ADMISI London Wheat Report for 21 February

- February 22, 2023

- ADMISI Grains Team

- Follow us on Twitter @TradeADMIS

London Wheat Report

Source: FutureSource

US markets were back in action today after yesterday’s bank holiday. Vladdy was on the TV screens today stating that the West are seeking to stoke a global war to destroy Russia and reaffirmed his intention to double down on his Ukrainian project. He’s nearly as delusional as Mike Lynch. Biden rebutted this earlier today. Vladdy also suspended the nuclear treaty with the US although this is more statement rather than Defcon 4. Chinese top diplomat Wang Yi arrived in Moscow today and made some interesting statements insisting that the US was further propelling the war in Ukraine with additional weaponry and support (take note who is making the most from the Ukraine war economically and he isn’t too far from the truth).

Black sea chatter continues although people really are trying to make this a major bull story on the wheat front. Just take a look at the amount of grains that Russia intend to move and we can assume that they aren’t going to do anything too off piste unless somebody decides to torpedo a Panamax out of Odessa and really spice things up. India today announced an additional 2Mmt of wheat support to bulk consumers on their internal market to try and quell prices. Vladdy reiterated the Russian intention for 60Mmt grains exports by the end of 2023 – see the corridor comment previously. Jordan bought 60kt of wheat for July shipment. US weekly wheat inspections fall 21% to 373,429t, within expectations. Turkey have tendered for 790kt of milling wheat for Mar-May delivery. Russian wheat should wipe the floor on these tenders.

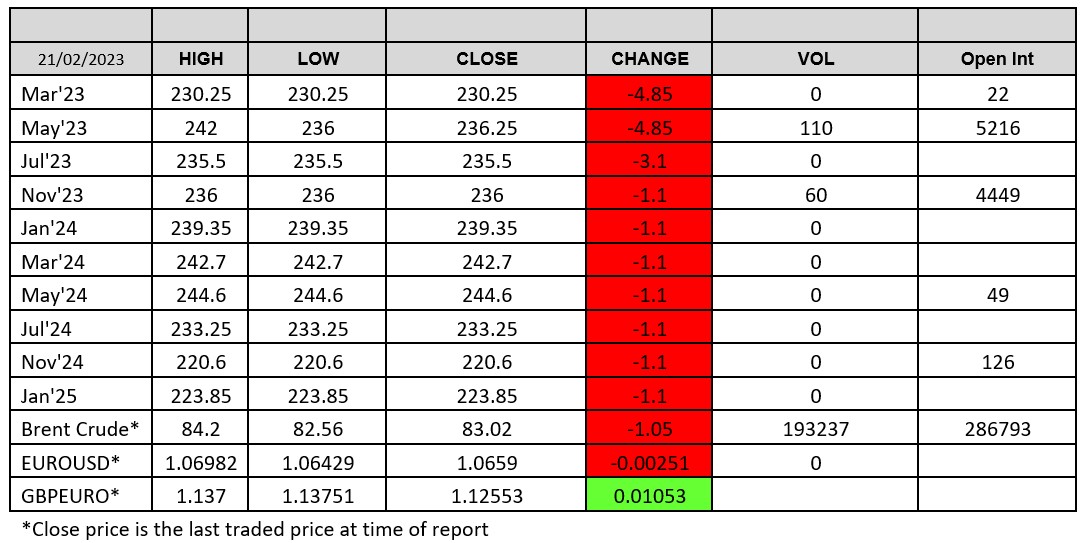

Matif wheat pushed lower on the back of Chicago pushing down alongside Indian and Russian announcements which go against the prospect of a Grains Deal standoff. Decent vols seen on both Mar & May 23. May-23 settled at €286.25, down €5.00 on yesterday. London wheat had quite an uninspiring day with a total of 170 lots traded and moved lower lead by Matif.

Dr Cordonnier lowered his Argentine soybean estimate by another 2Mmt to 34Mmt – quite a substantial difference to the 51Mmt anticipated at the beginning of the season. US weekly bean exports declined 6.8% to 1.58Mmt. Matif rapeseed May-23 settled up €3.75 on yesterday at €560.75/t.

Contact the ADMISI Grains and Oilseeds Derivatives Brokerage team

Hanne Bell, Ryan Easterbrook, Dominic Enston and Aaron Stockley-Isted

Phone: +44 (0)20 7716 8477 or +44 (0)20 7716 8140 Email: intl.grains@admisi.com

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice. ADM Investor Services International Limited, registered in England No. 2547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG. A subsidiary of Archer Daniels Midland Company.

© 2023 ADM Investor Services International Limited3

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice.

ADM Investor Services International Limited, registered in England No. 2547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG.

A subsidiary of Archer Daniels Midland Company.

© 2021 ADM Investor Services International Limited.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.