ADMISI London Wheat Report for 24 January

- January 25, 2023

- ADMISI Grains Team

- Follow us on Twitter @TradeADMIS

London Wheat Report

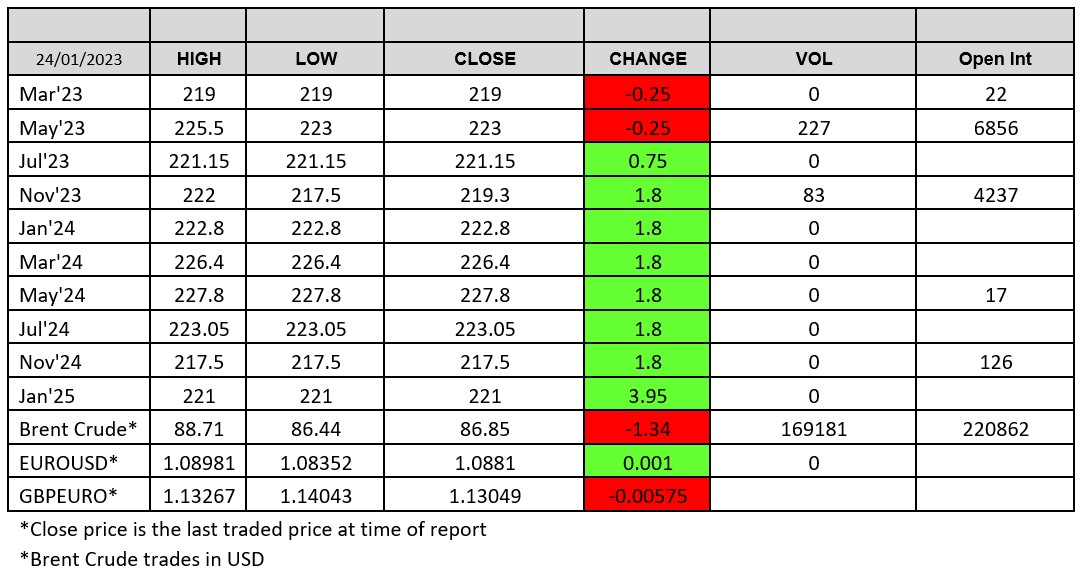

Source: FutureSource

Turn around Tuesday has been evident on the markets. Been a little while since we’ve seen this. Tankgate continues although with a greater positivity than previously with the Germans now being more open in their vocab to allowing member Nato states to send Ukraine Leopards. It was also announced this afternoon that the US are considering sending Abrahams tanks to Ukraine, something which they previously denied. Ukraine have had their largest purge of officials since the war began due to corruption charges. Turkey have spat their dummy out over talks with Sweden and Finland joining Nato with the Fins now seeking to go alone as the Swedes and Turks continue to see differently regarding the Kurdish issue.

Wheat markets finally found some support from the slide seen in recent days. Chicago found support, trading up 10 cents at time of writing. EU weekly wheat export pace was up 77% W-O-W, amounting to 242,392t, 76.8% higher on last week. YTD currently stands at 18.1Mmt. Chinese buying of European barley was seen up prior to Chinese NY slowdown. Russian Black Sea wheat shipments see little sign of slowing with Lavrov saying that the grains corridor is working more or less as anticipated. EU winter crops are in good shape according to MARS. Algeria have stated they intend to be 50% sufficient in their wheat requirements with Russia taking up the slack.

Matif Mar-23 wheat settled up €2.50 on yesterday at €281.75/t. London wheat was pretty steady on the May and Nov 23 contracts. Volumes pretty average. May was seen settling marginally down and Nov was seen supported. As current things stand, we will very much be looking towards the US and crop conditions over the next few months for price support as the UK’s exportable surplus is substantial and carryover stocks are anticipated to be considerable.

USDA reported 130kt of corn that was sold to an unknown. ANEC have upped their Brazilian corn exports for Jan-23 to 5.2Mmt while reducing bean exports to 1.356Mmt. Corn is much stronger than Jan-22 where it stood at 2.82Mmt.

Chicago soybeans kicked off the main trading session with a rally before pulling back to near unchanged at time of writing, primarily due to recent rainfall in Argentina. Rains have appeared to stabilise crops according to trade reports. Matif rapeseed was also supported in today’s trade with May-23 settling up €2.25 on yesterday at €529/t. Imports and bio-diesel concerns, especially German suggested limitations on bio-diesel production have been weighing on Matif rapeseed of late.

Contact the ADMISI Grains and Oilseeds Derivatives Brokerage team

Hanne Bell, Ryan Easterbrook, Dominic Enston and Aaron Stockley-Isted

Phone: +44 (0)20 7716 8477 or +44 (0)20 7716 8140 Email: intl.grains@admisi.com

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice. ADM Investor Services International Limited, registered in England No. 2547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG. A subsidiary of Archer Daniels Midland Company.

© 2022 ADM Investor Services International Limited

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice.

ADM Investor Services International Limited, registered in England No. 2547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG.

A subsidiary of Archer Daniels Midland Company.

© 2021 ADM Investor Services International Limited.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.