ADMISI London Wheat Report for 28 November

- November 29, 2022

- ADMISI Grains Team

- Follow us on Twitter @TradeADMIS

London Wheat Report

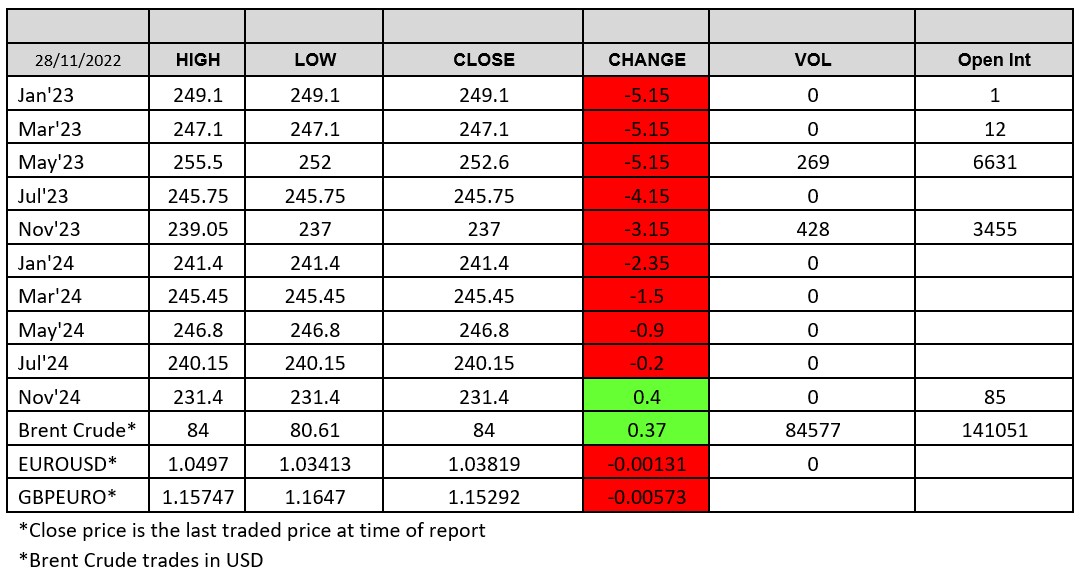

Source: FutureSource

Happy Monday!

Weekend news focuses on the continued increase in Chinese covid cases hitting fresh highs on a daily basis and supposed growing civil unrest against the Chinese government. Lockdowns are now starting to weigh serious questions on the Chinese economy, especially in the coming months if they cannot be rectified. Around the equivalent of 20% of GDP are either in partial or complete lockdown. Following this, equity markets and commodities dropped on the open this morning although Brent, which was trading down circa 3% at one point, hitting $80.61/ba was trading only 0.3% down at 83.25/ba at time of writing as new sources have said that OPEC are now looking at cutting production at last week’s meeting. How true this is, is up for debate.

All wheat markets were down in today’s trade, both US and Europe. Following other commodity markets lower. US wheat export inspections slipped under expectations at 198.5kt. Russian wheat still remains the cheapest by far and with good weather forecast for the Black Sea for December and a Russian will to fling it out the door, we could see a strong month for Russian exports. APK inform has cut its Ukraine 2022 grain crop forecast to 51.8-53.7Mmt from a previous outlook of 53.2-53.6Mmt.

Additional market rumours today that Iran was having issues securing letters of credit for wheat imports and so were Egypt for their Russian wheat purchases although these smell a bit off to me.

Matif wheat was pretty bearish today with Mar-23 settling down €3.25 on Friday at €315.25/t. Dec-22/Mar-23 spread is on the up again, trading around the €10.5 mark. London wheat had a decent day volume wise, trading 697 lots on the May-23 and Nov-23. Interestingly, 408/428 lots traded were traded pre 11am which is substantial volumes for so early on.

French soft wheat and winter barley crops are still about a week ahead of their usual rate of development following a mild autumn, data from farm office FranceAgriMer showed on Friday. Around 93% of soft wheat had emerged across the expected area by Nov 21st.

US oilseed complex has had a bit of a yo-yo in today’s trade, as initially it was trading lower after the announcement of the new Argentine ‘Soy peso’ will begin today at the rate of 230/$1 – comparing to the listed value of 165/$1. Expectations are that an additional 3-5Mmt will be sold before Dec-22. Potential uplift to sellers of 40% on value. Soybeans and soybean meal then shot up substantially later in the afternoon as reports came in over dry weather in Argentina, shifting demand across to the US.

South Korea bought 138kt of corn of optional origin corn. Ukraine, Russia and Paraguay are excluded. Matif rapeseed followed Brent lower, with Feb-23 settling down €5.75 on Friday at €584.25/t.

Contact the ADMISI Grains and Oilseeds Derivatives Brokerage team

Hanne Bell, Ryan Easterbrook, Dominic Enston and Aaron Stockley-Isted

Phone: +44 (0)20 7716 8477 or +44 (0)20 7716 8140 Email: intl.grains@admisi.com

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice. ADM Investor Services International Limited, registered in England No. 2547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG. A subsidiary of Archer Daniels Midland Company.

© 2022 ADM Investor Services International Limited

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice.

ADM Investor Services International Limited, registered in England No. 2547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG.

A subsidiary of Archer Daniels Midland Company.

© 2021 ADM Investor Services International Limited.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.