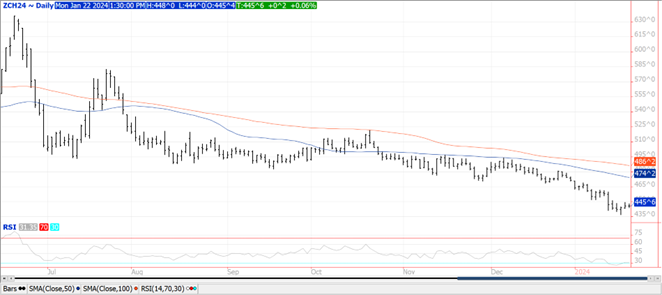

CORN

Prices were steady to $.00 ½ today in uneventful trade. It was an inside trading session for Mch-24. Support is at the contract low of $4.36 ¾ with resistance at $4.62. Heavy rains are expected this week along the US Gulf coast and Delta regions cutting into drought conditions. Little moisture is expected in the northern plains and western corn belt. Drought conditions are likely to deepen in western Iowa, eastern NE and KS. Export inspections at 28 mil. bu. were at the low end of expectations. YTD inspections at 579 mil. are up 28% from YA, vs the USDA forecast of up 26%. Last week Money managers sold nearly 30k contracts, extending their short position to just over 260k contracts, their largest short position since June-2020. Index funds however were net buyers of just over 20k. AgRural estimates Brazil’s 1st corn harvest has reached 8%, with 2nd crop plantings in the center south region having reached 5%. Algeria is back seeking 160k mt of feed corn in a tender that closes tomorrow. S&P Global is projecting US corn acres in 2024 to slip to 93 mil., while down 1.641 bil. from 2023, their updated estimate is up 500k acres from last month.

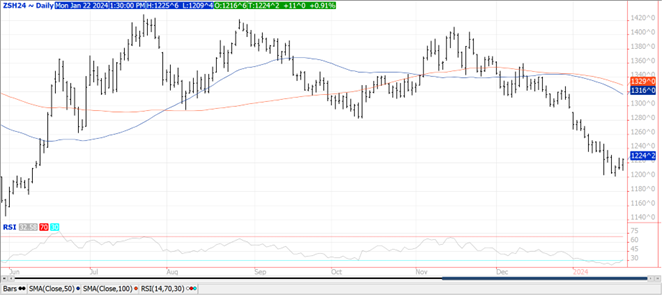

SOYBEANS

Prices were mixed with beans and oil reaching session highs near the close. Beans were $.06 – $.11 higher, oil was up 110 – 125, while meal was down less than $1. Despite the strong close Mch-24 beans failed to trade above Friday’s high of $12.27. First support below the market is at $12.01. Mch-24 oil briefly traded above resistance at 48.20 before settling back a touch. First support at last week’s low of 46.58. While Mch-24 meal traded to its lowest level since the summer of 2022 it held above support at $351.30, a low on the weekly chart. While conditions in Brazil remain mostly favorable, Argentina is expected to remain dry thru the end of January elevating crop stress in Central and Southern Buenos Aires and La Pampa. Follow up rains will be needed by early Feb-24 to avoid production losses. Spot board crush margins were little changed today holding near $.88 bu. however bean oil PV surged to 40.4%, a 3 ½ month high. Export inspections at 43 mil. bu. were in line with expectations. YTD inspections at 983 mil. are down 22% from YA, vs the USDA forecast of down 12%. Roughly 29 mil. bu. were destined for China. Last week MM’s were net sellers across the soybean complex. Their position in soybean meal flipped around to net short for the first time since Nov-2021. Their net short position in the bean complex has reached nearly 128k contracts, the largest since Feb-2020. AgRural estimates Brazil’s soybean harvest has reached 6%. S&P Global is projecting US soybean acres to increase 1.9 mil. in 2024, to 85.5 mil., however this is down 500k acres from their previous est.

WHEAT

Prices were mostly higher with Chicago and MGEX up $.01 – $.05 while KC was mixed and with a penny of unchanged. Mch-24 Chicago briefly traded over $6 with key resistance at the 50 and 100 day MA’s at $6.04 ¾ and $6.06 ¼ respectively. First resistance for Mch-24 KC is last week’s high at $6.22 ½ followed by the 50 day MA at $6.32 3/5. Export inspections at 12 mil. bu. were in line with expectations. YTD commitments at 394 mil. are down 16% from YA, vs. the USDA forecast of down 4.5%. MM’s were net sellers across all 3 classes last week as their combined short position swelled to nearly 137k contracts, the largest in 6 weeks, however well below the record short position of 199k in early Dec-23. IKAR reports Russian wheat export price ended last week at $238/mt down from $242/mt the previous week. SovEcon reports Russian grain exports last week fell 13% from the previous week to 650k mt, which included 580k mt of wheat. S&P Global is forecasting spring wheat acres at 11.1 mil., down 100k from YA.

See more market commentary here.

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice.

ADM Investor Services International Limited, registered in England No. 2547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG.

A subsidiary of Archer Daniels Midland Company.

© 2021 ADM Investor Services International Limited.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.