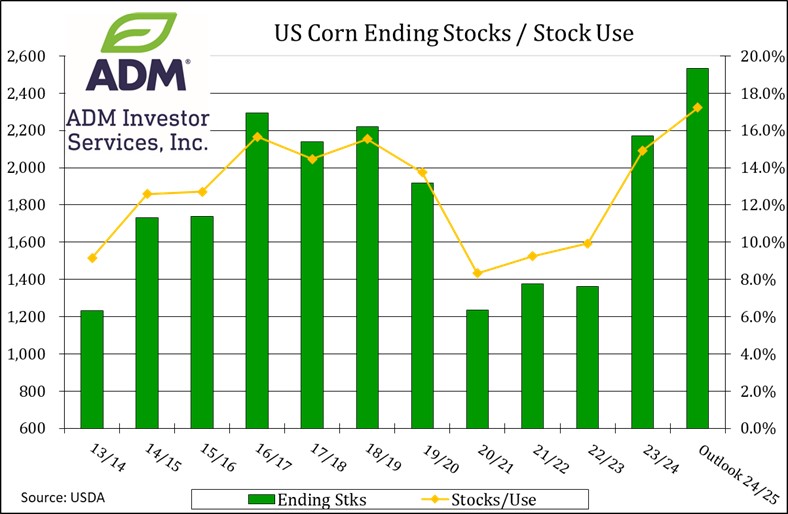

CORN

Prices plunged another $.06 – $.08 today with old crop futures reaching new contract lows for the 6th time in 7 trading sessions. Mch-24 has fallen to the lowest level on the weekly chart since Dec-2020. Next support is at $4.09. The USDA Outlook Forum showed 2024 corn plantings at 91 mil. acres, same as the Nov-24 baseline est. and down 3.6 mil. from YA. Trendline yield at 181 bpa, if realized would be record large. Production at just over 15 bil. and ending stocks at just over 2.5 bil., were both in line with expectations. The stocks/use ratio at 17.2%, if realized would be the highest in 19 years. The Ave. Farm price is expected to fall to $4.40 in the 24/25 MY, down from this year’s $4.80. The weekly export sales were solid at nearly 52 mil. bu. YTD commitments at 1.426 bil. are up 30% from YA, vs. the USDA forecast of up 26%. Largest buyers were Mexico – 17 mil. and Columbia – 14 mil. US corn area in drought fell 1% this week to 26%, the lowest since 25% last May. The biggest concern at the moment is Iowa, the largest producing state, where 78% of corn acres are in some form of drought. BAGE reports corn conditions slipped 4% to 31% despite good rains in the past week. Spot corn has reached our downside price range of $4.00 – $4.25 this week however still no spark to stimulate short covering rebound.

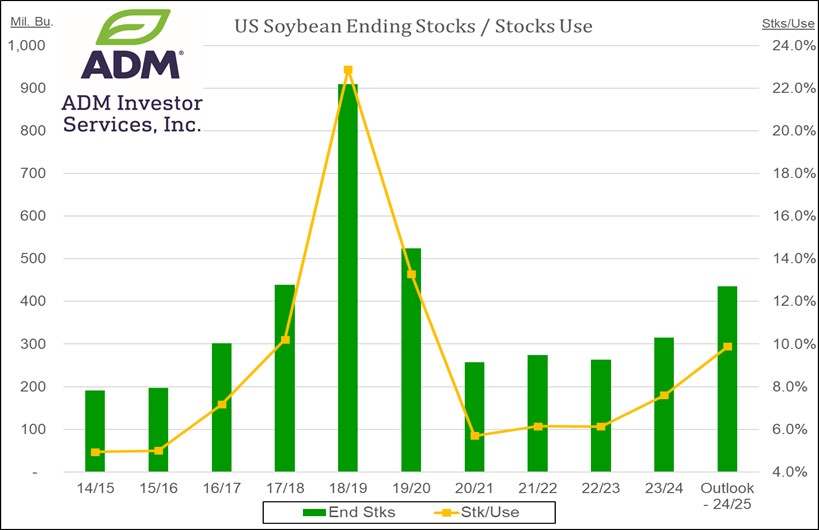

SOYBEANS

The soybean complex was lower across the board with beans down $.08 – $.14, meal was $3 – $4 lower, while oil was down 35 – 45. Beans spreads tightened up a bit, likely due to limited farmer selling, the heavy new crop balance sheet projections and potential harvest delays in Brazil with heavy rains in the NE. Mch-24 beans broke support at $11.75 with next support at its contract low from last May at $11.45. Mch-24 meal broke thru support at $341 with next support at its contract low of $336.80 from Dec-21. Next support for Mch-24 oil is at 44.50. The USDA Outlook Forum showed 2024 soybean plantings at 87.5 mil. acres, up nearly 4 mil. from YA. Trendline yield at 52 bpa, if realized would match a record high from 8 years ago. Production at just over 4.5 bil. and ending stocks at 435 mil. were in line with expectations. The Ave. Farm price is expected to fall to $11.20 in the 24/25 MY, down from this year’s $12.65. The Outlook Conf. did forecast 2024/25 bean oil usage for biofuel production would rise 1 bil. lbs. to 14 bil. Export sales were weak at 13 mil. bu. YTD commitments at 1.426 bil. are down 19% from YA, vs. the USDA forecast of down 14%. US soybean area in drought fell 2% this week to 25%, the lowest since 19% last May. NOPA crush at 185.8 mil. bu. was a record for January however below expectations and down from all-time record of 195.3 mil. in Dec-23. Oil stocks among NOPA members surged to 1.507 bil. lbs. up 11% from the 1.36 bil. at the end of Dec-23 and well above expectations of 1.409 bil. lbs. The BAGE reported Argentine crop conditions held steady at 31% G/E, however there was a 3% shift from poor/VP to fair.

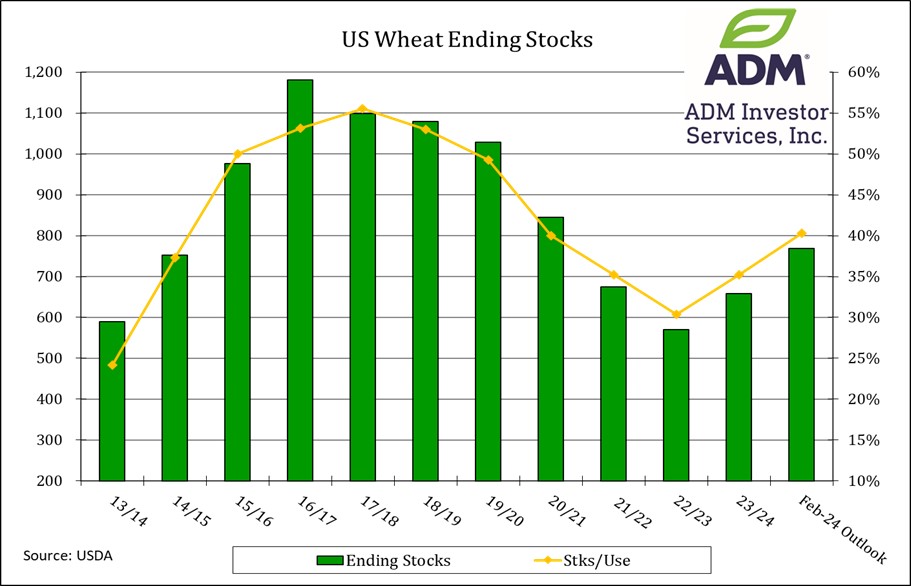

WHEAT

Prices were lower across all 3 classes in choppy 2 sided trade. Chicago was the downside leader at $.14 – $.18 lower, KC was down $.12 – $.14, while MGEX was $.04 – $.06 lower. New contract lows for both KC and MGEX Mch-24 contracts. Mch-24 Chicago fell to a 3 month low with next support at the contract low of $5.56 ¼ from last November. The USDA Outlook Forum showed 2024 wheat plantings at 47 mil. acres down 2.6 mil. from YA. Trendline yield at 49.5 bpa, production at 1.90 bil. and ending stocks at 769 mil. were all in line with expectations. The Ave. Farm price is expected to fall to $6.00 in 24/25, down from this year’s $7.20 in 2023/24. Export sales at 13 mil. were at the low end of expectations. YTD commitments at 647 mil. are up 7% from YA, vs. the USDA forecast of down 4.5%. Egypt reportedly bought 180k mt of wheat with 120k from Ukraine and 60k mt from Romania. Japan’s Ag Ministry bought just over 115k mt of Australian, US and Canadian wheat.

All charts provided by QST

>>See more market commentary here.

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice.

ADM Investor Services International Limited, registered in England No. 2547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG.

A subsidiary of Archer Daniels Midland Company.

© 2021 ADM Investor Services International Limited.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.