ADMISI London Wheat Report for 30 November

- December 1, 2022

- ADMISI Grains Team

- Follow us on Twitter @TradeADMIS

London Wheat Report

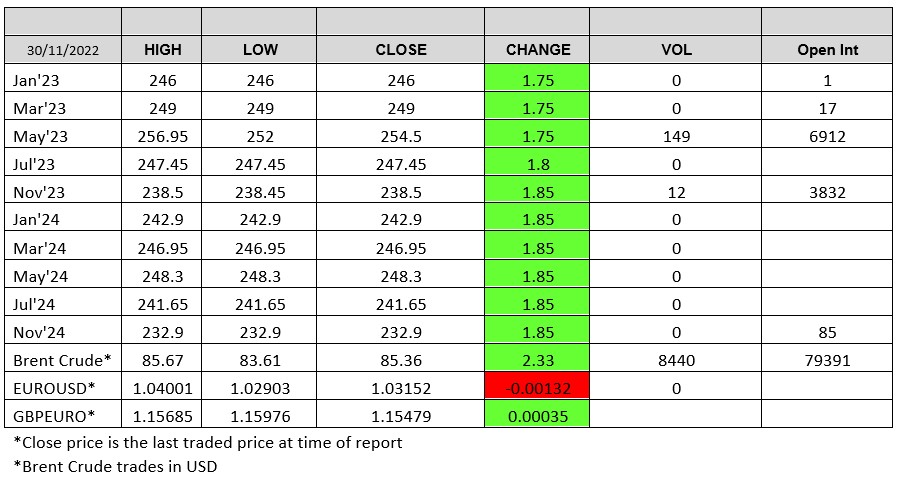

Source: FutureSource

Covid protests continue in China while there are signs that the softening of Chinese COVID policy is offering some support. Crude has bounced back and was trading up 2.8% at time of writing at $85.36/ba which helped reduce downward pressure across the commodity sector. Month end and first notice day on CBOT contracts. Mixture of showers across South America today and mixed growing conditions in the states. Pakistan is heard to have received offers in its tender for up to 500kt of wheat with the lowest at $372/t C&F which we all assume is from their Russian friends. We should see definitive results later on in the week. US winter wheat crop is more than 90% emerged according to the USDA in the week to 27th of November. London wheat had a pretty quiet day today overall with not a huge amount of excitement. May-23 saw some trade throughout the day with a good trading range whereas Nov-23 was pretty stagnant. Matif wheat had a slow morning then cranked up the pace volume wise. Mar-23 found support from Chicago, settling up €3.25 on yesterday at €316.00/t. South Korea bought some 69kt of corn from South America. European commission has lowered EU corn production to 53.5Mmt, down by 3% for the block. Matif corn was pretty dull in trade today. Brazil’s 2022-23 corn crop is forecast to reach 126Mmt, an increase of nearly 9% over the previous year. Soybeans were supported with an announcement of 136kt of beans sold to China. Couple of spot cargoes although no major volumes were seen or appear to be seen on the horizon. Argentine farmer sales of new crop soybeans continued to fall in the week to November 23rd. European commission lowers 2022 oilseed forecast by 800kt to 31.4Mmt. |

Contact the ADMISI Grains and Oilseeds Derivatives Brokerage team

Hanne Bell, Ryan Easterbrook, Dominic Enston and Aaron Stockley-Isted

Phone: +44 (0)20 7716 8477 or +44 (0)20 7716 8140 Email: intl.grains@admisi.com

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice. ADM Investor Services International Limited, registered in England No. 2547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG. A subsidiary of Archer Daniels Midland Company.

© 2022 ADM Investor Services International Limited

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice.

ADM Investor Services International Limited, registered in England No. 2547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG.

A subsidiary of Archer Daniels Midland Company.

© 2021 ADM Investor Services International Limited.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.