SOYBEANS

Soybean futures traded sharply lower and one of the largest daily losses ever. Futures increased the selloff after USDA raised US soybean carryout and weather maps forecasted needed US rains over the next 2 weeks. Maps do differ on amounts and coverage. Our weather guy was looking for these rains earlier in June and could still see drier and warmer US July and August weather. Still, Managed momentum funds were heavy sellers with few buyers willing to step in front of this freight train. Warm and dry weather this week is expected to drop weekly US soybean crop ratings on Monday. Weather forecast should help crops in east and south. Weekly US soybean exports sales were only 2.4 mil bushels. Total commit is near 2,127 mil bu vs 1,337 last year. USDA goal is 2,280. Some feel final exports could be closer to 2,350. China shipments are near 1,260 mi bu with total commit near 1,285. Talk that Biden could lower the biofuel mandate and offer waivers for refiners has dropped Rin values and continues to weigh on soyoil futures. US farmers loss $4.5 billion dollar of potential soybean revenues in just one trading day.

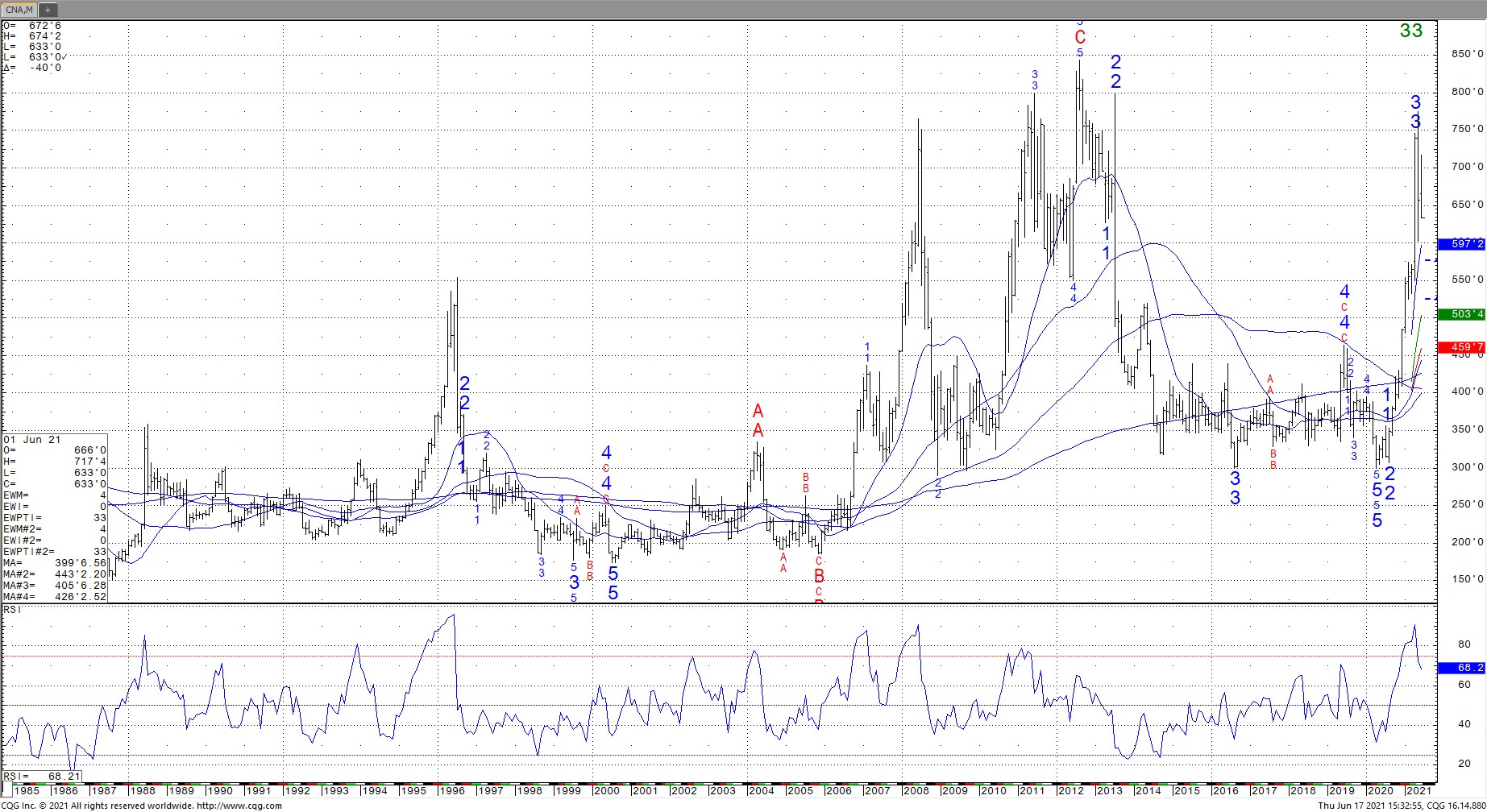

CQG Monthly soybean futures chart

CORN

Corn futures were down the daily price limit. Corn continued to traded lower after USDA failed to lower the Brazil corn crop and raise US exports as much as expected. Prices also dropped after US weather map models forecast US Midwest rains over the next 2 weeks. This after weekly US corn ratings dropped more in one week than ever. Dry and warm weather should drop ratings again on Monday. Still Managed momentum traders increased selling as futures dropped below key support levels. Most commodities were lower and US Dollar was sharply higher following hawkish US Fed comments. Seems like overnight trade is assuming US economy will slow which would slow commodity demand. Weekly US ethanol data was negative with production down and stocks up. Weekly US corn exports sales were only 700 thousand bushels. Total commit is near 2,148 mil bu vs 1,225 last year. USDA goal is 2,450. Some feel final exports could be closer to 2,900. China shipments are near 620 mi bu with total commit near 1,031.US farmers loss $13.5 billion dollar of potential corn revenues since USDA report. Corn synthetically was offered at July 6.30 1/2 , Sep 5.48 ½, Dec 5.31, March,21 5.39 and May,21 543 ¾.

CQG Monthly corn futures chart

WHEAT

Wheat futures traded lower following the limit down move in corn, sharply higher US dollar and risk off in most commodities. US Fed hawkish comments almost erased most commodity gains so far this year. Some fear tapering and eventually higher interest rates could slow the economy and commodity demand. US wheat export prices are still a premium to EU and Black Sea. Weekly US wheat exports sales were only 10.5 mil bushels. Total commit is near 213 mil bu vs 233 last year. USDA goal is 900. Some feel final total wheat demand could be higher than USDA and final crop lower. Over next 2 weeks parts of Russia could see hot and windy weather that could stress crops there. WU finished near 6.43. Range was 6.40-6.70. KWU finished near 5.86. Range was 5.83-6.13. MWU finished near7.51. Range was 7.39-7.75. US weather could slow SRW harvest but speed up HRW harvest. Weather could continue to stress US HRS and Durum crop and Canada HRS crop.

CQG Monthly Chicago wheat futures chart

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice.

ADM Investor Services International Limited, registered in England No. 2547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG.

A subsidiary of Archer Daniels Midland Company.

© 2021 ADM Investor Services International Limited.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.