SOYBEANS

Soybean traded sharply lower as bids for US gulf dropped sharply after Hurricane IDA may have caused damage to one commercial grain export elevator. Most of New Orleans is without power. Most feel damage to crops due to flooding may be minimal. Rains across parts of the upper central Midwest may be helping soybean yields there. Fact that these rains may now have a more southerly patch could also help soybeans in IA, C IL and IN. Parts of NE IA, WI, N IL and MI could miss rains. Weekly US soybean exports were 13 mil bu vs 30 last year. Season to date exports are near 2,178 vs 1,588 ly. USDA goal is 2,260. Some feel US 20/21 soybean carryout could be up 20-30 mil bu due to lower use. US 21/22 soybean carryout could be near 150 mil bu depending upon size of final crop and export demand. Bears feel lower China imports and higher 2022 Brazil could reduce US soybean imports. SX still in flag formation between 12.81 to 13.59.

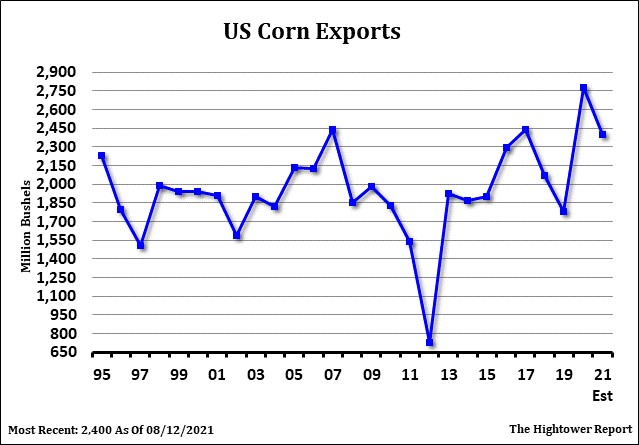

CORN

Corn futures traded sharply lower. Some of the selling was liquidation of September open interest and Hurricane IDA may have damaged one US export terminal. Bids to US gulf dropped sharply until more is known about delays in US exports. Most feel damage to crops due to flooding may be minimal. Weekly US corn exports were 22 mil bu vs 16 last year. Season to date exports are near 2,588 vs 1,659 ly. USDA goal is 2,775. Some feel US 20/21 corn carryout could be up 100 mil bu due to lower domestic use. US 21/22 corn carryout could be near 1,000 mil bu depending upon size of final crop and export demand. Bulls feel higher US corn exports due to 2021 Brazil corn crop could support higher prices. Bulls still look for US 2021/22 corn exports to be near 2,700 mil bu vs USDA estimate of 2.400. CZ still in flag formation between 5.32 to 5.83. Some feel support could be from lack of farmer selling and tight World supplies. Resistance could be from harvest pressure and talk of higher World 2022 corn supplies.

WHEAT

Wheat futures ended lower. Concern about US corn and soybean gulf exports due to Category 4 Hurricane weighed on wheat futures. WZ traded down to 7.23 with range 7.22 to 7.43. KWZ traded down to 7.12 with range 7.11 to 7.35. MWZ traded down to 9.09 with range 9.06 to 9.23. Weekly US wheat exports were 12 mil bu vs 19 last year. Season to date exports are near 222 vs 248 ly. USDA goal is 875. Egypt bought 180 mt Romanian and Ukraine wheat in their tender. Most look for US 21/22 total Wheat demand near 2,100 mil bu. This suggest a carryout near 555 mil bu vs USDA 627. Stats Canada estimated 2021 wheat crop near 22.9 mmt vs average guess of 22.6 and 35.2 last year. Some early forecast for the US south plains fall weather could be warmer and drier than normal. US spring 2022 weather could also be warmer and drier than normal. Russia New Lands also remain drier than normal.

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice.

ADM Investor Services International Limited, registered in England No. 2547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG.

A subsidiary of Archer Daniels Midland Company.

© 2021 ADM Investor Services International Limited.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.