ADMISI London Wheat Report for 21 June

- June 22, 2023

- ADMISI Grains Team

- Follow us on Twitter @TradeADMIS

London Wheat Report

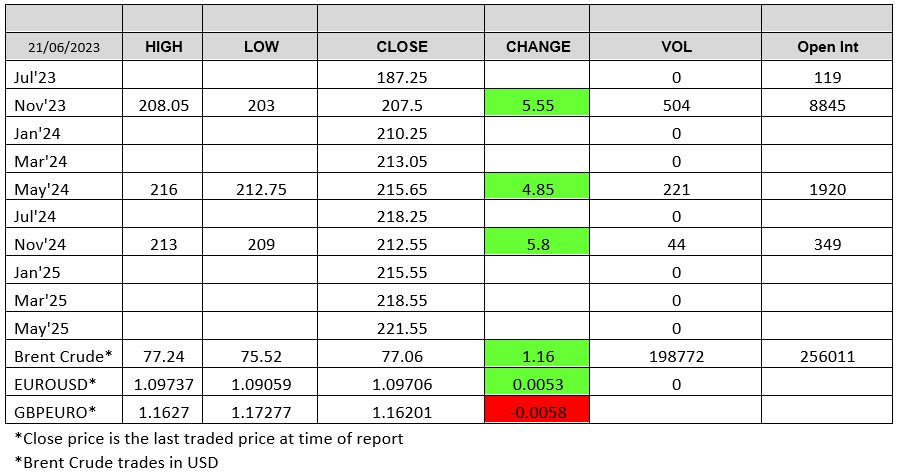

Source: FutureSource

Global Ag markets followed King Charles at Royal Ascot, off to the races!! There was bullish news everywhere!! At this point it’s harder to tell what makes better viewing, the Ashes test which ended in a nail biting finish last night, or todays Corn, Wheat and Soybean markets…??

The Biden administration on Wednesday increased the amount of biofuels that oil refiners must blend into the nation’s fuel mix over the next three years, but the plan has angered the biofuel industry, which says mandates for corn-based ethanol and biodiesel are not high enough. Corn prices had a double whammy of bullish news today, Bidens biofuels mandate along with weather concerns continuing in the key Midwest areas raised concerns of crop conditions and supply issues. The U.S. Department of Agriculture cut its corn and soy crop ratings more than expected on Tuesday, including steep drops in top-producing states Iowa and Illinois, as a deepening drought stressed crops in the heart of the Midwest farm belt.

Soybean markets were up over 30 cents at the time of writing off the back of the above mentioned Biden Biofuels mandate. Soybean Meal however was trading limit down pretty much all day which should see extended limits tomorrow if it settles this way.

India’s wheat harvest in 2023 is at least 10% lower than the government’s estimate, a leading trade body told Reuters on Wednesday, amid a sharp rise in local prices during the past two months.

The Kremlin on Wednesday restated its position that there are “no grounds” to extend the Black Sea grain deal, saying that the Turkish- and United Nations-brokered accord was not being properly implemented.

Germany’s 2023 wheat crop of all types will fall 2.9% on the year to 21.87 million metric tons, the country’s association of farm cooperatives said in its latest harvest estimate on Wednesday, as plants suffered from dry, hot weather. The association forecast Germany’s 2023 winter rapeseed crop will fall 3.1% to 4.14 million metric tons. This was down from its May forecast of a German 2023 wheat crop of 22.31 million metric tons and a winter rapeseed crop of 4.28 million metric tons.

Chicago wheat was trading up 30 cents at the time of writing across the curve as was Kansas wheat. Min’ wheat also gained double digits and was trading up 15 cents. European wheat had a strong day Sep 23 was at one point trading up 9 euros on yesterday’s sett, but cooled a little off the top to be up around 6 euros. London Wheat followed US and European wheat markets and saw large gains. On average across the curve, the market gained around £5. Volumes were pretty strong with around 800 lots crossing the line.

Contact the ADMISI Grains and Oilseeds Derivatives Brokerage team

Hanne Bell, Ryan Easterbrook, Dominic Enston and Aaron Stockley-Isted

Phone: +44 (0)20 7716 8477 or +44 (0)20 7716 8140 Email: intl.grains@admisi.com

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice. ADM Investor Services International Limited, registered in England No. 2547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG. A subsidiary of Archer Daniels Midland Company.

© 2023 ADM Investor Services International Limited3

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice.

ADM Investor Services International Limited, registered in England No. 2547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG.

A subsidiary of Archer Daniels Midland Company.

© 2021 ADM Investor Services International Limited.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.