London Wheat Report

Source: FutureSource

WASDE day tomorrow. News this morning was full of the prisoner swap, basketball star Brittany Griner for the notorious arms dealer (and apparently the largest private air transport supplier to the Pentagon in the invasion of the 2003 Iraq war – well worth a Google FYI) Viktor Bout whom the Kremlin have been trying to annul ever since he was caught in 2008. Turkey is continuing to say that it will block vessels without the required paperwork even though Western vessels were never part of this agreement … maybe a little lesson here that the world doesn’t run on what the West says.

Market news offered support to Ags on the basis that UralChem announced that should Viterra or Cargill leave the Russian market, they will be intent on buying their Russian Operating companies. Putin has signed approval of the letter of intent. Food companies are not sanctioned by this but made some people jitter for sure. Not sure what the market inferred by this but it certainly pushed markets up earlier on.

US export sales weren’t great today. US weekly wheat sales rose 22% to 189.5kt, landing within estimates. Trade are all positioning ahead of tomorrow’s report. A lot of short covering was seen while the wheat markets were supressed. Drastic freight rate falls for grain from Ukraine’s ports fails to stimulate Black Sea Ukrainian demand. Grain exports from France’s Rouen port totalled 211,093t compared with 151,310t a week earlier, according to an emailed report. Rouen’s exports to China continue, up 10% W-O-W in the week to December 8th. What are they playing at here? Aussie October exports have been the highest in 10 years.

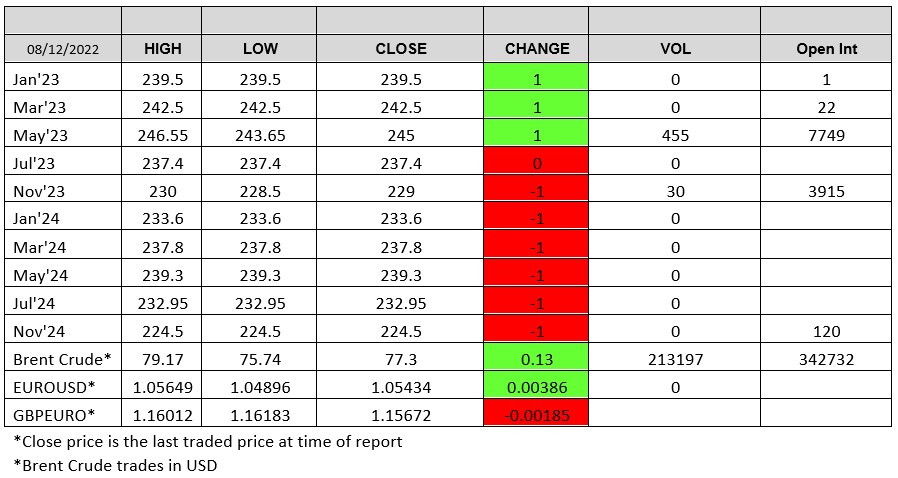

Matif wheat found support earlier on following US markets before settling unchanged with Mar-23 settling at €307.25/t. Matif Dec-23/Mar-23 spread was trading at 1.5 today, substantial decrease on late. London wheat had a pretty average day volume wise.

118kt of beans sold to China with another 718kt of beans sold to unknown today (most probably China). US soybean exports have risen to 1.2Mmt, above expectations. Brazil’s 2022/23 soybean crop is reported to hit 153.5Mmt, an all-time high and 20% increase from last year’s 127.9Mmt. Brazilian 2023 corn crop has been downgraded by 500kt by Conab that could be seen as supportive. We shall have to wait and see what tomorrow’s report holds.

Contact the ADMISI Grains and Oilseeds Derivatives Brokerage team

Hanne Bell, Ryan Easterbrook, Dominic Enston and Aaron Stockley-Isted

Phone: +44 (0)20 7716 8477 or +44 (0)20 7716 8140 Email: intl.grains@admisi.com

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice. ADM Investor Services International Limited, registered in England No. 2547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG. A subsidiary of Archer Daniels Midland Company.

© 2022 ADM Investor Services International Limited

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice.

ADM Investor Services International Limited, registered in England No. 2547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG.

A subsidiary of Archer Daniels Midland Company.

© 2021 ADM Investor Services International Limited.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.