Soybeans, soymeal, soyoil, corn and wheat traded higher. US stocks were marginally higher. US Dollar was lower. Crude was sharply higher.

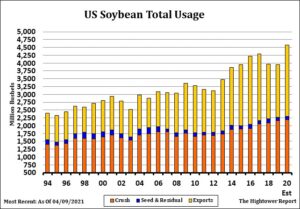

SOYBEANS

Soybean traded higher. SK traded back over 14.00. Some feel there is now a chance SK could test 14.96. SX traded over 12.50. BOK tested last week’s high. Some feel a close over 54.36 could send futures higher. US March NOPA soybean crush is estimated at a new record high. This could add to soyoil stocks. Still declining US soybean supplies could drop US crush and soyoil supplies. C IL soybean basis is reported at +70. There were 158 C IL soyoil receipts cancelled. Basis is near +550-600. Weekly US soybean exports sales are estimated near -100-200 mt vs -92 lw. US soybean export commit is near 60.7 mmt vs 37.2 last year. USDA goal is 62.0 vs 45.7 ly. USDA est of World soybean exports are near 170.9 mmt vs 165.0 last year. US soybean export commit to China is 35.8 mmt with 34.9 shipped. There is 1.6 in unknown. USDA est China total imports at 100 mmt. There was late word that Managed funds may be adding to longs in front of any US weather problem.

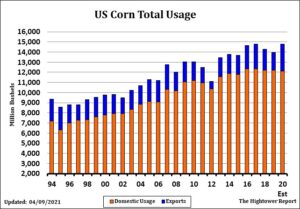

CORN

CK and CZ made new highs on a combination of new fund buying and end user buying. Fact open interest increased Tuesday suggested new longs. Cold US Midwest weather could slow US corn planting and early germination of the crop that is already planted. Some feel final US 2021 corn plantings may not increase from USDA March guess due to higher input cost and trouble getting new Seed. Some feel CK could now test 6.29. Index fund roll is now complete. This could increase new CK and CN buying. Domestic US corn buyers are bidding up for corn with C IL basis +50. Brazil 2nd crop corn weather is dry. Some are lowering their est of crop ratings. Central Brazil could see some rain mid-week next week but maps then turn dry and 16-30 day forecast is also dry. Some feel corn futures made new highs on adverse Brazil and west US Midwest weather. Our weather guy is watching west Midwest weather after temps warm. Dry west Midwest could suggest a dry summer. Weekly US corn sales are est near 500-800 mt vs 757 last week. US corn export commit is near 66.4 mmt corn exports are near 187.2 mmt vs 171.7 last year. US corn export commit to China is 23.3 mmt with 9.0 shipped. There is 3.7 in unknown. USDA est China total imports at 24 mmt. Some feel USDA est of 24 mmt China corn imports suggest 6 mmt open commit will be rolled forward. Commercials feel loadings will increase soon. There was late word that Managed funds may be adding to longs in front of any US weather problem.

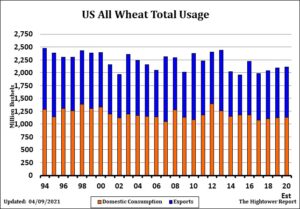

WHEAT

Wheat rallied and followed higher corn prices. Some concern about adverse US/World 2021 weather may have helped wheat. Lower US Dollar and higher commodity prices may have also helped wheat. Lower Dollar linked to higher US debt and higher commodity prices due to concern higher demand post vaccinations will drive raw material prices up due to tight supplies. This includes flour. There Is also concern about long term dryness in parts of US and Canada wheat areas and parts of west EU. Recent freeze across parts of EU raised concern about the winter wheat crop. Cold temps esp next week across US south plains WW area is also raising some concern over wheat there. Trade est weekly US wheat export sales near 50-200 mt vs 81 last week and new crop 300-550 mt vs 529 last week. US wheat exports commit is near 25.1 mmt vs 25.0 last year. Some report exporters pulling out of Russia trade until June due to uncertainty over where prices are. There was late word that Managed funds may be adding to longs in front of any US/World weather problem.

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice.

ADM Investor Services International Limited, registered in England No. 2547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG.

A subsidiary of Archer Daniels Midland Company.

© 2021 ADM Investor Services International Limited.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.