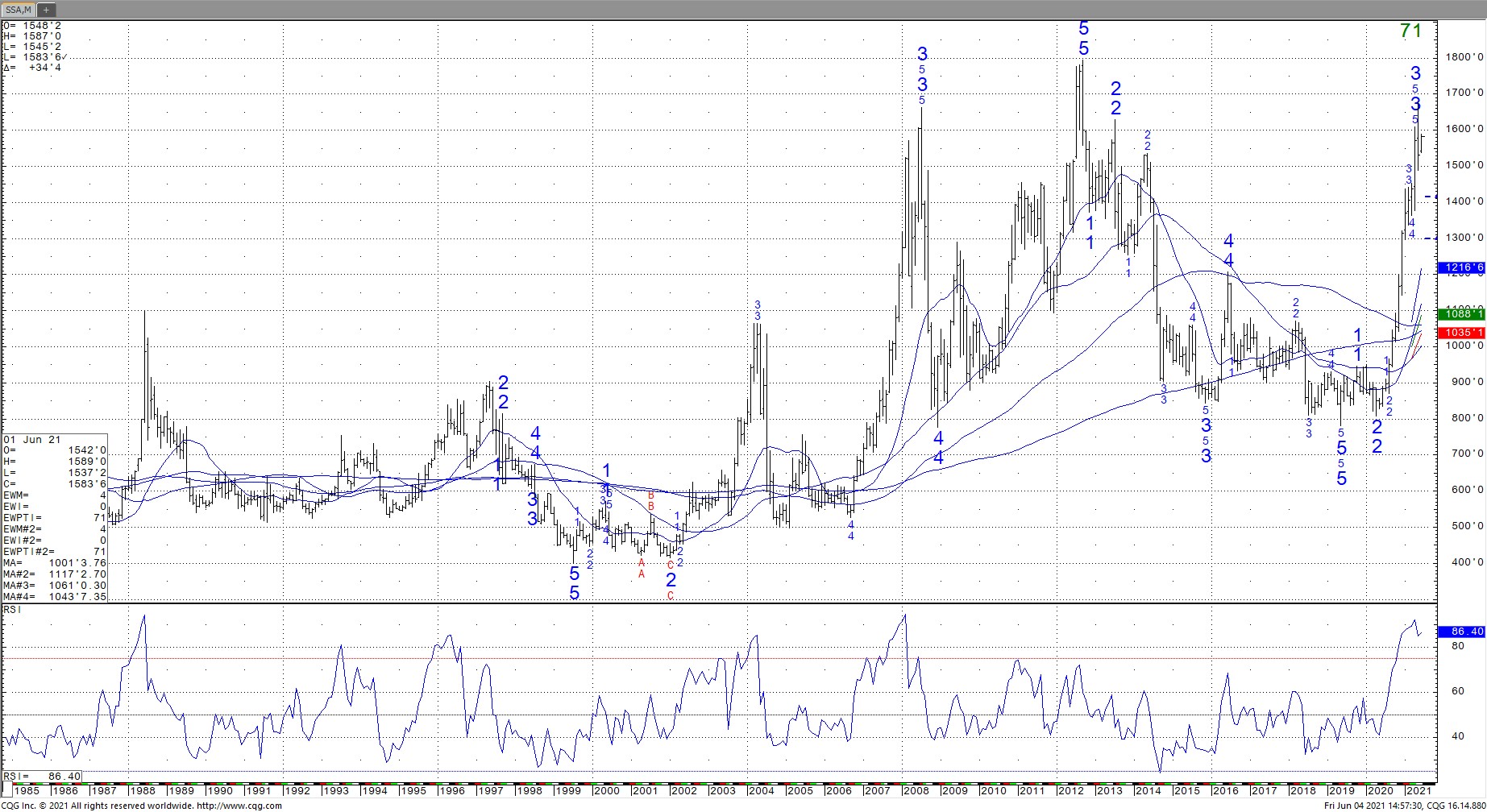

SOYBEANS

Soybeans and soyoil traded sharply higher. Dry US upper Midwest and north plains weather forecast increased new buying into next week. There is also strong indication that China could take more US soybeans in 2021/22 than this year. Trade though feels USDA will not make a lot of changes on their June 10 US/World S/D. Today, Informa est US 2021 soybean crop near 122 mmt vs 112 last year. Brazil 2021 soybean crop is est near 139 mmt vs 128 last year. They also est 2022 crop at 140. Argentina 2021 soybean crop is est near 44 mmt vs 49 last year. They also est 2022 crop at 54. Average traded guess for US 2020/21 soybean carryout is 122 mil bu vs USDA 120 and 2021/22 carryout near 143 vs USDA 140.

Nearby Soybean Monthly Futures chart by CQG

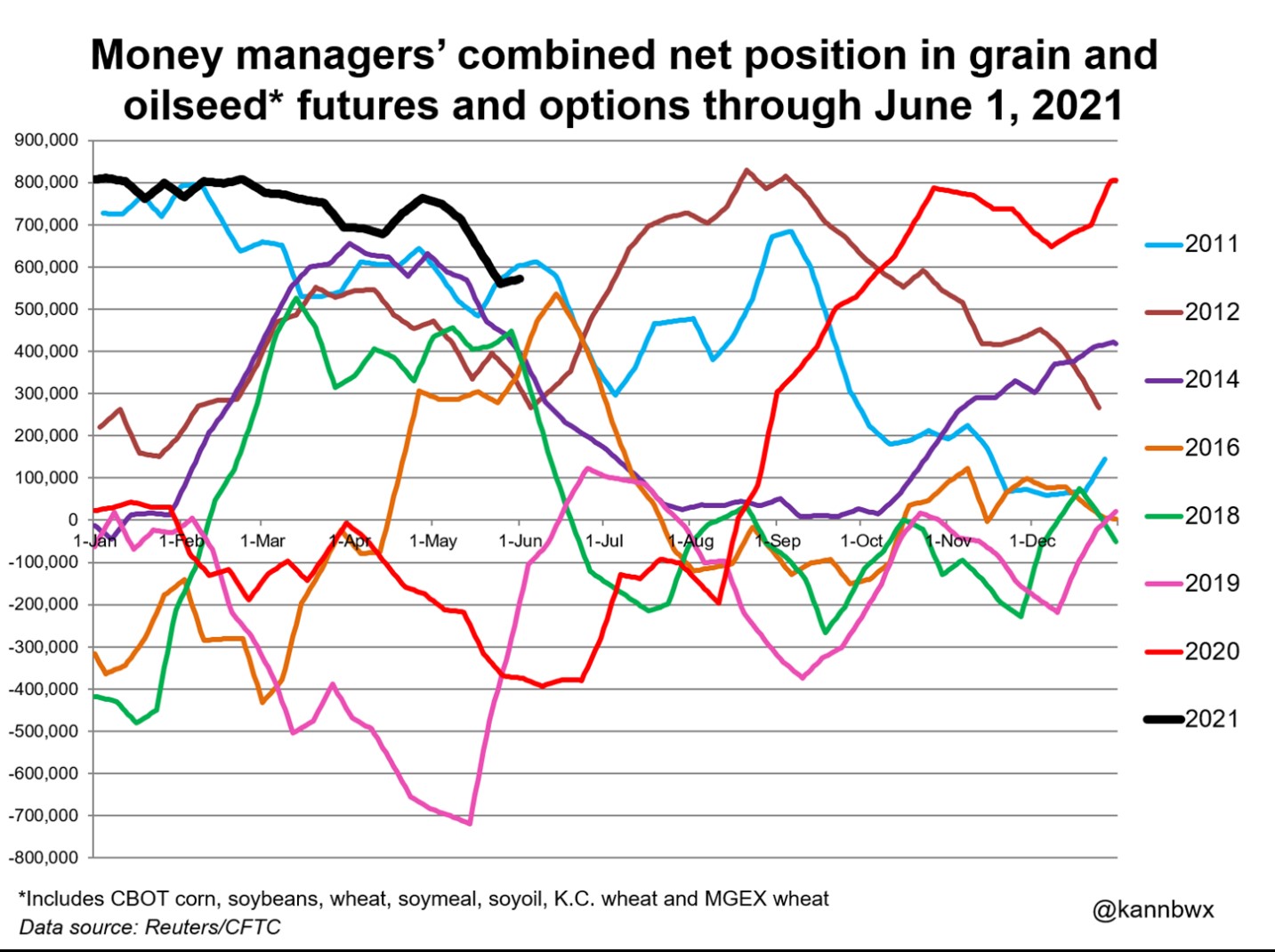

CORN

Corn futures traded higher on concern that US crop could be stressed if the next 2-3 weeks are warmer and drier over parts of the US upper Midwest and north plains. 27 pct of US corn acres are under severe drought. 10 pct of US corn acres are in ND/SD. One SD farmer said today, farmers there are haying winter Wheat crop and could lose their spring crops if rains do not fall soon. One weather watcher today said he feels long range US weather maps look now like 2012. Today, Informa est US 2021 corn crop near 360 mmt vs 345 last year. They also est US 2021 corn crop at 406. Brazil 2021 corn crop is est down to 88 mmt vs 103 last year. They also est 2022 crop at 119. Argentina 2021 corn crop is est near 47 mmt vs 51 last year. They also est 2022 crop at 53. Average traded guess for US 2020/21 corn carryout is 1,203 mil bu vs USDA 1,257 and 2021/22 carryout near 1,417 vs USDA 1,507. Most feel final 20/21 carryout could be closer to 1,100 and 21/22 1,200 with a normal crop!! There is also strong indication that China could take more US corn in 2021/22 than this year. US corn export commit is near 2,721 mil bu vs 1,593 ly. China unshipped open sales are near 330 mil bu. New US corn crop sales are near record 593 mil bu.

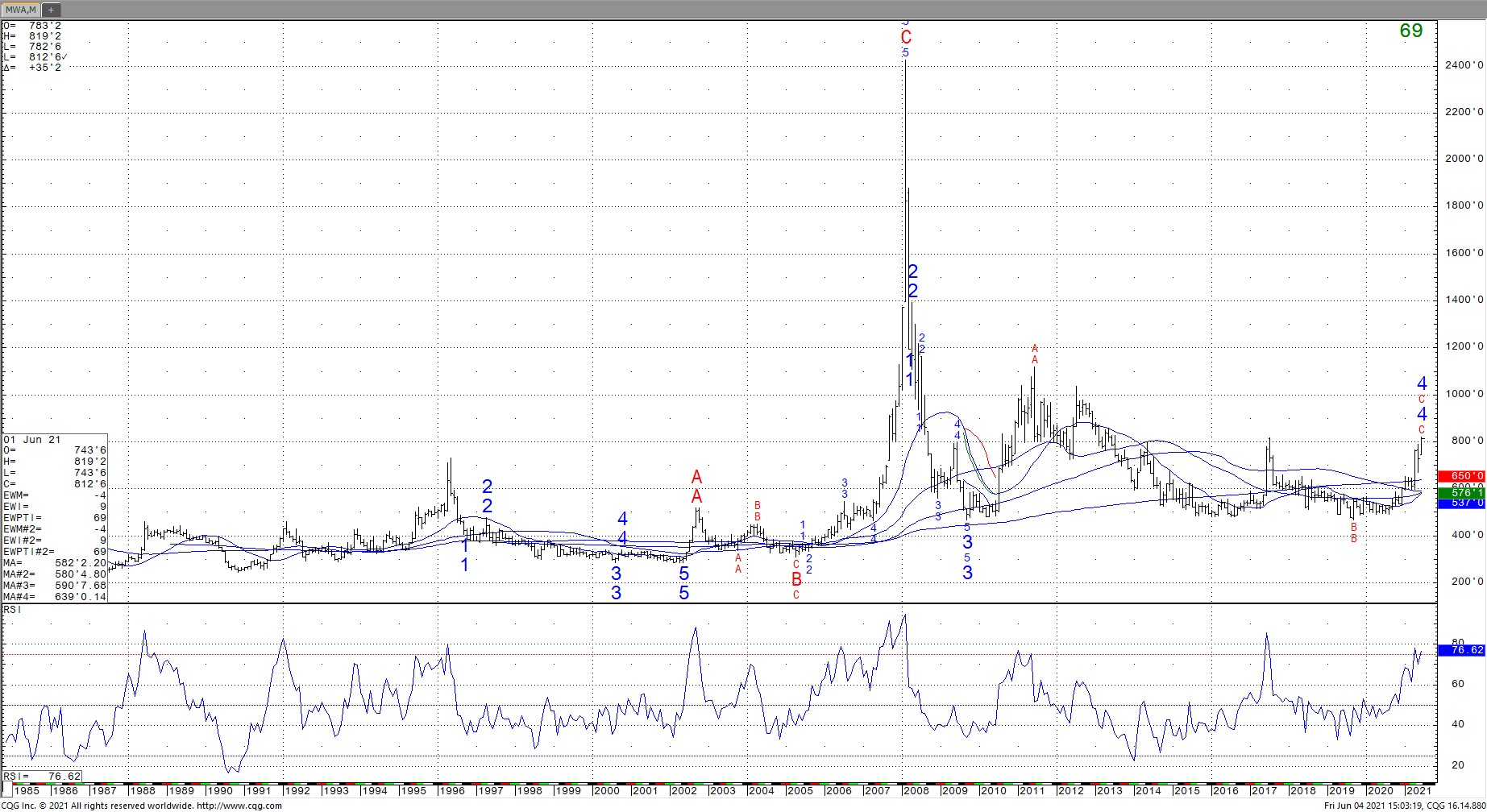

WHEAT

Wheat futures traded higher. Lower US Dollar and higher commodity prices may have helped WN and KWN. Last 4 trading days WN has traded between 50 day moving average support near 6.77 and 50 Day resistance near 6.92. KWN has traded near the 50 and 100 day moving average near 6.32 and 6.37. Resistance is the 20 day near 6.46. Talk of higher US HRW crop offers resistance. US export demand is also slow but there could be record HRW feeding. MWN has jumped from a low near 6.68 to todays high near 8.19 in just 6 trading days. Dry US north plains and Canada prairie 2-3 week forecast continues to push Minneapolis spring wheat futures higher. Today, Informa est US 2021 wheat crop near 1,924 mil bu vs 1,826 last year. Winter wheat 1,300 vs 1,171. HRW 759 vs 659, SRW 335 vs 266. White 261 vs 302. Durum 64 vs 69. Some feel HRS and Durum may be too high. Also, today Informa est US 2021 wheat crop near 52 mmt vs 49 ly. EU 2021 crop is est near 135 mmt vs 125 ly. Russia 2021 crop is est near 82 mmt vs 85 last year. Canada 2021 crop is est near 32 mmt vs 35 ly. China 2021 crop est near 136 mmt vs 134 last year.

Nearby Minneapolis Monthly Wheat Futures chart by CQG

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice.

ADM Investor Services International Limited, registered in England No. 2547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG.

A subsidiary of Archer Daniels Midland Company.

© 2021 ADM Investor Services International Limited.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.