London Wheat Report

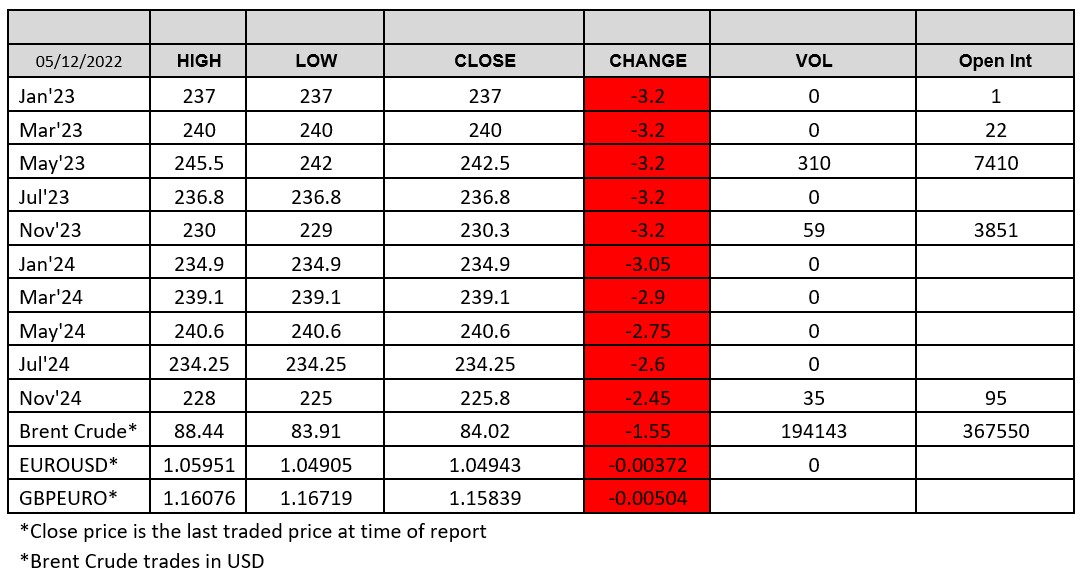

Source: FutureSource

Happy Monday! Great to see so many faces new and old on Friday at the London Bourse with a good attendance seen. Chinese markets appear to be firing up again with the central government announcing that they are dropping measures toward COVID. Russian oil price cap has been set at $60/ba, offered brent some support earlier on today. Most Russian oil is being sold to India and China at circa $50/ba, market discount for Russian crude and costs of production sit around $20/ba, so coffers are still being lined. And this is before we get into any creative rebranding/invoicing/origin that will most certainly be seen.

Wheat markets actually opened up with some support before tailing off again. Chicago wheat pushed much lower than expected with Mar-23 trading down 19 cents at time of writing, trading low being 74.5 so far. US weekly wheat inspections rose above expectations to 334,653t in the week to Dec-1.

Prices for Russian wheat with 12.5% protein content and for supply from Black Sea ports in late December-early January were at $315/t free on board (FOB) on Friday evening, down $2 from a week earlier, the IKAR agriculture consultancy said in a note.

Further downward pressure seen from announcements that the Aussie wheat harvest is coming in at a stonking 36.6Mmt, 1% increase over last year’s stonker. While the spring rain has impacted production, yields and quality in some parts of the country, some states are experiencing their best winter crops on record,” ABARES Director Jared Greenville said in a statement. Pakistan has announced a 950kt wheat purchase of optional origin with circa 450kt of this purchase expected to be Russian at a reported $372/t.

Beans are still experiencing small spot buying with China purchasing a reported 130kt of beans from the US. Brazil’s soybean sowing is 91% complete as of Thursday last week according to trade reports.

Contact the ADMISI Grains and Oilseeds Derivatives Brokerage team

Hanne Bell, Ryan Easterbrook, Dominic Enston and Aaron Stockley-Isted

Phone: +44 (0)20 7716 8477 or +44 (0)20 7716 8140 Email: intl.grains@admisi.com

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice. ADM Investor Services International Limited, registered in England No. 2547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG. A subsidiary of Archer Daniels Midland Company.

© 2022 ADM Investor Services International Limited

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice.

ADM Investor Services International Limited, registered in England No. 2547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG.

A subsidiary of Archer Daniels Midland Company.

© 2021 ADM Investor Services International Limited.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.