soybean import data. US north Midwest 2 week weather forecast turned drier overnight. US soybean planting is 42 pct done vs 24 last week.

CORN

Corn futures traded higher led by nearby July. CN rallied from overnight lows on announcement of new China new crop US corn sales and talk they are bidding for more. USDA has now announced 3.0 mmt new new crop sales to China, They were rumored to have bought 5-6 mmt. Some feel they could buy 30-35 mmt US corn in 2021/22 versus 23 this year. Interesting to note that China COFEED will suspend data release, This could make it harder to gauge China corn import data. US north Midwest 2 week weather forecast turned drier overnight. US corn planting is 67 pct done vs 46 last week. USDA Outlook yield and March acres could suggest a US 2021/22 corn carryout of 1,165 mil bu unless USDA drops demand guess below most estimates. As always trade will be a lot smarter after USDA 11:00 numbers. Trade will be also watching for USDA China 2020/21 imports, their guess of Brazil corn crop with some estimate as low as 85 mmt versus USDA 109.This could add 400-500 mil bu to US 2021/22 corn export demand. Brazil Parana state lowered their corn crop rating to 25 pct G/E. Trade will also watch USDA 2021/22 China corn imports with some est close to 50 mmt.

WHEAT

Wheat futures traded higher. Wheat rebounded off overnight lows and followed corn. There was some talk that US equities were lower due to concern about global inflations. Word of China increase interest in new crop US corn rallied corn. Talk of higher US domestic corn basis also helped rally corn with wheat following. Latest US weather maps reduced Canada prairie and US HRS rains fall. Some now look for a warm and dry 2 week forecast. USDA estimated US HRS plantings near 70 pct done versus 49 last week. There is some talk that US spring wheat farmers may be switch wheat acres to soybeans. Matif wheat futures rebounded from recent selloff. Recent rains have improved EU and Black Sea 2021 crops. US wheat export prices remain a premium to Baltic and Black Sea. Most do not expect much change in US/World 2020/21 wheat supply and demand report tomorrow. Some feel USDA March wheat acres and outlook yield could suggest a US 2021/22 wheat carryout of 715 mil bu.

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice.

ADM Investor Services International Limited, registered in England No. 2547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG.

A subsidiary of Archer Daniels Midland Company.

© 2021 ADM Investor Services International Limited.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.