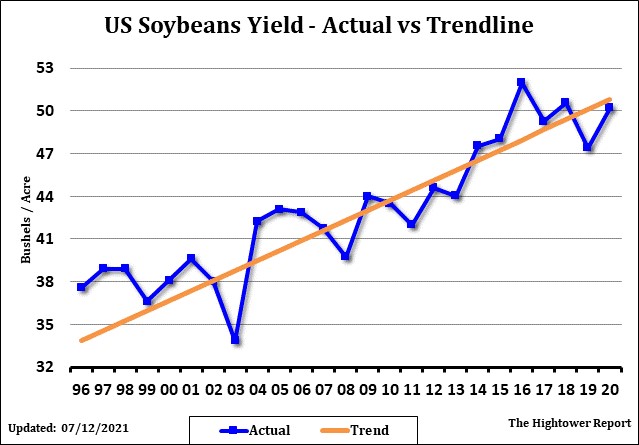

SOYBEANS

Soybeans rallied and ended near 13.48. SU tested 13.54. Resistance starts at 13.62 then 13.67 and 13.73. Some feel US farmers could increase cash sales above 13.80. Bulls feel tightening global soybean stocks to use ratio could suggest nearby soybean futures could eventually trade over 14.50. Natural hurdle for futures to trade above resistance is approaching US harvest and potential record yields in ECB and south states and uncertainty over USDA August soybean yield and carryout guesses. USDA continued to rate the US soybean crop 60 pct G/E vs 74 last year. Highest rate crops are in LA, MS, TN, IL, WI, KY and OH. Lowest rated crops are in ND, SD, MN and IA. USDA announced new US soybean sales to unknown and China. China has imported 83 mmt soybeans to date. They need to import 14 mmt Aug-Sep to reach USDA goal or down 25 pct from last year Aug-Sep.

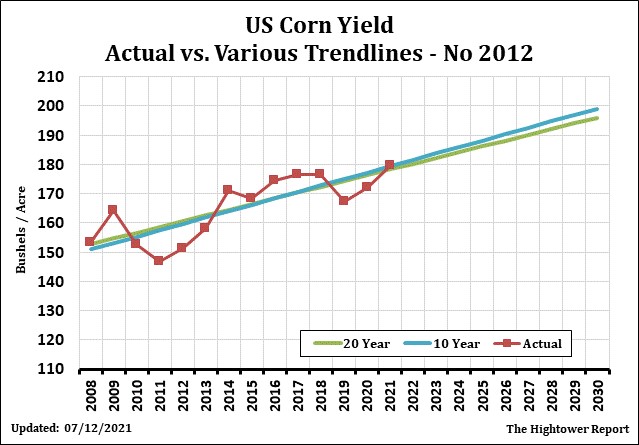

CORN

Corn futures ended lower but off session lows. CU ended near 5.49. Range was 5.44-5.50. CZ ended near 5.53. Range was 5.47-5.54. Since mid July CZ has traded between 5.40 and 5.60 with a midpoint near the 20 day 5.53. Support is 5.40 and the 100 day 5.44. Resistance is 5.60 and 50 day. Market awaits new China buying and USDA August est of US corn yield and 21/22 carryout. Trade est US corn yield near 177.6 vs USDA 179.5. Range is 175.7 to 180.0. Last year August farmer survey yield was 181 with final yield 172. Drop was linked to dry August. USDA increased US corn crop rating from 60 pct G/E to 62 pct and vs 71 last year. Highest rated crops are in OH, MI, KY, IL, WI and IN. Lowest rated crops are in ND, SD, MN and IA. Dalian corn futures ended lower after CNGOIC raised their China crop est 15 mmt. Trade is looking for USDA WOB to lower Brazil corn crop and raise US 2021/22 exports and lower US carryout. Average guess for the carryout is 1,297 versus USDA 1,432. Brazil CONAB est their corn crop at 86 mmt vs 93 previous and USDA 93. This week, most of the west Midwest should be dry. GFS has rain the second week especially IA. EU model is drier.

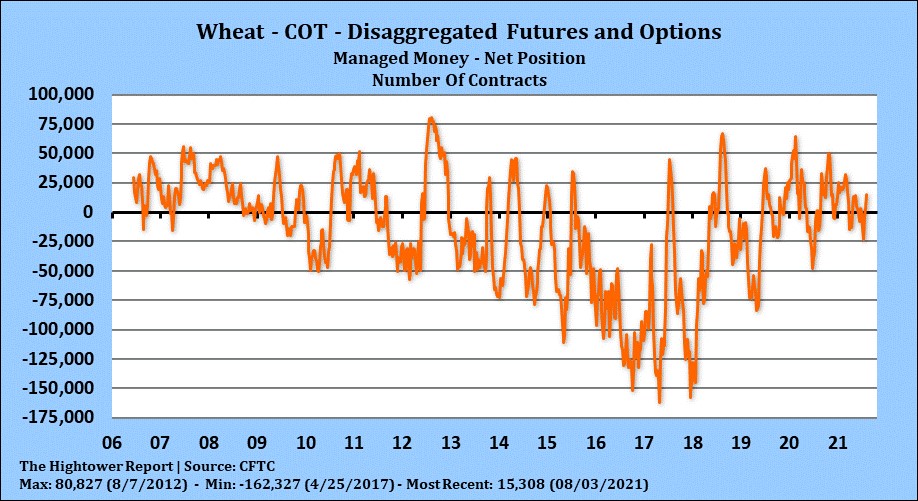

WHEAT

Wheat futures ended higher and closer to session high. Recent rally in US Dollar and concern over spread of new Covid variant virus was offering strong overhead resistance. Talk that US HRW fob prices are a premium to other sellers and that corn prices have dropped vs feed wheat lowering the feeding of wheat also offered resistance. Talk that US/Canada/Russia crops will be lower offers support. Todays higher close was linked to higher Russia prices. WU ended near 7.27 with range 7.08-7.30. Trade over 7.38 could suggest a test of 7.67. KWU ended near 7.14. Trade over 7.19 suggest a test of 7.45. Some feel drop in World exporters supply could suggest KC wheat could trade over 8.00 early in 2022. Since July 29, MWU has traded in a range between 9.00 and 9.28. Trade over 9.28 could suggest a test of 9.44. USDA rated the US spring wheat crop 11 pct G/E vs 10 last week and 69 last year. 38 pct of the crop is harvested vs 21 average. ND is rated 12 pct G/E with 24 pct of the crop harvested vs 15 average.

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice.

ADM Investor Services International Limited, registered in England No. 2547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG.

A subsidiary of Archer Daniels Midland Company.

© 2021 ADM Investor Services International Limited.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.