ADMISI London Wheat Report for 27 April

- April 28, 2023

- ADMISI Grains Team

- Follow us on Twitter @TradeADMIS

London Wheat Report

Source: FutureSource

Well Jerry Springer passes away at the ripe old age of 79. Main headline today pretty much with little on the macro markets. The yuan became the most widely used currency for cross-border transactions in China in March, overtaking the dollar for the first time. Very much in flow with Beijing’s policy. On the back of that, Argentina has announced that it is going to pay for Chinese imports in Yuan. Gremlins from Just Oil continue their irritancies across London in a very much minimal form, where are those good old Water Cannons that Bozza bought a while back ….

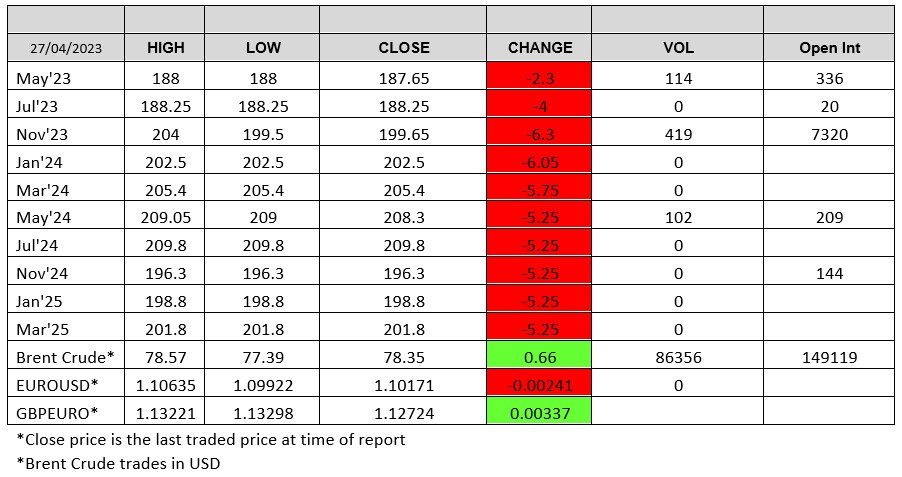

Kremlin’s drums continue to rumble as they insist on a full implementation of the Black Sea grains deal and unless the West removes obstacles to Russian grain and fertiliser exports. Iraq books 150kt of Australian wheat at a recent tender. US weekly wheat sales were down 40% with exports up 50%. Rouen’s weekly exports shot up 88% to 145kt, primarily led by Morocco buying. Rains are coming down across the US plains, quelling weather and drought chat to the max. Chicago wheat was pretty soft with Sep-23 trading down 16 cents at time of writing. Matif was also looking very squishy, with Sep-23 settling down €5.75 on yesterday at €236.75/t. London Wheat Nov-23 was also pushed down the slide, hitting £200/t and looking like we’re going to be sliding further.

Lots of chatter on corn markets today as Chicago Jul-23 corn sank below 585 as China announced its done buying US and Brazilian summer corn is undercutting US. Trade analysts are already lowering estimates of US corn exports and increasing carryout. US domestic demand remains strong.

Soybean was also following a similar pattern with Chicago cooling off. Demand for US soybean exports is also being tainted by additional Brazilian exports. Increased Indonesian palm oil export supplies and talk of higher 2023 world sunoil and RSO supply is weighing on soyoil futures. Matif Rapeseed pushed lower with Aug-23 settling down €12.25 on yesterday at €440/t.

Contact the ADMISI Grains and Oilseeds Derivatives Brokerage team

Hanne Bell, Ryan Easterbrook, Dominic Enston and Aaron Stockley-Isted

Phone: +44 (0)20 7716 8477 or +44 (0)20 7716 8140 Email: intl.grains@admisi.com

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice. ADM Investor Services International Limited, registered in England No. 2547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG. A subsidiary of Archer Daniels Midland Company.

© 2023 ADM Investor Services International Limited3

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice.

ADM Investor Services International Limited, registered in England No. 2547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG.

A subsidiary of Archer Daniels Midland Company.

© 2021 ADM Investor Services International Limited.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.