SOYBEANS

Soybeans ended lower on fears of lower US 20/21 final US demand increasing US 20/21 soybean carryout. US upper Midwest rains could add to 2021 crop bushels there and offset potential lower yields in Central US Midwest where temps have been above normal and rain below normal. Some in market may now be trading US soybean yield closer to 51 than USDA 50. US 2021/21 soybean shipments are near 2,203 mil bu vs 1,579 last year. USDA goal is 2,260 vs 1,679 last year. This could suggest US 20/21 soybean carryout could be increased 20-30 mil bu from 160. China 20/21 soybean exports are near 1,291 mil bu. New crop China soybean sales are near 244 mil bu. Some report China may have bought 20-30 US soybean cargoes this week or 1.7 mmt. USDA reported that 2022 China hog production could be down 5 pct and pork production down 14 pct yoy.

CORN

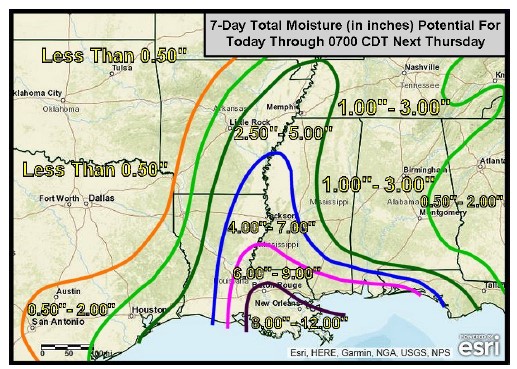

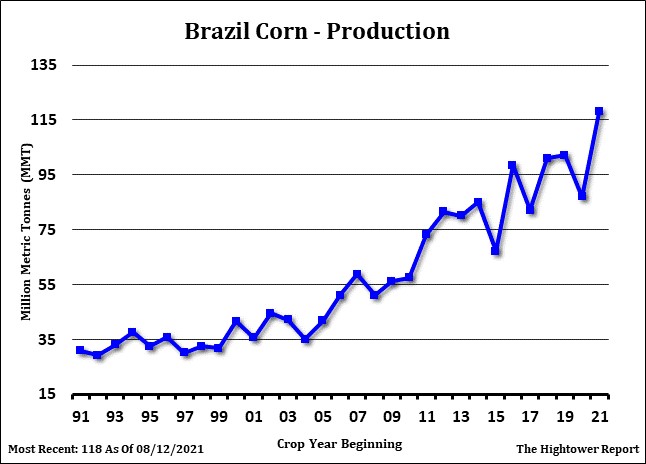

Corn futures ended mixed. Tightening old crop supplies and lack deliveries helped CU gain 1 cent and end near 5.52. Talk of lower than expected US export sales dropped CZ 2 censt and near 5.50. Talk of higher Brazil 2022 and Argentina corn acres weighed on CZ22 down 6 cents and near 5.15. Some yesterday suggested that current CZ22 prices were not high enough to increase US 2022 acres enough to satisfy projected demand and increase carryout. One analyst est US 20/21 corn exports near 2,790 and 21/22 at 2,600. There estimate of final US 2021 corn acres ss 94.4 vs USDA 92.7. Their yield is 174 with a US carryout near 1,117 mil bu vs USDA 1,242. US 2020/21 corn export commit is near 2,768 mil bu vs 1,721 last year. Shipments are near 2,605 mil bu vs 1,659 last year. USDA goal is 2,775 vs 1,777 last year. There is 163 mil bu of old crop unshipped corn that could be rolled forward. China 20/21 corn exports are near 846 mil bu. New crop China corn sales are near 421 mil bu. Trade est World non US exporters 2021 production down 10 mmt from last year and 2021/22 World corn demand up 22 mmt. Conad est Brazil 2022 corn acres up 4 pct and crop near 116 mmt vs USDA 118 and 87 this year. Will see what La Nina does to the final 2022 Brazil corn crop.

WHEAT

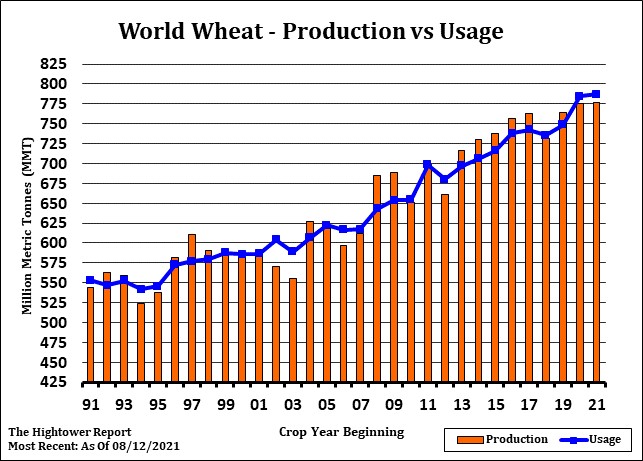

Wheat futures ended higher. Talk of lower World wheat crops helped rally Wheat futures. WU ended up 14 cents and near 7.25 on talk of no deliveries and that US SRW fob prices are now 40 cents below low protein French Wheat prices. WZ ended up 13 cents and near 7.39. Trade over 7.49 is needed to negate a negative chart formation. KWU ended up 15 cents and near 7.17. KWZ ended up 14 cents and near 7.29. KWZ needs to trade over 7.30 to offset a similar negative chart formation. MWZ ended up 3 cents and near 9.11. Increase harvest pressure may be limiting new buying vs the winter wheat. IGC lowered World wheat crop 6 mmt to 782. Russia was lowered from 81 mmt to 75, Canada was lowered from 28.5 to 24.6 and US from 47..5 to 46.2. Increase in Ukraine from 29.5 to 32 and Australia from 28.9 to 30.1 could not offset the declines. US Wheat export sales were 4 mil bu. Total commit is near 335 mil bu vs 431 last year. USDA goal is 875 vs 992 last year.

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice.

ADM Investor Services International Limited, registered in England No. 2547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG.

A subsidiary of Archer Daniels Midland Company.

© 2021 ADM Investor Services International Limited.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.