SOYBEANS

Soybeans ended higher but off session highs. Choppy trade remains inside the flag formation. Prices were supported by new US new crop soybean sales to unknown. Prices found resistance on talk of rains early next week across parts of US Midwest and a private est of US 2021 soybean crop above USDA July guess. Weekly US soybean export sales were only 400 thousand bu old crop and 15 mil bu new crop. US export commit is near 2,179 vs 1,468 last year. USDA goal is 2,270 vs 1,679 last year. New crop commit is near 390. China commit is near 1,313mil bu. China new crop commit is 160 mil bu. Some feel China may take a little less US new crop soybean than this year. This depends upon China hog numbers, protein in ration and competition from Brazil. Informa est US 2021 soybean crop at 4,464 vs USDA 4,405. Informa raised Argentina soybean crop 1.5 mmt and US new crop soybean crop 2.3 mmt. Informa lowered Canada rapeseed crop 1 mmt. Some feel their crop could be even smaller.

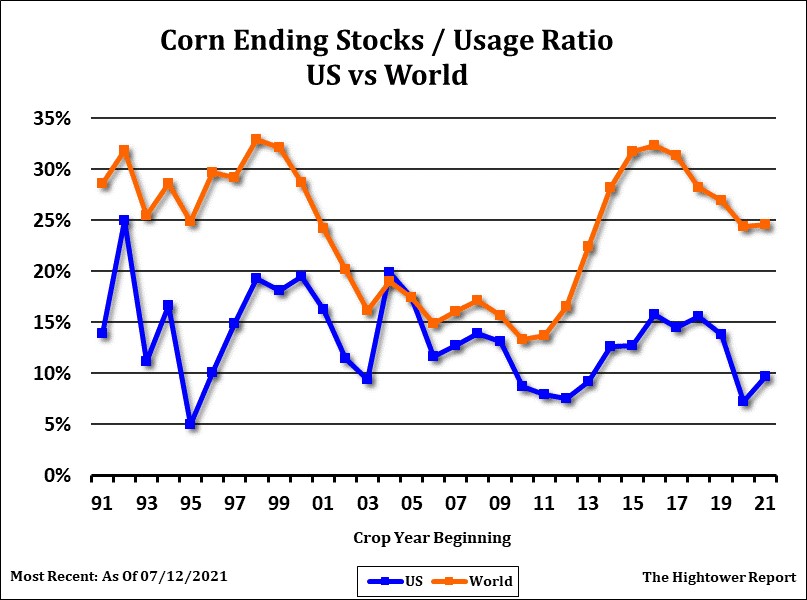

CORN

Corn futures ended higher. CU tested the higher end of the recent trading range near 5.60 and ended near 5.55. New buying may have increased after a private group estimated the US 2021 corn crop below USDA July guess. Same group raised their est of Argentina corn crop 2 mmt to 50 but left Brazil crop near 87. Some feel Brazil corn crop could be below 80 mmt. Today, Brazil est their corn exports at 17 mmt down 11 from USDA and down 18 mmt from last year. Weekly US corn export sales were 2 mil bu old crop and 32 mil bu new crop. US export commit is near 2,745 vs 1,723 last year. USDA goal is 2,850 vs 1,777 last year. New crop commit is near 688. China commit is near 900 mil bu. China new crop commit is 420 mil bu. Some feel China will take more US new crop corn than this year. Informa est US 2021 corn crop at 14,911 mil bu vs USDA 15,165. IL corn yield 211 vs 192 ly, IA 195/178, MN 160/192. OH 195/171, ND 115/139. The GFS model was wetter from south-central to most of eastern IA and NW IL as well as in MI Sat into Mon. Some may be too wet. The GFS model reduced rain from C IL to C IN Sat into Mon The GFS model increased rain from WC IL to S IL and C KY. This increase is likely overdone. The GFS model reduced rain in MO to E OH Aug. 12-14. Some of this reduction was likely needed. The GFS model increased rain from NE IA to WI, MI, and N IN Aug. 15-17. The latest run is likely too wet.

WHEAT

Wheat traded mixed to lower. Fact a private group estimated US all Wheat 2021 crop below USDA and lowered Canada and Russia wheat crops offered support. Slow demand for US wheat exports and fear that the spread of the Delta variant virus could slow food demand offered resistance. There is talk of lower China and EU wheat quality could increase wheat feeding there. The virus spread could also slow US/World economic recovery. Bulls feel Wheat prices may need to rally in 2022 to buy acres to increase supply vs demand. Still higher prices could encourage US farmers to plant more corn beams, sorghum and oats. Weekly US wheat export sales were 11 mil bu. US export commit is near 309 vs 372 last year. USDA goal is 875 vs 992 last year. US export prices remain a premium to World sellers. Informa est US all wheat crop at 1,730 mil bu vs USDA 1,746 and 1,826 ly. HRW 817/659. SRW 366/266. Informa est US spring wheat crop at 312 vs 586 ly and durum 35 vs 69.

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice.

ADM Investor Services International Limited, registered in England No. 2547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG.

A subsidiary of Archer Daniels Midland Company.

© 2021 ADM Investor Services International Limited.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.