London Wheat Report

Source: FutureSource

WeWork WE.N warned of a possible bankruptcy in a stunning reversal of fortune for the shared workspace provider that four years ago was one of the world’s most prized startups with a valuation of $47 billion. The company was valued at just $446.8 million as of last close. A major GDPR breach involving PSNI, police service northern Ireland has left all officers details online after a mix up after a freedom of information request went wrong. The error lead to a spreadsheet being published online containing names of all officers and staff, where they were based and their roles.

Chinas floods are more serious than first thought and broadcast. It was suggested today that 2 percent of the sown area of China’s grain belt has been hit by the latest typhoon. Typhoon Doksuri has affected 3.87 million mu (258,000 hectares) of the sown area in China’s largest grain producing province Heilongjiang

Brazil have surpassed Argentina as the world’s largest exporter of soymeal so far in 2022/23. While potentially on track to break their own corn monthly export numbers of 7.67 MMT’s from August 2019, with estimates ranging from 7.8 to 9.8 so far for the month.

Australia’s largest bulk grain exporter has been cleared to resume barley shipments to China, the Australian government said on Wednesday, days after China removed steep anti-dumping tariffs on Australian barley imports. China suspended barley imports from CBH Grain, a subsidiary of CBH Group, in late 2020 after allegedly finding quarantine pests in cargoes. The suspension came during a low point in relations, when China restricted a range of Australian imports including barley, wine, coal and lobsters.

Rain delays to the end of the soft wheat harvest in France may affect milling quality, though crop gathered before the wet spell was generally showing satisfactory readings, farm office FranceAgriMer said on Wednesday. Frequent showers and cool temperatures since late July in northern France and a swathe of northern Europe have raised concern about quality loss. That has added to doubts about global milling wheat supply as war in Ukraine threatens Black Sea trade and drought hurts North American crops.

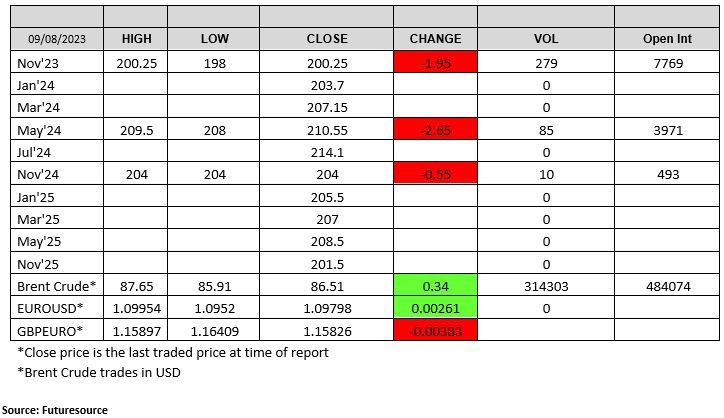

Overall today, Global Ags markets were in the Red. As was London. November 23 traded between £198 and £200.25 with the majority of volume around the 199 mark. May 24 was also trading around £3 down for most of the day. Volumes across the curve were poor, under 350 lots crossed the line.

Contact the ADMISI Grains and Oilseeds Derivatives Brokerage team

Hanne Bell, Ryan Easterbrook, Dominic Enston and Aaron Stockley-Isted

Phone: +44 (0)20 7716 8477 or +44 (0)20 7716 8140 Email: intl.grains@admisi.com

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice. ADM Investor Services International Limited, registered in England No. 2547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG. A subsidiary of Archer Daniels Midland Company.

© 2023 ADM Investor Services International Limited3

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice.

ADM Investor Services International Limited, registered in England No. 2547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG.

A subsidiary of Archer Daniels Midland Company.

© 2021 ADM Investor Services International Limited.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.