CORN

Today’s late surge enabled May-24 to close just above its 50 day MA resistance. This marks the 3rd time since late March. The first 2 times prices quickly pulled back below the technical indicator. Dec-24 quickly rejected trade below $4.60, however today’s rally stalled out right at its 50 day MA. Spreads continue to firm. Showers have exited the ECB with much of the Midwest left in a cool, dry pattern this weekend. Rains over the next 5 days expected to favor East TX and the US gulf coast. Good rains have shown up across the southern half of IA days 6 and 7. The USDA announced the sale of 216.5k mt (8.5 mil. bu.) of corn to Mexico, most of it new crop 2024/25. In addition, the EPA announced they will allow the expanded sale of E-15 during the summer months. Late Thursday the BAGE estimated Argentine corn harvest has reached 17% while holding their production forecast unchanged at 49.5 mmt. Cattle on feed as of April 1st at 101% of YA was just below expectations of 102%. Marketings at 86% and placements at 88% were both below expectations of 89% and 92% respectively.

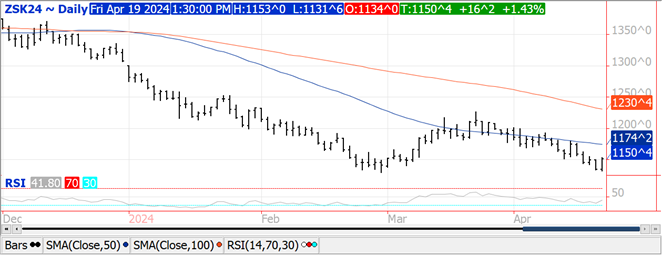

SOYBEANS

Prices were higher across the complex in choppy 2 sided trade. A day after establishing a new contract low close, May-24 beans staged an outside day higher trade. Near term resistance is the 50 day MA, currently $11.74 ¼, followed by the March high at $12.26 ¾. May-24 meal made a new high for the month with next resistance at the March high of $347.60. May-24 oil traded to a fresh 3 year low for the spot contract before recovering. An overnight surge in energy prices fueled by Israel’s retaliatory strike against Iran helped kick start a broad based commodities rally. For the week, crush margins increased nearly $.05 to $.94 bu., with soybean oil PV falling to 39.2%, the lowest since late Jan-24. Net drying is expected for much to Brazil in the next week to 10 days. The exception being RGDS in the deep south where heavy rains may lead to localized flooding while delaying the remaining soybean harvest. Today’s forecast is also wetter for NE Argentina, also threatening harvest delays. The USDA announced the sale of 121.5k mt (4.5 mil. bu.) of soybeans to an unknown buyer, most of it for new crop 2024/25 MY. Late Thursday Argentina’s Ag. Ministry forecast their soybean production at 49.7 mmt, while the BAGE held their production forecast unchanged at 51 mmt. They also estimate the crop to be 14% harvested. China’s pig inventory at the end of March stood at 408.5 mil. head, down 5.2% from YA. Their sow heard has declined to just below 40 mil. head, down 7.3% from YA. The Govt. continues to urge for reduced hog capacity while lowering their national target for breeding sows to 39 mil. head, down from the earlier target of 41 mil.

WHEAT

Prices were higher across all 3 classes today with Chicago up $.13 – $.14 while KC and MGEX were $.05 – $.10 higher. The overnight surge in Chicago May-24 stalled right at its 50-day MA resistance at $5.58 ½. KC May-24 briefly traded to a new high for the week before pulling back. For now the $5.25 – $5.75 range for spot Chicago and $5.50 – $6.05 range for spot KC remain intact. Longer range models do see improved prospects for rain in the Southern plains, however amounts and coverage appears lightest for western KS. India’s Govt. reports wheat stocks as of April 1st at 7.5 mmt, down from 8.35 mmt YA and the lowest in 16 years. In their most recent forecast, SovEcon lowered Russia’s 2024 wheat production 1 mmt to 93 mmt, still above the USDA forecast of 91.5 mmt. Russia’s Ag. Ministry announced they raised their wheat export tax 5% to 3,443 roubles/mt.

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice.

ADM Investor Services International Limited, registered in England No. 2547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG.

A subsidiary of Archer Daniels Midland Company.

© 2021 ADM Investor Services International Limited.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.