ADMISI London Wheat Report for 24 November

- November 24, 2021

- ADMISI Grains Team

- Follow us on Twitter @TradeADMIS

London Wheat Report

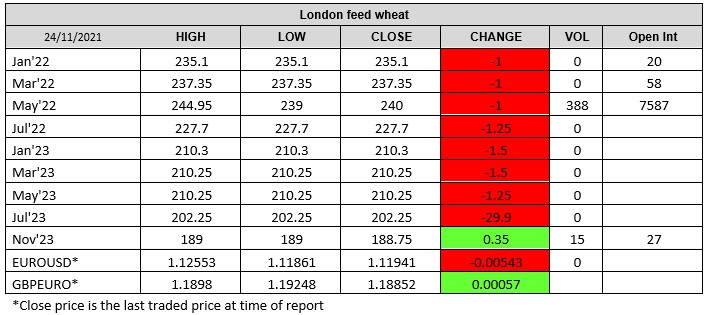

Source: FutureSource

Global wheat markets started high before cooling off as the US Thanksgiving holiday approaches. US wheat was trading up to start the morning along with Matif. Matif wheat hit new record contract highs, a new all-time high for Matif wheat with Dec-21 hitting €313.50/t and Mar-22 hitting another all-time high for second month at €311.50/t. US markets pulled back substantially in the afternoon with Chicago Dec-21 trading down 17 cents and Kansas Dec-21 trading down 4 cents at time of writing. Prime focus remains on the Australian wheat harvest. WA harvest is continuing at pace with a spate of good weather and yields coming in higher than expected but protein content is turning into an issue. E Australian harvest continues to be hampered by rain. Percentage of feed wheat is building with the APW-ASW spread reportedly hitting A$80. Ukraine have raised their wheat production to 31.1Mmt (up by 1%) reflecting the slightly elevated harvested area and unchanged yield potential. Rasputin is back on the Russian grain scene with the Russian Ministry of Ag’s weekly harvest update continuing to raise production without raising harvested acres or yield which is quite an achievement. Export optimism was supporting German premiums. Standard 12% protein wheat for January onwards delivery in Hamburg was offered for a round a €3.00 premium over Matif Mar-22 futures.

Matif Dec-21 settled down €5.25 on yesterday at €306.25/t and Mar-22 settled down €0.25 on yesterday at €308.25/t. London wheat followed suit with May-22 settling down £1.00 on yesterday at £240/t.

Positive news from Canadian Pacific as they have said that some level of service will be reinstated on the West Coast corridor. Only a single line for now but at least exports will start flowing once again out of Vancouver where Monday’s stats indicated there were 19 grain boats at anchor.

South Korea have reportedly bought between 50kt – 65kt of corn according to the trade with a purchase price of $319.76/t c&f. Brazil’s grain exporters association Anec has increased its forecast for soybeans exports in November in its latest report with 2.6Mmt of soybeans and 3mmt of corn. USDSA ethanol update is anticipated to confirm that USDA’s annual projection is too low. Chicago Dec-21 corn was trading a quarter of a cent down. Aussie rapeseed production has been increased by 2% since the last update to 4.6Mmt. Matif rapeseed regained its losses with Feb-22 settling up €9.25 on yesterday at €691.25/t.

Contact the ADMISI Grains and Oilseeds Derivatives Brokerage team

Hanne Bell, Ryan Easterbrook, Dominic Enston, Aaron Stockley-Isted

Phone: +44 (0)20 7716 8477 or +44 (0)20 7716 8140 Email: intl.grains@admisi.com

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice. ADM Investor Services International Limited, registered in England No. 2547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG. A subsidiary of Archer Daniels Midland Company.

© 2021 ADM Investor Services International Limited

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice.

ADM Investor Services International Limited, registered in England No. 2547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG.

A subsidiary of Archer Daniels Midland Company.

© 2021 ADM Investor Services International Limited.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.