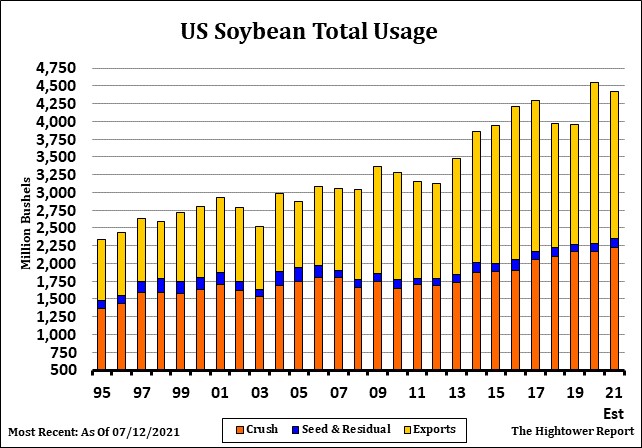

SOYBEANS

Soybeans ended higher. SU was near 13.56 with range 13,42 to 13.62. 13.50 support held. SX ended near 13.53 with range 13.36 to 13.59. Dry US west Midwest weather offered support despite slow export inspections and new sales. BOU traded below 64 cents. Sharply lower palmoil prices weighed on soyoil. There was talk that this weekend some rain could fall across parts of Canada prairies. Talk of lower US soybean crush may be offering support to soymeal futures. Some feel USDA may not make big changes to US and World supply and demand on August 12. This limits new buying until China buys US or post US harvest. Weekly US soybean export inspections were near 6 mil bu vs 20 last year. Season to date exports are near 2,139 mil bu vs 1,447 last year. USDA goal is 2,270 vs 1,679 last year. Some feel final US total 2020/21 soybean demand could be 35 mil bu lower than USDA.

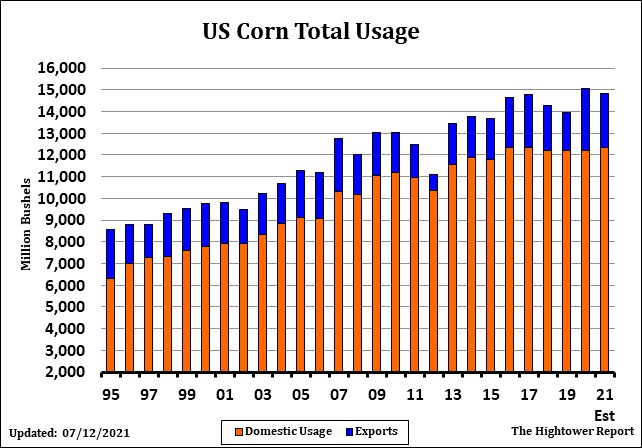

CORN

Corn futures ended higher. Drier midday US 2 week weather outlook and talk of lower Brazil crop and US 2021/22 corn end stocks triggered buying near 5.40 CZ. CZ ended near 5.59 with range 5.40 to 5.59. The noon GFS model reduced rain from the eastern Dakotas to Michigan Aug. 9-12. The GFS model also reduced rain from southwestern Nebraska to western and southern Iowa Aug. 13-14. Finally, the GFS model reduced rain from the northern Plains into the Midwest Aug.14-16. Last night GFS forecast had rains across the Midwest next week. After drought then frosts spoiled much of the crop, Brazilian farmers are now expected to collect 51.6 million tonnes of second corn, almost 19 million tonnes below the 70.5 million from last season, Ag Rural said. On July 1, Ag Rural had predicted the second corn crop would total 54.6 million tonnes. Weekly US corn export inspections were near 54 mil bu vs 28 last year. Season to date exports are near 2,472 mil bu vs 1,499 last year. USDA goal is 2,850 vs 1,777 last year. Domestic US cash corn basis levels remain firm due to lack of new farmer selling. Since July 14, CZ has traded mostly sideways between 5.40 and 5.60.

WHEAT

Wheat futures traded sharply higher led by KC. Talk of lower Canada, Russia and US crops. This could suggest record low World top exporters end stocks to use ratio. Russian agriculture consultancy Sovecon said on Monday it had cut its forecast for Russia’s 2021 wheat crop by 5.9 million tonnes to 76.4 million tonnes. There is also talk that late harvested EU wheat crop has also raised concern about wheat quality due to wet harvest. Some also feel that Canada crop could be as low as 21 mmr vs USDA 31 and exports and lower exports. Weekly US wheat export inspections were near 14 mil bu vs 20 last year. Season to date exports are near 138 mil bu vs 172 last year. USDA goal is 875 vs 992 last year. US wheat export prices are a premium to EU and Black Sea. WU ended near 7.29 with range 7.04 to 7.31. KWU ended near 7.04 with range 6.72 to 7.05. MWU ended near 9.22 with range 9.01 to 9.26.

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice.

ADM Investor Services International Limited, registered in England No. 2547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG.

A subsidiary of Archer Daniels Midland Company.

© 2021 ADM Investor Services International Limited.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.