ADMISI London Wheat Report for 23 March

- March 24, 2023

- ADMISI Grains Team

- Follow us on Twitter @TradeADMIS

London Wheat Report

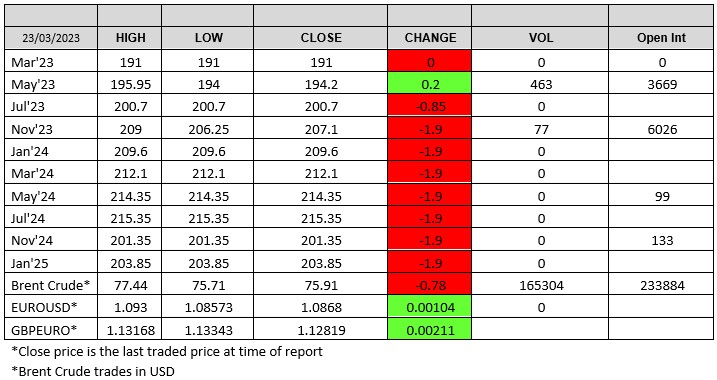

Source: FutureSource

Bank of England increased rates to 4.25% today, as anticipated by the market. Yesterday the FED increased their rates by 25bps to 4.75%. GBP strengthened against USD, trading at 1.23 at time of writing. Stock markets found support.

More market murmurings that Xi also did a deal to buy additional Russian wheat but that’s just rumours and tbf, there’s so much of the stuff that it won’t have much of an impact. US weekly wheat sales tumbled 63% to 125,600t while exports improved. Chicago wheat was trading unchanged at time of writing with EU and Russian export prices continuing to offer resistance. Rouen’s wheat exports also rebounded after a quiet spell last week according to French numbers. Matif wheat was still trading lower with May-23 hitting trading lows of €244/t before settling down €3.00 on yesterday at €245/t. After yesterday’s action-packed day on London, it was a much quieter affair. May-23 stayed trading around £194 for most of the day, unchanged on yesterday while Nov-23 was trading lower.

US weekly reporting confirmed corn sales to China with the 5th largest week of corn sales with China buying 2.24Mm and Japan buying 648kt equating to 3Mmt. Chicago corn was trading unchanged at time of writing. Oilseed complex was trading lower as Brazil soybean exports are offering resistance with market rumours flying around that Brazilian soybeans could soon be imported into the US.

Contact the ADMISI Grains and Oilseeds Derivatives Brokerage team

Hanne Bell, Ryan Easterbrook, Dominic Enston and Aaron Stockley-Isted

Phone: +44 (0)20 7716 8477 or +44 (0)20 7716 8140 Email: intl.grains@admisi.com

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice. ADM Investor Services International Limited, registered in England No. 2547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG. A subsidiary of Archer Daniels Midland Company.

© 2023 ADM Investor Services International Limited3

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice.

ADM Investor Services International Limited, registered in England No. 2547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG.

A subsidiary of Archer Daniels Midland Company.

© 2021 ADM Investor Services International Limited.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.