CORN

Prices were $.03 – $.06 lower today. Mch-24 held above its contract low at $4.36 ¾. Resistance is at last week’s high of $4.53 ¼ followed by the 50 day MA at $4.70 ¼. Recent rains across northern growing regions in Brazil has not only improved their soybean production prospects, but have also help build moisture reserves for the 2nd corn crop where plantings have reached 11%. A Hong Kong judge ordered China’s largest property developer, Evergrande Group, to liquidate assets as they have been in debt default for just over 2 years. Export inspections at nearly 36 mil. bu. were in line with expectations. YTD inspections at 616 mil. bu. are up 30% from YA, vs. the USDA forecast of up 26%. Last week Money managers were net sellers of nearly 5,000 contracts extending their short position to just over 265k, the largest since June-2020. Their record short position was just over 322k in April-2019. The Eu Commission held their EU 2023/24 corn production forecast unchanged at 61.4 mmt, slightly above the USDA forecast of 60.1 mmt. They also held their corn import forecast unchanged at 19 mmt, well below the USDA est. of 23.5 mmt. With ending stock likely to remain in excess of 2.1 bil. bu. the path of least resistance remains lower.

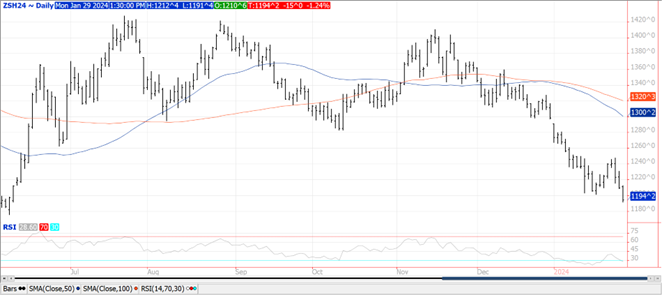

SOYBEANS

The soybean complex was mixed today with beans $.05 – $.15 lower with bear spreading noted, oil plunged 100 – 140, while meal jumped $2 – $5. Mch-24 beans broke below $12 carving a fresh 7 month in the process. Next support between $11.70 – $11.75. A new 8 month low for Mch-24 oil with next support at the May-23 low at 44.49. Mch-24 meal rebounded after trading to nearly a 2 year low. Support is at $344 with near term resistance at Friday’s high just above $360. Prior to today’s rebound, US meal prices are below SA origin awaiting Argentine harvest. Production estimates for Brazil will likely level off, or even firm up following recent showers across the northern growing regions. Rains will gradually work south improving crop prospects for much of the country. Crop stress in Argentina will be on the rise this week as dryness and above normal temperatures remain intact until next weekend. Some mild relief expected Sat. thru Tues with cooler temperature and scattered showers. A more widespread rain event is not until the end of the following week. The wide gap between US and Brazilian bean prices has fueled talk of Brazilian imports into the US East Coast by poultry operators. Also weighing on spreads is talk that China may have rolled back 3-5 cargoes of US soybeans from Feb to March due to surging freight costs. Spot board crush margins jumped $.11 ½ today to $.86 bu. Soybean meal PV gained a full 1% today to 61%. AgRural estimates Brazil’s harvest has reached 11% up from 6% LW and 5% YA. Export inspections at 33 mil. bu. were in line with expectations. YTD inspections at 1.016 bil. are down 24% from YA, vs. the USDA forecast of down 12%. Last week MM’s were net sellers of roughly 15k contracts of both soybeans and meal, while buying just over 2k bean oil. Their net short position in the soybean complex has swelled to nearly 156,000 contracts, the largest since Sept-2019. Key usage figures due out later this week with monthly EIA biofuel production, capacity and feedstock usage data on Wednesday, along with Dec-23 census soybean crush on Thursday.

WHEAT

Prices were $.06 – $.10 lower across all three classes today. Mch-24 Chicago has held support above last week’s low at $5.87. Same for Mch-24 KC at $6.01. Next support for Mch-24 MGEX is the contract low at $6.78 ¾. Little moisture across the US midsection the next 5 days. The exception being lite rainfall in the Great Lakes region and ECB along with the Southern Plains. Better prospects for rains for the WCB in both the 6-10 and 8-14 day outlooks. Export inspections at only 10 mil. bu. were below expectations. YTD inspections at 404 mil. bu. are down 17% from YA, vs. the USDA forecast of down only 4.5%. IKAR reports Russia’s wheat price ended last week at $235/mt FOB, down $3 from the previous week. Russian grain exports last week totaled 650k mt, down from 750k mt the previous week. Wheat exports totaled 580k mt. A South Korean wheat miller is tendering for 100k mt of Australian or US milling wheat for April/May shipment. Last week MM’s were net buyers of just over 4k contracts of Chicago wheat while being lite sellers of MGEX and lite buyers of KC. The MM’s short holdings in MGEX wheat at just over 30k is within 700 contracts of their record large short position. The EU Commission increased their 2023/24 EU soft wheat production forecast .2 mmt to 125.9 mmt. They left their export forecast unchanged at 31 mmt.

See more market commentary here.

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice.

ADM Investor Services International Limited, registered in England No. 2547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG.

A subsidiary of Archer Daniels Midland Company.

© 2021 ADM Investor Services International Limited.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.