CORN

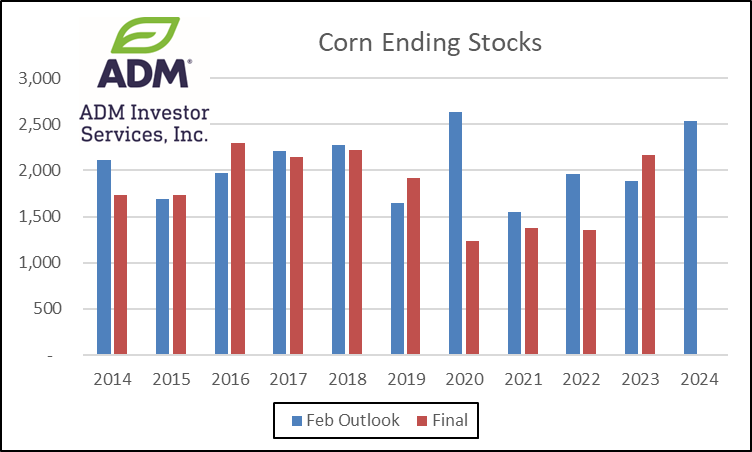

Prices ranged from down $.01 in spot Mch-24 to up $.02 in new crop contracts. Old crop reaching fresh contract lows for 7th time in the last 8 trading sessions. Next support for Mch-24 is at $4.09. Weekly export sales have held up nicely despite the lack of daily announcements and Argentine corn priced slightly below the US thru the Spring months. Argentine crop ratings as reported by the BAGE actually fell this past week despite recent shower activity. 27% of their crop was reported as G/E, down 4% from LW, while 17% was poor/VP up 2% for the week. Still much better than YA when only 11% was G/E and 45% poor/VP. Safras & Mercado lowered their Brazilian production forecast by 10% to 125.9 mmt, which is still among the highest estimates, above the USDA at 124 mmt and well above Conab at 113.7 mmt. Huge variations in Brazilian production forecasts not likely to change real soon with the much larger 2nd crop still being planted. Recent history shows the USDA has a slight tendency to overestimate stocks in the February Outlook. 6 years in the past 10 stocks finished lower than the initial forecast.

SOYBEANS

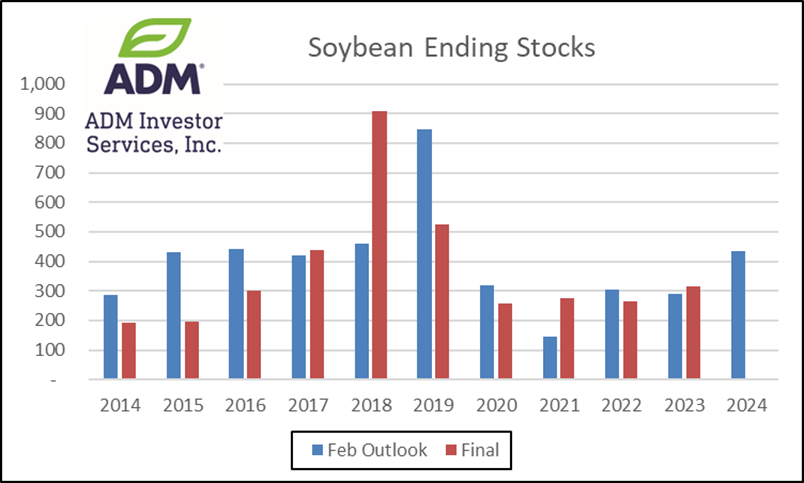

The soybean complex was mixed with beans $.08 – $.10 higher, meal was up $4 – $6, while oil was 40 – 50 lower. An inside day for Mch-24 beans as prices held just below yesterday’s high at $11.74 ¾. Mch-24 meal rebounded after holding above yesterday’s low at $339. Mch-24 oil traded to a new low for the week with next support at 45.33. Spot board crush margins slipped $.01 today to $.89 ½ bu. today and were down $.10 for the week. Bean oil production value slipped back below 40%. SA weather remains mostly favorable. Argentina will see net drying over the next week to 10 days however recent showers and moderate temperatures will limit crop stress. Additional moisture will be needed by late Feb/early March to keep production prospects favorable. Good harvest progress has likely been made across central and northern growing areas of Brazil this week. Showers return by the end of the weekend that are likely to persist for much of next week, particularly in EC and NE growing areas. A spokesperson from Brazil’s Ag. Ministry stated at the USDA Outlook Conf. that their soybean crop would come in at 145 mmt or lower as yields have remained below trend. Their forecast is below the Conab est. of 149.2 and well below the USDA est. of 156 mmt. Yesterday’s NOPA crush at 185.8 mil. bu. was a record for January however below expectations and down from the all-time high of 195.3 mil. in Dec-23. Implied census crush for the month at 196 mil. bu. would bring YTD usage to 977 mil. bu., up nearly 5% from YA, vs. the USDA forecast of up 4%. Oil stocks among NOPA members surged to 1.507 bil. lbs. up 11% from 1.36 bil. at the end of Dec-23 and well above expectations of 1.409 bil. lbs.

WHEAT

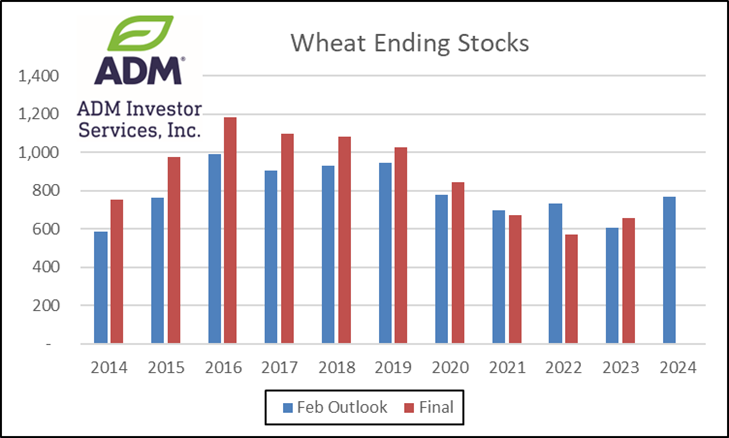

Prices were lower across all 3 classes at today with new contract lows for KC and MGEX. Today’s low for Mch-24 Chicago at $5.56 ¾ held just above contract lows at $5.56 ¼. Despite the recent selloff, US still finds itself $25 – $30/mt above offers from Russia and the Black Sea. Russia’s Ag. Ministry lowered their wheat export tax 2.6% to 3,953 roubles/mt for the period ending Feb. 27th. Little to no rain for the US plain states and WCB over the next week. Temperatures are expected to warm to much above normal readings the last week to 10 days of February for most of the nation’s midsection. Spreads in Chicago continue to firm as exporters are forced to pay up to pry SRW wheat away tightfisted farmers/elevators perhaps needing to start shipments to China. Yesterday’s export sales report showed there are still 60 mil. bu. of outstanding wheat sales to China, with 55 mil. of that SRW. Another 8 mil. SRW are in unknown. IKAR raised their Russian grain production forecast for 2024 to 146 mmt, with 93 mmt of wheat. Their forecast is in line with the 93.6 mmt from SovEcon earlier in the week and just above the USDA forecast of 91 mmt. IKAR also raised their wheat export forecast to 52 mmt, just above the USDA est. of 51 mmt. History shows the USDA has a strong tendency to underestimate stocks in the February Outlook. 8 of the past 10 years stocks finished higher than the initial forecast.

All charts provided by QST

>>See more market commentary here.

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice.

ADM Investor Services International Limited, registered in England No. 2547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG.

A subsidiary of Archer Daniels Midland Company.

© 2021 ADM Investor Services International Limited.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.