Soybeans & nearby corn traded higher. Wheat traded lower. Gold up $16 as stocks were lower today.

SOYBEANS

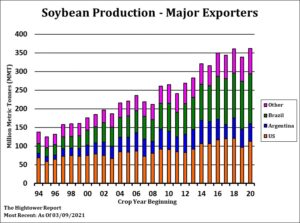

Soybean traded higher led by nearby. Some new buying old and selling new crop soybean spreading was noted. Some feel talk of tighter US 2020/21 balance sheet may have supported the May. Talk of favorable US 2 week weather forecast may have weighed on the Nov. NOPA March soybean crush could be record high. This continues to increase demand for cash soybeans. Some feel farmer may be not selling during planting season. Spreads may need to rally to move elevator supplies. Some feel USDA should lower South America soybean crops on Friday. Average trade guess for Brazil soybean is 134.2 mmt vs USDA 134.0.Trade est Argentina soybean crop near 46.7 mmt vs USDA 47.5. Trade also looks for US 2020/21 soybean carryout near 118 vs USDA 120. Range is 105-135. Some feel USDA should increase US soybean crush and raise US exports 25 mil bu. World vegoil prices are back higher on increase demand, lower than expected palmoil production and concern over cold EU temps.

CORN

Corn futures traded mixed. Nearby futures traded higher but off session highs. Early fund buying supported prices. Once fund buying slowed prices trended lower. New crop was lower on talk of favorable US Midwest 2 week and even 30 day weather that should help corn planting. US domestic cash corn basis firmed as new farmer selling is expected to slow over the next 6-8 week as farmers focus on field work. One group did increase their corn planted acreage guess to closer to 93.0 million acres vs USDA guess of 91.1. Good US planting weather could increase final corn acres vs first farmer intentions. Some feel USDA should lower South America corn crops on Friday. Average trade guess for Brazil corn is 108.3 mmt vs USDA 109.0. Some are as low as 105.0. Trade est Argentina corn crop near 46.7 mmt vs USDA 47.5. Trade also looks for US 2020/21 corn carryout near 1,379 vs USDA 1,502. Range is 1,200-1,550. Some feel USDA should increase China imports 5 mmt to 29, raise US exports 200 mil bu and increase US domestic use. USDA estimated that 3 pct of the US corn crop is planted vs 2 average. CK and KWK are near even money. Some feel this is rare and could suggest lower corn supply and higher US wheat feeding. Cash HRW is 85 cents below corn in US south plains feed areas. CZ should find support near 4.80 given forecast of lower US 2021/22 corn balance sheet and uncertain summer weather.

WHEAT

Wheat futures traded mixed. WK traded lower. Some feel this may have been due to lack of new export demand and USDA higher than average rating of the US 2021 SRW crop. KWK traded lower and now Is even money with CK. Some feel higher est of US 2021 wheat crop and lack of new export demand could be weighing on KC futures. The fact KC wheat cash prices are 85 cents below corn in US SW Feed areas could increase US wheat feeding. Trade will also be watching Egypt tender with Russia, Ukraine and East Europe origin only offers. USDA rated US 2021 winter wheat 53 pct G/E versus 62 ly. USDA rated US HRW crop 16 pct P/VP. Some feel some ridging will develop over US Rockies and spill into US plains. This must be watched in estimating final US HRW and HRS crops. Trade est US 2020/21 wheat carryout near 846 mil bu versus USDA 836 and World stocks near 301.7 mmt vs 301.2.

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice.

ADM Investor Services International Limited, registered in England No. 2547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG.

A subsidiary of Archer Daniels Midland Company.

© 2021 ADM Investor Services International Limited.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.