CORN

Prices were down $.05 – $.08 today with weakness in wheat spilling over into corn. Better prospects for rain across northern growing areas of Brazil in the extended forecast also weighed on corn valuations. Next support for May-24 futures is at this month’s low at $4.22. Near term resistance at the 50 day MA currently $4.46 ¼. A recent US farmer survey suggests not as much shifting of corn acres to soybeans as forecast by the USDA in the February Outlook Conf. Price action from the past few sessions seem to be trying to swing some acres away from corn toward soybeans. Export sales at 51 mil. bu. were in line with expectations. YTD commitments at 1.595 bil. are up 27% from YA, vs. the USDA forecast of up 26%. In addition the USDA announced the sale of 100k mt (4 mil. bu.) of corn to Mexico. Today’s US drought monitor showed 36% of the US corn area in drought, up 4% from LW. The Rosario Grain Exchange held its Argentine production forecast unchanged at 57 mmt, just above the USDA forecast of 56 mmt.

SOYBEANS

Prices were not able to hold early strength as the soybean complex closed mixed. Beans were within $.02 with bear spreading noted, meal $1 higher, while oil was 15 – 20 lower. May-24 beans surged above the $12 level and its 50 day MA before pulling back. May-24 meal traded to a 3 week high before drifting back to near steady. May-24 oil surged to a 2 month high, trading thru resistance at its 100 day MA at 48.72. Heat and dryness will continue to impact areas of west central and interior south Brazil thru early next week before rains are expected to bring relief by late next week. Additional moisture will be needed thru April to support their 2nd corn crop. Export sales at 17 mil. bu. were at the low end of expectations. YTD commitments at 1.457 bil. are down 20% from YA, vs. the USDA forecast of down 14%. Soybean meal sales at 210k tons were also at the low end of expectations. YTD commitments are up 19% from YA, vs. the revised USDA forecast of up 8%. Bean oil exports at 11k tons were in line with expectations with YTD commitments now up 15% from YA vs. the USDA est. of down 21%. The recent surge in oil exports reflects how US BO prices have become more competitive in the global veg. oil market. The Rosario Grain Exchange raised its Argentine production forecast .5 mmt to 50 mmt, matching the USDA forecast. AgroConsults lowered their Brazilian production forecast 1.6 mmt to 152.2 mmt, just below the USDA est. of 155 mmt, however above Conab’s forecast of 146.8 mmt. Today’s US drought monitor showed 33% of the US soybean area in drought, up 2% from LW. Tomorrow’s NOPA crush is expected to members crushed 178 mil. bu. in Feb-24, down from 185.8 mil. in January, due to few # of days. This however would be well above the previous record for Feb. at 166.3 mil. bu. from 2020. Oil stocks are expected to build to 1.591 bil. lbs. up from 1.507 at the end of Jan-24.

WHEAT

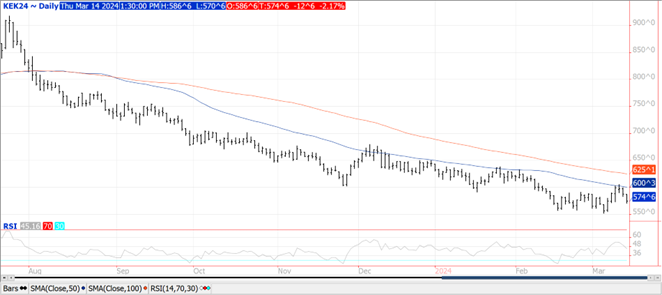

Prices were lower across all 3 classes today with Chicago and KC down $.10 – $.12, while MGEX was $.07 – $.08 lower. May-24 Chicago has given back most of its recent gains with support at the contract low of $5.23 ½. Support for May-24 KC is at $5.51 ½. Following recent cancellations of US and French wheat purchases, China has now reportedly canceled or pushed back 1 mmt of Australian wheat purchases. US old crop export sales at 3 mil. bu. were a MY low bringing YTD commitments to 680 mil., still up 4% over YA vs. the revised USDA forecast of down 6.5%. Today’s report shows 40 mil. bu. of SRW wheat sales to China, which is likely closer to 30 mil. taking into acct. Monday’s cancellations of another 10 mil. IKAR reports Russian grain production will reach 147 mmt in 2024, up from 144 mmt YA. Wheat production is expected to acct. for 93 mmt in 2024, vs. 91.6 mmt in 2023.

All charts provided by QST

>>See more market commentary here.

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice.

ADM Investor Services International Limited, registered in England No. 2547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG.

A subsidiary of Archer Daniels Midland Company.

© 2021 ADM Investor Services International Limited.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.