ADMISI London Wheat Report for 9 March

- March 10, 2023

- ADMISI Grains Team

- Follow us on Twitter @TradeADMIS

London Wheat Report

Source: FutureSource

Well the Kremlin’s pyro machine kicked in again with one of the largest missile waves for weeks hitting Ukrainian cities, primarily the power grid and power generation. Unsurprising really following the Ukrainian attacks on a few key Russian areas. US weekly jobless claims post largest rise in 5 months but the underlying trend remains consistent with a tight labour market. Newsfeeds kept trying to pump up the grains corridor chat as Lavrov said there were issues but the market was having none of it in any sense.

Wheat markets got absolutely slammed. Chicago continued its downwards trajectory throughout the day with May-23 hitting lows of 667.5 at time of writing. Current weather trends are predicted to linger for US winter wheat areas while rains are forecast for Argentina for the coming week. Russian weekly exports recover to 1Mmt as weather improves. Saudi are in for 480kt of wheat for their first tender of 2023. Matif wheat fell further with traded volumes increasing on the May-23 contract. Driver lower by Chicago and by the Matif commitment of trades posting increased gains in short positions. Matif May-23 hit a trading low of €263/t, settling at €263.50/t which was down €3.75 on yesterday. Market sentiment continues to be bearish so how much lower will we go?

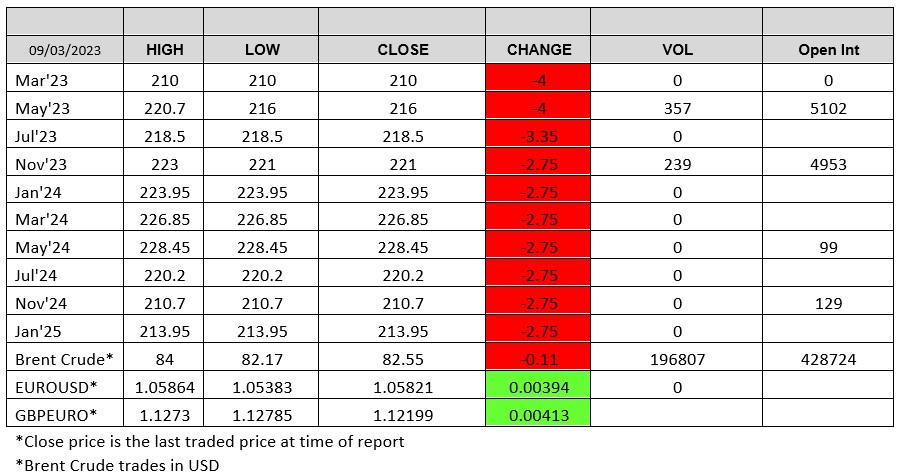

London wheat also continued on its bearish slide with May-23 hitting lows of £216/t and where it settled, down £4.00 on yesterday. These levels have not been seen since pre Ukraine war. Nov-23 was down £2.75 at 221/t. May/Nov-23 London spread was trading at circa -4. The murmurings of hitting £212/t on the May are coming closer and closer.

Matif rapeseed smashed through the €500/t level on May-23, not seen since pre Ukraine invasion and settled down €14.25 on yesterday at €499/t. Incredible considering the levels it has previously hit and it very much appears to be heading back to previous price levels.

Contact the ADMISI Grains and Oilseeds Derivatives Brokerage team

Hanne Bell, Ryan Easterbrook, Dominic Enston and Aaron Stockley-Isted

Phone: +44 (0)20 7716 8477 or +44 (0)20 7716 8140 Email: intl.grains@admisi.com

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice. ADM Investor Services International Limited, registered in England No. 2547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG. A subsidiary of Archer Daniels Midland Company.

© 2023 ADM Investor Services International Limited3

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice.

ADM Investor Services International Limited, registered in England No. 2547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG.

A subsidiary of Archer Daniels Midland Company.

© 2021 ADM Investor Services International Limited.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.