Source: Future Source

After last week’s buoyant trade, US grains and oilseeds were mixed as all three commodities search for something fresh to trade while harvest activity picks up. Strong global wheat demand continues to support prices, with the 984kt issues last week. Today, the UN have issued a tender for Ethiopia amounting 200kt milling wheat issued today and Algeria’s state grain importer has also added a tender for November shipment for milling wheat, amount tbc. China has continued to purchase wheat for the 2021/22 season, opting for Australian wheat despite trade friction with volumes circa 2Mmt. China has cancelled French wheat due to quality concerns and has turned back to Down Under as pricing, logistics and quality all appear superior. Global wheat availability is still tight this season which limit’s China’s options. China is set to produce 136.9Mmt of wheat but should consume 149Mmt. Chicago Dec-21 wheat was trading a cent down and Kansas Dec-21 was up ¾ a cent at the time of writing.

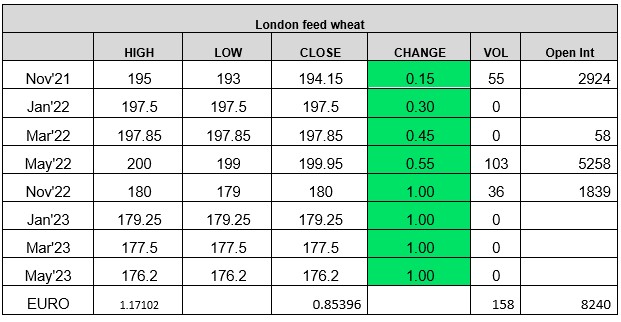

Matif Dec-21 settled unchanged on Friday at €253.25/t and Matif May-22 settled up €0.25 on Friday at €244.50/t. EU exports continue, with the latest EU export data showing that over 6.5Mmt has now been shipped this season, 2Mmt up from this time last year. London wheat Nov-21 settled up £0.15 on Friday at £194.15/t and May-22 settled £0.55 up at £199.95/t. UK delivered prices followed futures gains last week. Into East Anglia (Nov-21) delivered prices rose £3.50/t to £193.00/t (Thurs-Thurs). Milling wheat Northamptonshire (Nov-21) was up £7.00/t (Thursday 23rd) at £232.00/t (AHDB).

Rapeseed continues to be bullish, especially in the front end. Matif Nov-21 settled up €6.00 on Friday’s settlement at €625.50/t and May-22 settled up €3.75 at €602.50/t. The squeeze on the front end may potentially become even more significant as we approach delivery due to the lack of supply on the market. Delivered rapeseed into Erith on Friday was quoted at £532.00/t. Chicago Soybeans were trading up, Nov-21 was up 4 cents and Mar-22 up 6 cents at the time of writing. Harvest support and Chinese demand helped the bulls. The USDA announced 334kt of beans to China in today’s news.

Contact the ADMISI Grains and Oilseeds Derivatives Brokerage team

Hanne Bell & Ryan Easterbrook

Phone: +44 (0)20 7716 8477 or +44 (0)20 7716 8140 Email: intl.grains@admisi.com

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice. ADM Investor Services International Limited, registered in England No. 2547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG. A subsidiary of Archer Daniels Midland Company.

© 2021 ADM Investor Services International Limited

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice.

ADM Investor Services International Limited, registered in England No. 2547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG.

A subsidiary of Archer Daniels Midland Company.

© 2021 ADM Investor Services International Limited.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.