ADMISI London Wheat Report for 3 August

- August 4, 2023

- ADMISI Grains Team

- Follow us on Twitter @TradeADMIS

London Wheat Report

Source: FutureSource

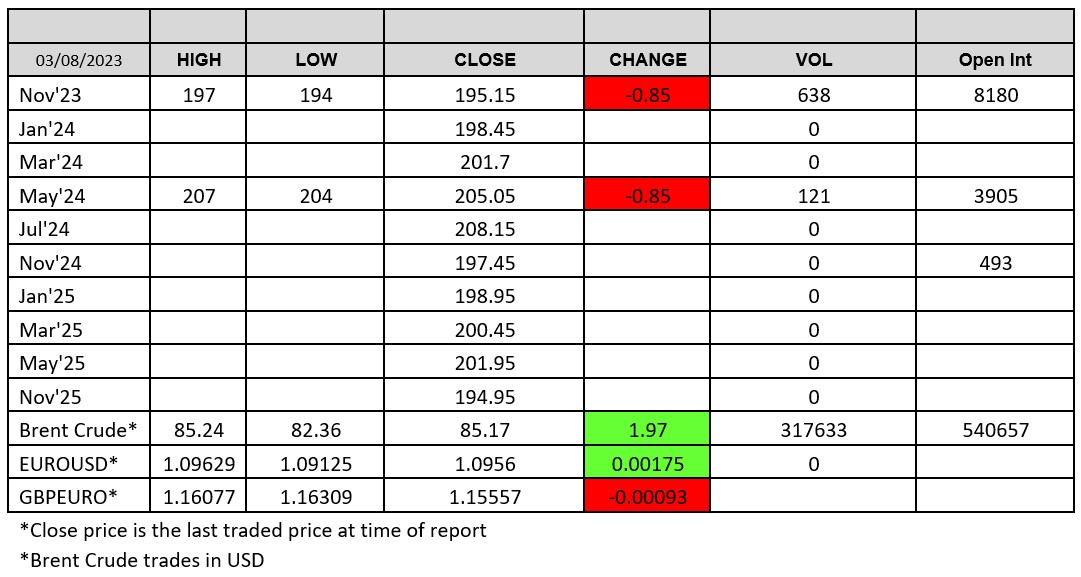

Bank of England raised UK base rate by 25bps to 5.25% with murmurings of a peak next spring of 5.75%, we shall have to see. Eco activists were arrested today on Rishi Sunak’s roof protesting against the new oil licenses. Saudi announced they were extending the 1M bpd oil cut for another month to include September as they try to prop oil prices. Brent crude was trading up nearly 2% today around the $84.65/ba levels.

Wheat markets weren’t that exciting today across the pond or in Europe. Rouen total weekly export sales took a dump, down 25% on the back of a hiatus of Moroccan buying of late and coming in at 256kt. US weekly wheat net sales were up at 421,300t, up 81% as exports were up. A lot of market chatter today about India and Russia doing a govt/govt deal for around 9Mmt of Russian wheat which would be seen as quite a winner and an offload for the Kremlin. As seen, this is part of their long term strategy to conduct govt/govt deals rather than through intermediaries. We are going to be seeing a lot more of this going forward, whether this deal in question happens or not. Danube and Rhine water levels are improving substantially and should alleviate any pressure on logistics.

Chicago wheat kicked off the day trading around the unchanged levels before pushing lower later in the afternoon with Sep-23 trading down 13 cents at time of writing. Matif wheat was trading around unchanged to marginally lower for most of the day with volumes around average. London wheat after a very quiet start ended up trading not too badly volume wise with Nov-23 seemingly trucking along around the £195/196 level towards the close.

USDA announced a couple of cargoes of new crop beans to China again. 2.6Mmt of beans sales for new crop have been posted. Weather looking good across the US. Chicago corn was trading lower again today, US corn is not hitting the export spot currently alongside the strength of USD of late. Matif rapeseed was supported, with Nov-23 shooting up, sitting at circa €459/t going into the close.

Contact the ADMISI Grains and Oilseeds Derivatives Brokerage team

Hanne Bell, Ryan Easterbrook, Dominic Enston and Aaron Stockley-Isted

Phone: +44 (0)20 7716 8477 or +44 (0)20 7716 8140 Email: intl.grains@admisi.com

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice. ADM Investor Services International Limited, registered in England No. 2547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG. A subsidiary of Archer Daniels Midland Company.

© 2023 ADM Investor Services International Limited3

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice.

ADM Investor Services International Limited, registered in England No. 2547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG.

A subsidiary of Archer Daniels Midland Company.

© 2021 ADM Investor Services International Limited.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.