London Wheat Report

Happy Monday!

Well, what a weekend for the rugby as the Aussies had another setback last night against Wales. How Eddie Jones still has a job there is beyond me. Verstappen yet again performed in Japan, getting a little boring now. Time to reduce the rules and increase the spice. Zelensky has met with US finances to discuss investment and reconstruction and Lavrov said any grain corridor revival is unrealistic. Trade will continue to watch the independent corridor. A lot of US reports trying to ramp up UKR/RUS tensions but nothing fundamentally has changed, a 3kmsq gain is a 3kmsq gain, a lot still to go to get to the Azov and the war of attrition will inevitably continue.

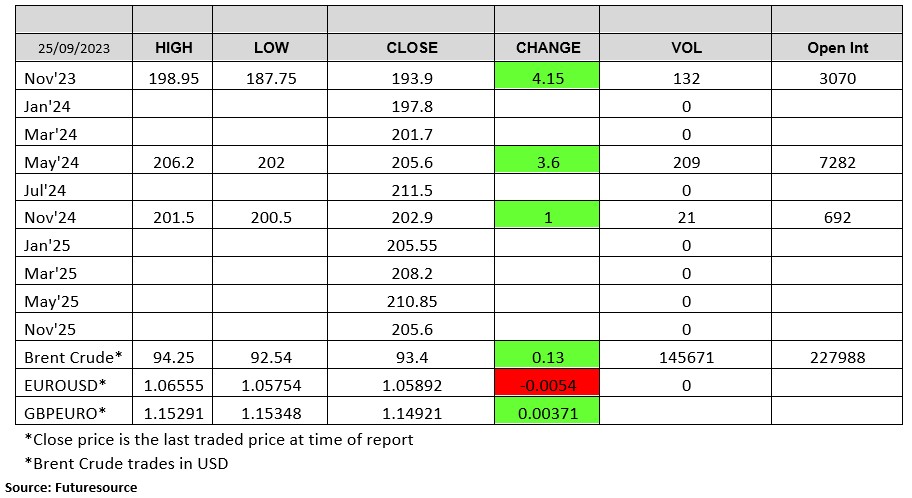

Markets are a little uninspiring to kick the week off. Minimal juicy chat and quite a flat day of trade. Egypt is in talks with Abu Dhabi Commercial Bank for some monies to able them to finance some wheat from Kazakhstan, which supposedly will be cheaper than Russian origin which was reportedly turned down last time due to not hitting the unofficial minimum pricing. US wheat inspections rise 6.7% to 451kt, above market expectations. CFTC saw funds increasing their shorts in US wheat. Market chatter on dryness concerns in Aussie and Argentina, need something to feed the bulls albeit most of the price action today on wheat was a mixture between this and the Odessa strikes. Chicago wheat was supported this afternoon with Dec-23 trading up 5 cents at time of writing. Matif was also trading higher with Dec-23 settling up €4.50 on Friday at €240.25/t. London wheat had a slow day with a single lot of Nov-23 hitting £198.95, seems someone slammed through a market order when there was minimal liquidity.

USDA announced the sale of 1,049,771t of Corn to Mexico in marketing year 23/24 and a further 611,389t in 24/25. US weekly corn export inspections down 2% but above estimates at 660,811t. Chicago soybeans and soyoil were trading lower today in comparison to last week while Matif rapeseed was sat around unchanged into the close. Brazil’s soybean sowing starts at good pace despite weather concerns.

Contact the ADMISI Grains and Oilseeds Derivatives Brokerage team

Hanne Bell, Ryan Easterbrook, Dominic Enston and Aaron Stockley-Isted

Phone: +44 (0)20 7716 8477 or +44 (0)20 7716 8140 Email: intl.grains@admisi.com

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice. ADM Investor Services International Limited, registered in England No. 2547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG. A subsidiary of Archer Daniels Midland Company.

© 2023 ADM Investor Services International Limited3

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice.

ADM Investor Services International Limited, registered in England No. 2547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG.

A subsidiary of Archer Daniels Midland Company.

© 2021 ADM Investor Services International Limited.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.