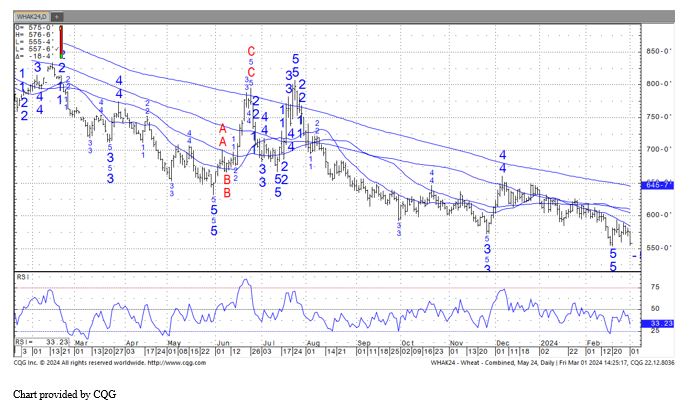

WHEAT

Chicago wheats ended sharply lower. Lower Russia export prices offers resistance. KWK found resistance near 5.86, MWK near 6.60. Matif March futures made new contract lows. Interesting that managed funds are covering Matif shorts but cash long liquidation weighed on futures. Ukraine plus Russia Feb exports are est near a record 6.5 mmt. S&P Global left their estimate of Russia wheat crop at 90 mmt and Ukraine 20 mmt. . KS, NE, OK, TX and CO wheat crop ratings are higher than last year and average. OH, IN, IL, MI, and MO wheat crop ratings are also above average.

CORN

Corn futures ended lower. CK is near 4.24. There is talk of increase China demand for Ukraine corn. Ukraine corn is offered near $171 versus US $190. Crude rallied on talk of higher China demand. Central Brazil could see rain next week. USDA tends to adjust South America crop size on their March report. There is a wide range of estimates for Brazil corn crop as low as 114 mmt vs USDA 124. S&P Global left their estimate of Brazil corn crop at 125 mmt. They reduced their estimate of the Argentina crop 2 mmt ot 55.0. Brazil farmers remain slow sellers of their crop due to dry weather and drop is prices.

SOYBEANS

Soybean were higher. Soymeal futures were higher. There continues to be unconfirmed talk that US may control the imports of used China cooking oil and Canada RSO for renewable fuel production. US missed SAF deadline to determine eligible feedstocks for aviation fuel tax credits. US. Jan US soybean crush is expected to be a new record for January. Most doubt USDA will make much changes to US 2023/24 soybean carryout in March but could increase crush and lower exports equal amount. Abiove est Brazil soybean crop at 153.8 mmt vs 156.1 previous and 159 ly. Brazil exports were est at 97.8 mmt vs 98.1 previous and 101.8 ly. S&P Global left their estimate of Brazil soybean crop at 153 mmt. They reduced their estimate of the Argentina crop 1 mmt ot 52.0. Brazil farmers slowed cash sales. Brazil soybean export prices are still lower than US.

Chart provided by CQG

>>See more market commentary here.

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice.

ADM Investor Services International Limited, registered in England No. 2547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG.

A subsidiary of Archer Daniels Midland Company.

© 2021 ADM Investor Services International Limited.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.