ADMISI London Wheat Report for 23 February

- February 24, 2023

- ADMISI Grains Team

- Follow us on Twitter @TradeADMIS

London Wheat Report

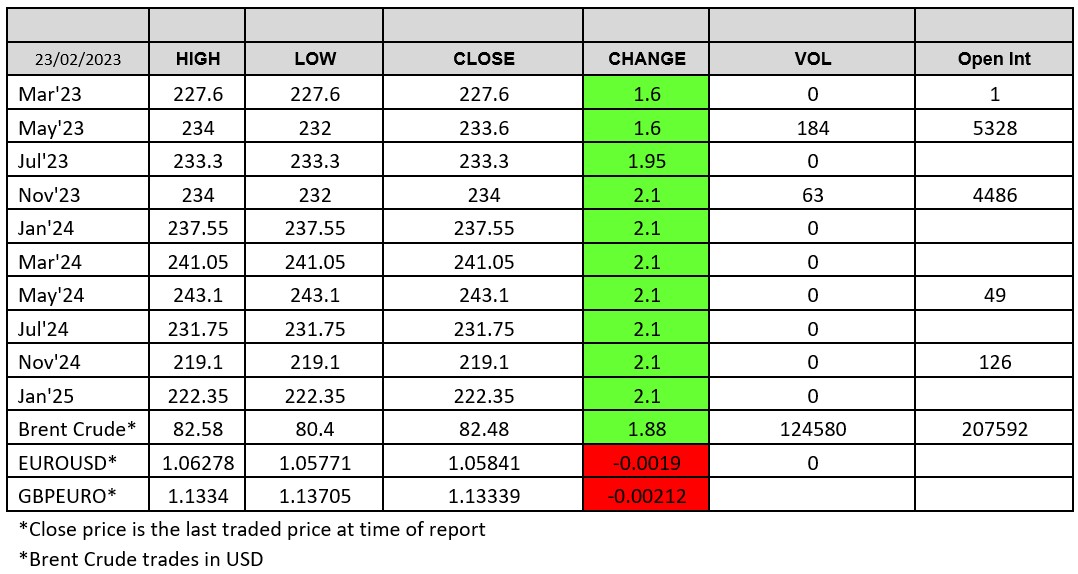

Source: FutureSource

Well, tomorrow marks the 1 year anniversary of Russia’s invasion of Ukraine so expect some additional pyro from the Kremlin. Q4 US GDP came in yesterday at 2.7% vs estimates of 2.9%. US weekly jobless claims fall. Iraq announced yesterday that they will start to use yuan in Chinese trade rather than USD – that’ll be an irk for the Americans. Sabre rattling continues between Russia/Ukraine – Moldova situation is heating up. US is threatening to release intelligence showing that China is agreeing to supply Russia with weaponry. USD strength continues to act as a bearish force toward the attractiveness of ag and other major commodities globally. Supermarket Veg shortage hype continues.

USDA released their outlook numbers for corn, beans and wheat acres alongside respective balance sheets. Only real chatter as there literally is no exciting news in the market. Wheat markets weren’t overly exciting today with Russian wheat still cleaning up pretty well – the spread between the Rouen offering and cheapest Russian offer in GASC’s recent tender was $24/t. Rouen’s weekly wheat exports fall to 33.5kt, with total amount destined for Algeria. Chatter continues from the trade about the long term extension of the grains corridor which I just find as lacking substance really, the reality of obtaining a yearlong extension is minimal but the Kremlin isn’t just going to stop the flow. Ukraine are requesting larger vessels due to hold ups in the Dardanelles but this is quite unlikely and also the addition of Mykolaiv port to the agreement. Nibulon have come out saying that there is little point in this until Ukraine control a decent amount of territory on both sides.

Matif wheat rebounded in trade today compared to yesterday’s downfall. Even though there is minimal physical tenders in the European sphere and zero opportunity in this week’s tenders, the market strengthened. May-23 settled up €3.25 on yesterday at €284.25/t. London wheat had a steady day, following Matif higher. London Old Crop/New Crop spread is currently trading at parity, what a difference to May-22 when it hit a high of £69.50 – serious tekkers. Current physical UK sales are limited and we are not export competitive as a result.

Ukraine’s weekly oilseed product export falls on Istanbul delays. Argentine weekly soybean sales increased. USDA outlook numbers, market seems to anticipate Corn acres increasing from 91m ad bean acres could decrease below the 87.5m. Matif rapeseed May-23 settled down €13.50 on yesterday at €544.50/t.

Contact the ADMISI Grains and Oilseeds Derivatives Brokerage team

Hanne Bell, Ryan Easterbrook, Dominic Enston and Aaron Stockley-Isted

Phone: +44 (0)20 7716 8477 or +44 (0)20 7716 8140 Email: intl.grains@admisi.com

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice. ADM Investor Services International Limited, registered in England No. 2547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG. A subsidiary of Archer Daniels Midland Company.

© 2023 ADM Investor Services International Limited3

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice.

ADM Investor Services International Limited, registered in England No. 2547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG.

A subsidiary of Archer Daniels Midland Company.

© 2021 ADM Investor Services International Limited.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.