ADMISI London Wheat Report for 22 November

- November 22, 2021

- ADMISI Grains Team

- Follow us on Twitter @TradeADMIS

London Wheat Report

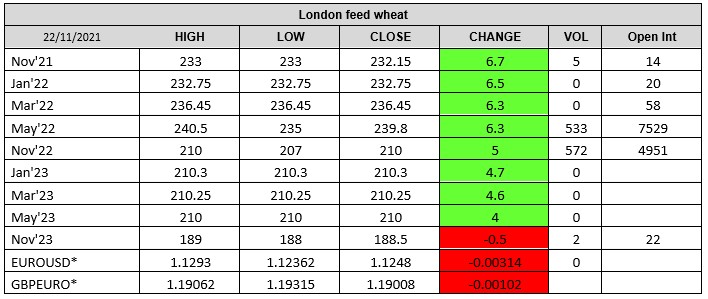

Source: FutureSource

Global wheat markets started the week booming in today’s trading. Record levels were seen in US and European markets. Chicago Dec-21 hit a trading high of $8.48-1/2 at time of writing, a high not seen since December 2012. Matif wheat also broke new records, with Dec-21 hitting a new record high of €310.25/t in today’s trade. London wheat followed suit hitting a new contract and all-time high of £240.50/t in the May contract. Unbelievable prices in an extraordinary market. Eastern Australia experienced unwelcomed rain over the weekend across Queensland, Northern NSW, SA and WA. Forecast remains unchanged for the coming week which will once again hamper harvest progress. Canadian Pacific have said that the rail disruption should be sorted out by the end of the week, initial reports stated months to rectify. Russian grain exports are down by 23% YOY. Russian troops amassing at Ukrainian eastern boarder are up by 100% YOY. 90,000 Russian troops complete with artillery and armour have amassed at the border. U.S. intel shared with EU, Ukraine officials fear late Jan or Feb attack a possibility although in reality this is doubtful. Vlad turning off the gas taps and now the T90s are revving up on the Russia/Ukraine border, classic Kremlin mischief making, seeing how far they can push things. What is for certain though is that they are adding to the bullish wheat markets sentiment. Jordan tenders for 120kt of wheat for Nov-29 and Bangladesh sees offers for 50kt of wheat, lowest at $409.77 to $437.47. Matif Dec-21 settled up €9.25 on Friday at €309/t and Mar-22 settled up €8.75 at €305.75/t. London wheat prices continue to fire on all cylinders following global markets. May-22 settling up £6.30 on Friday at £239.80/t and Nov-22 up £5.00 on Friday at £210/t. Physical markets remain strong with market chatter saying that parts of Yorkshire are buying at a £7t-£9t premium against May futures for feed wheat. Dec-21 delivered int North Humberside is quoted at £240.50/t (AHDB). China soybean imports from the US in October just 29M bushels compared to 125M last year. South American weather currently going well although talk of La Nina and when it will hit and the associated consequences. Brazil has 86% of first crop corn in and 91% of the bean crop in the ground. Matif rapeseed was bouncing forward with Feb-22 settling up €15.75 on Friday at €693.50/t. |

Contact the ADMISI Grains and Oilseeds Derivatives Brokerage team

Hanne Bell, Ryan Easterbrook, Dominic Enston, Aaron Stockley-Isted

Phone: +44 (0)20 7716 8477 or +44 (0)20 7716 8140 Email: intl.grains@admisi.com

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice. ADM Investor Services International Limited, registered in England No. 2547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG. A subsidiary of Archer Daniels Midland Company.

© 2021 ADM Investor Services International Limited

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice.

ADM Investor Services International Limited, registered in England No. 2547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG.

A subsidiary of Archer Daniels Midland Company.

© 2021 ADM Investor Services International Limited.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.