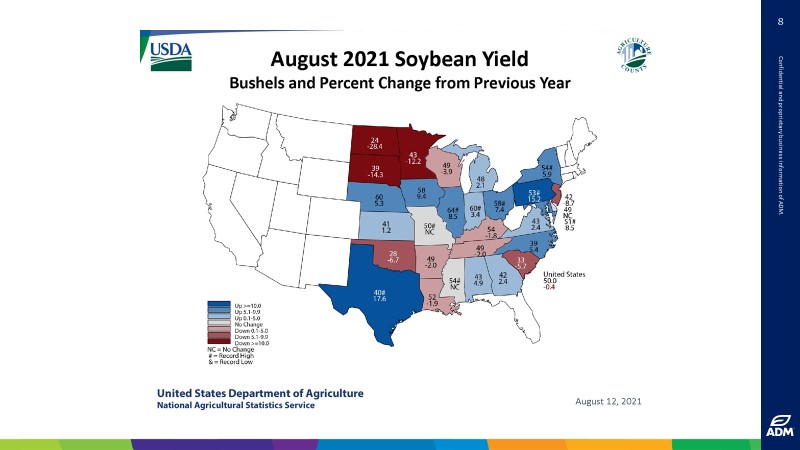

SOYBEANS

USDA lowered US 2021 soybean crop but dropped demand even more. They lowered the US crush but also lowered US soyoil and soymeal demand. USDA est US 2021 soybean crop near 4,339 mil bu vs USDA 4,405. Soybean yield near 50.0 vs USDA 50.8. IL yield 64 vs 59 ly. IA 58 vs 52. ND 24 vs 33.5.USDA est US 20/21 soybean carryout near 160 vs USDA 135, 21/22 160 vs USDA 155. USDA dropped US 20/21 crush 15 and exports 10. USDA also dropped US 21/22 exports 20 crush 20. USDA dropped US 20/21 soyoil biofuel demand 200 mil lbs. USDA dropped 20/21 soymeal exports 150 tst and domestic use 150 tst. USDA dropped US 21/22 soyoil biofuel demand 500 mil lbs. USDA dropped 20/21 soymeal exports 100 tst and domestic use 350 tst. USDA increased World 20/21 soybean end stocks to 92.8, est 21/22 at 96.1. US farmer selling increased near session highs. Trade will need to see lower US 21/22 crop/carryout to trade over todays high. USDA est China 20/21 imports at 97 mmt vs 98 in July and 98.5 ly. 21/22 imports est near 101.

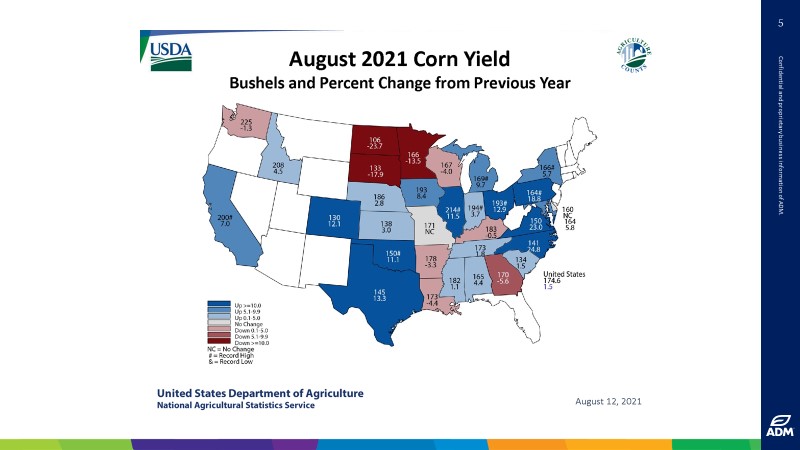

CORN

Corn futures ended higher but off session highs. USDA lowered US corn crop more than expected. USDA raised US 20/21 carryout due to lower exports. USDA also lowered US 21/22 corm exports and feed use to help offset the lower crop. US farmer selling increase near session highs. Some feel in some locations they may be now sold out of old crop corn and near 60 pct sold new crop. End user remain uncovered for 2022. CU ended near 5.67 with range 5.48-5.89. CZ ended near 5.73 with range 5.51-5.94. Some early selling was linked to talk that China may close their number 1 port due to Covid. China new 5 year policy form more restriction and scrutiny for private business also offered resistance to equities and energies. USDA est US 2021 corn crop near 14,750 mil bu vs USDA 15,165. 2021 corn yield was 174.6 vs USDA 179.5. USDA est US 21/22 corn carryout at 1,242 vs USDA 1,432. USDA increased US 20/21 feed use 25 but lowered exports 75. USDA lowered 21/22 feed 100 and exports 100. USDA est World corn end stocks at 284.6 mmt vs 291.2. Brazil crop was lowered to 87.0 vs 93.0. US corn exports commit is near 2,760 mil bu vs 1,738 ly. USDA goal is now 2,775 vs 1,777 ly. USDA est US 21/22 corn exports near 2,400 vs most private rest near 2,800.

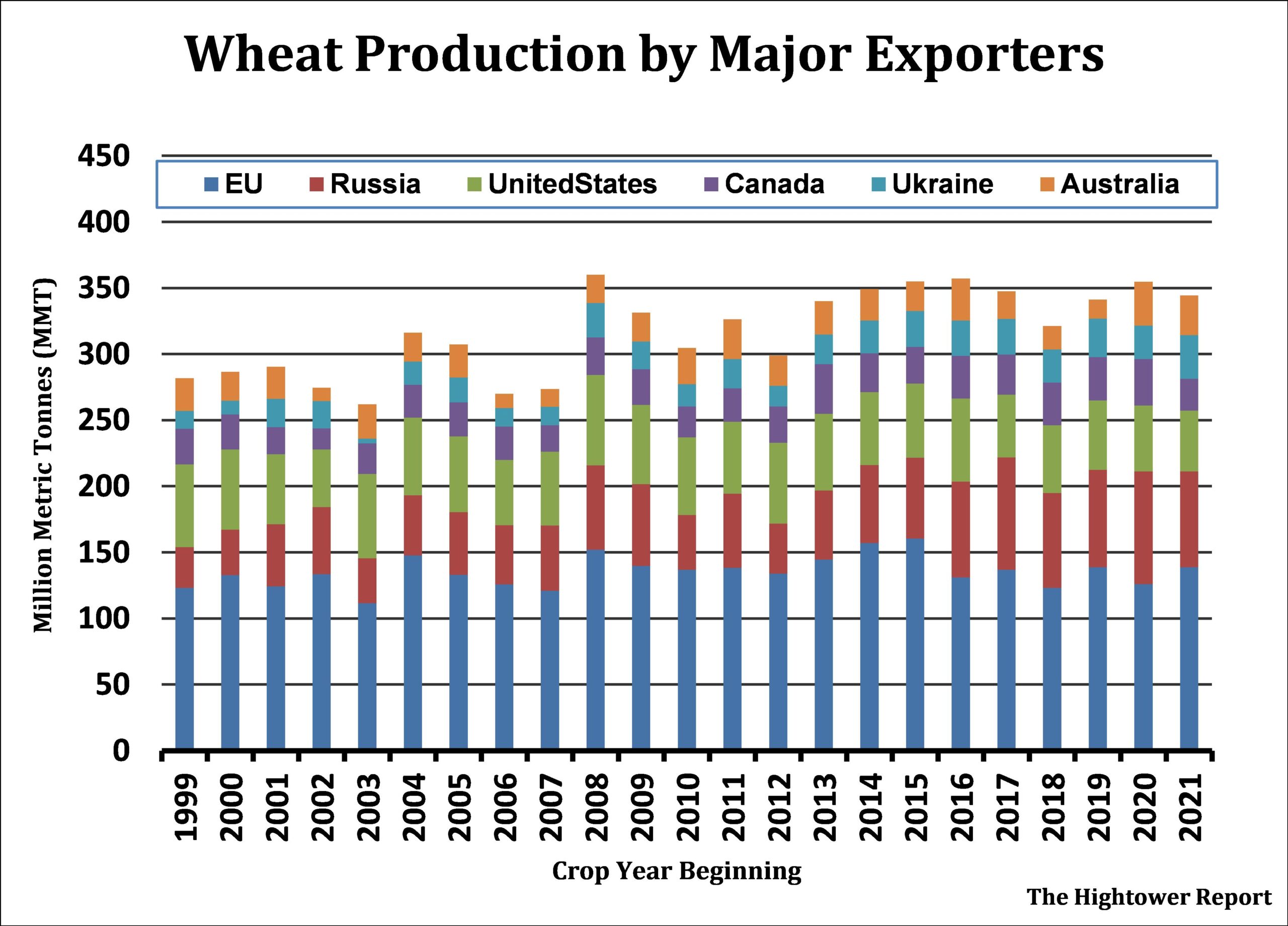

WHEAT

Wheat futures traded higher. WU ended near 7.53. Range was 7.23 to 7.62. US farmer was active seller of new crop wheat. WN22 was near 7.39. KWU ended near 7.36. Range was 7.06 to 7.47. US HRW farmer was and active seller of new crop KWN22 near 7.24. MWU ended near 9.32 with range 9.10-9.42, US HRS farmer should be a seller of MWN22 near 8.85. USDA est US 2021 wheat crop at 1,697 mil bu vs USDA 1,746. Spring 343 vs 345. Winter 1,319 vs 1,354. USDA est US wheat 21/22 carryout at 627 vs USDA 665. USDA est World wheat end stocks at 279.0 mmt vs USDA 291.2. USDA est Canada wheat crop at 24 vs 31.5 and Russia 72.5 vs 85.0. Steep drop inRussia crop could increase unknown for Russia wheat exports. USDA est Russia wheat exports at 35 mmt vs 40 previous and 38.5 ly. USDA dropped Canada what exports to 17.5 vs 23 in July and 27.5 ly. USDA est Ukraine crop at 33 mmt vs 30 previous.

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice.

ADM Investor Services International Limited, registered in England No. 2547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG.

A subsidiary of Archer Daniels Midland Company.

© 2021 ADM Investor Services International Limited.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.