SOYBEANS

Soybeans traded lower. Limit down move is soyoil weighed on soybeans with SN below 14.50. SX dropped below 13.50. at the end of the day, Managed funds sold 16,000 soybeans, 22,000 soyoil and bought 5,000 soymeal. Weekly old crop soybean sales are est near -100/200 vs 15 last week. New crop 100-300 vs 105 last week. USDA est 20/21 exports at 2,280 and 21/22 at 2,075. Both could be 50-100 too low. This week, USDA dropped US soybean crop ratings to 62 pct G/E with IL down 11, IA down 12 and MN down 9. Lack of rains this week could drop ratings next week. The models are mixed for next weeks US weather. GFS calls for rains across most of the Midwest. Canadian model suggest scattered showers favoring the east and south. EU model is dry. Soybean prices may be undervalued if next 30 day US NW Midwest rains are below normal.

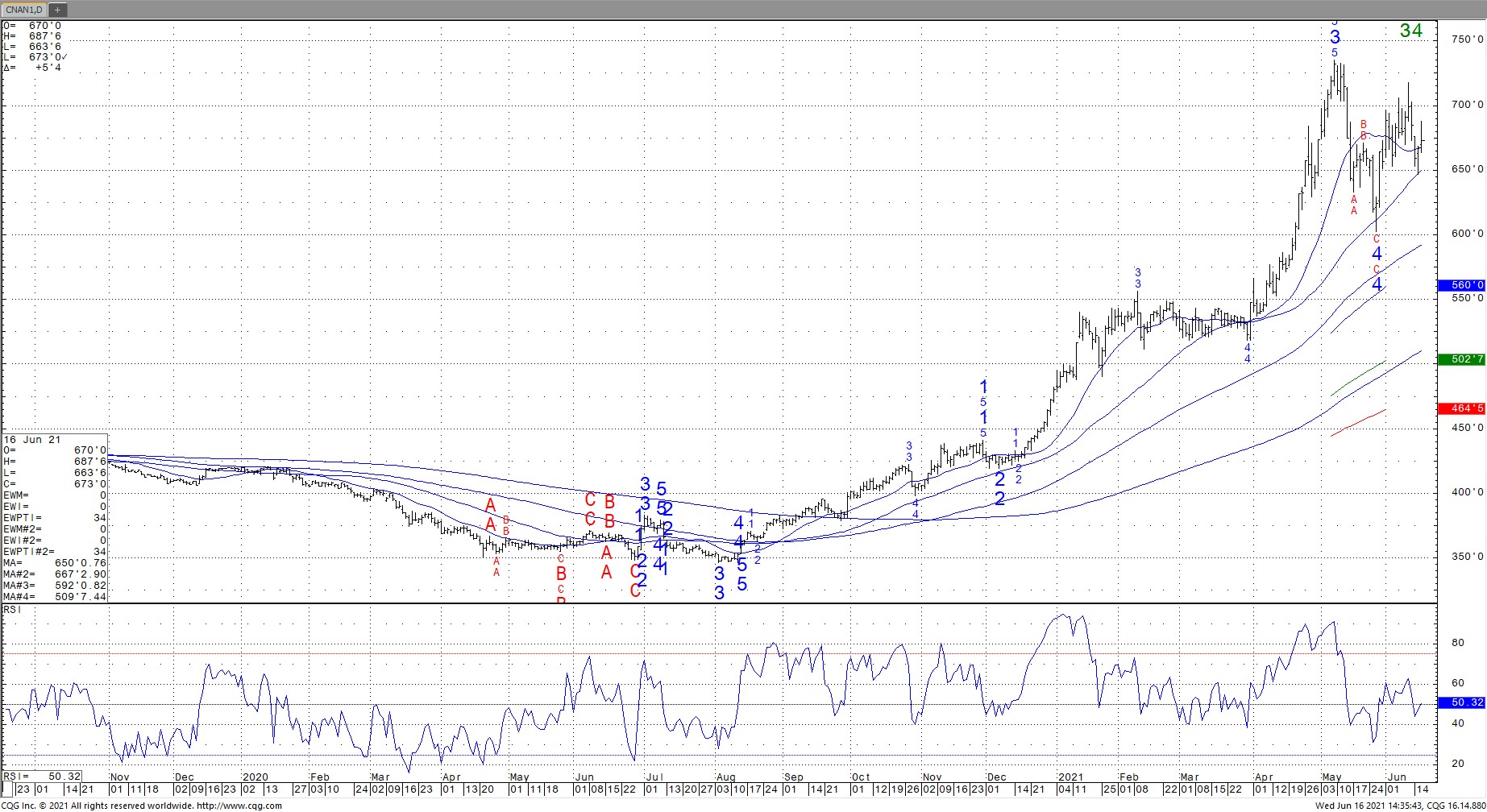

Nearby July soybean futures CQG chart

CORN

Corn futures were mixed. CN traded higher and near 6.73. Range was 6.63-6.87. CZ finished down 1 cent and near 5.72. Range was 5.66-5.85. Nearby corn supported by talk of commercial buying. Weekly US corn ethanol production was down 4 pct from last week but still up 22 pct from last year. Stocks were up 3 pct from last week and down 2 pct from last year. Margins declined. Talk Biden might adjust biofuel mandate may have offered resistance to corn prices. Weekly old crop corn sales are est near -100/400 vs 189 last week. New crop 100-500 vs 26 last week. USDA est 20/21 exports at 2,850 and 21/22 at 2,450. Both could be 200-330 too low. China announced they would begin to sale imported corn from their reserve. This is to try to lower record high domestic prices. Some feel China has slowed new corn buying due to increase congestion at ports and talk of increase domestic wheat and rice feeding above record levels. This week, USDA dropped US corn crop ratings to 68 pct G/E with IL down 6, IA down 14 and MN down 11. Lack of rains this week could drop ratings next week. The models are mixed for next weeks US weather. GFS calls for rains across most of the Midwest. Canadian model suggest scattered showers favoring the east and south. EU model is dry. Corn prices may be undervalued if next 30 day US NW Midwest rains are below normal.

Nearby July corn futures CQG chart

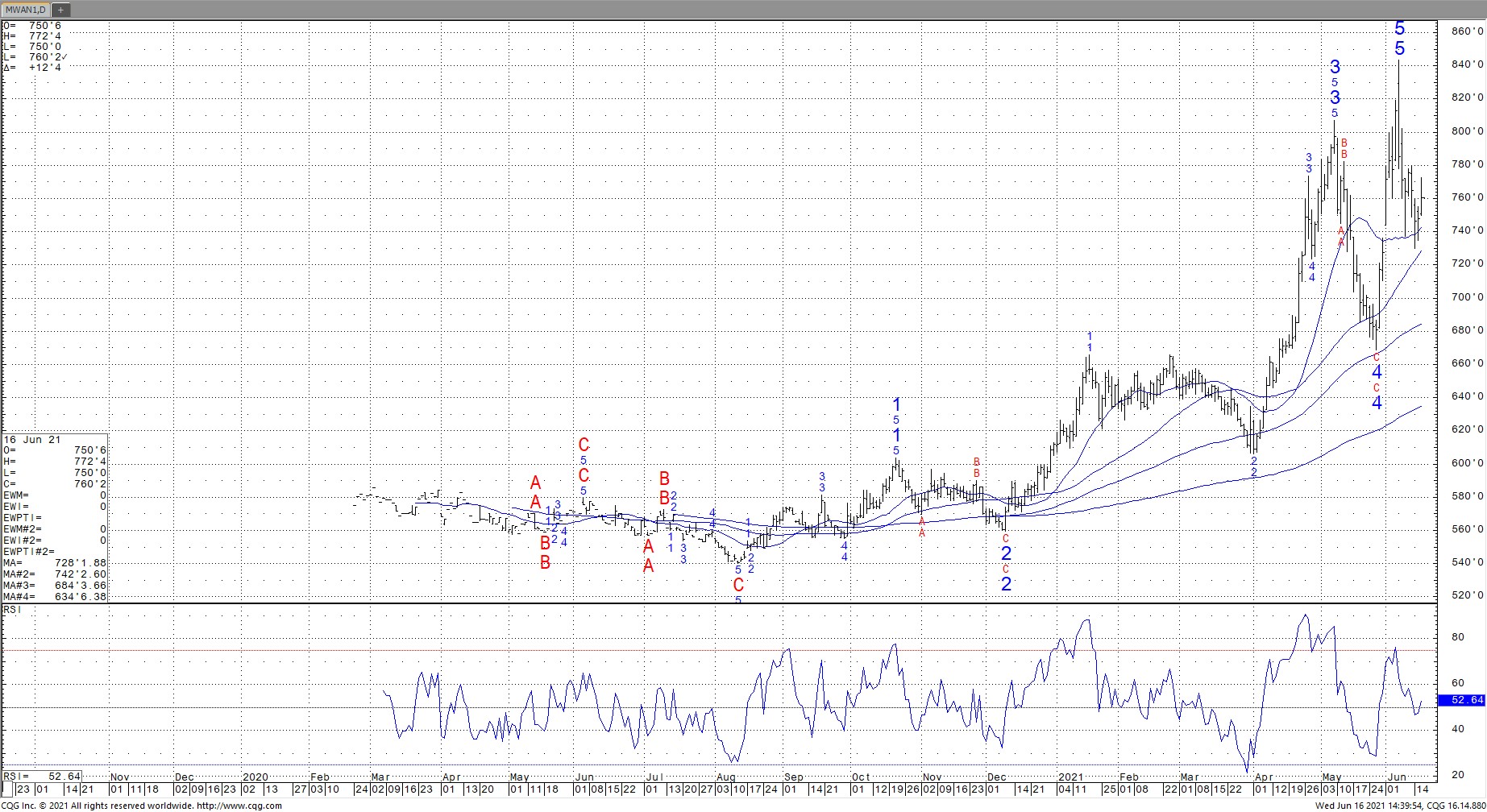

WHEAT

Wheat futures traded mixed. Volatile weather trade in corn slipped into wheat. WN finished up 1 cent and near 6.62. Range was 6.58-6.72. KWN ended down 1 cent and near 6.11. Range was 6.08-6.22. MWN ended up 12 cents and near 7.60. Range was 7.50-7.72. Rains across US SRW areas could slow harvest but conditions are favorable for above average yields. OK harvest suggest above average test weight and yields and lower protein. HRW crop could be above USDA latest guess. Both HRW and SRW domestic feeding could be record high. Dry and warm forecast could lower US HRS crop ratings further and final crop size. Weekly US wheat export sales are est near200-350 mt versus 325 last week. USDA est exports near 900 mil bu vs 985 last year. US winter wheat end user Q3 coverage is est near 70 pct and 20 pct Q4. Large end users may be long 2022 futures but little basis has been bought to date. S Russia could see hot and windy weather next week.

Nearby Minneapolis July futures CQG chart

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice.

ADM Investor Services International Limited, registered in England No. 2547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG.

A subsidiary of Archer Daniels Midland Company.

© 2021 ADM Investor Services International Limited.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.