ADMISI London Wheat Report for 21 December

- December 22, 2022

- ADMISI Grains Team

- Follow us on Twitter @TradeADMIS

London Wheat Report

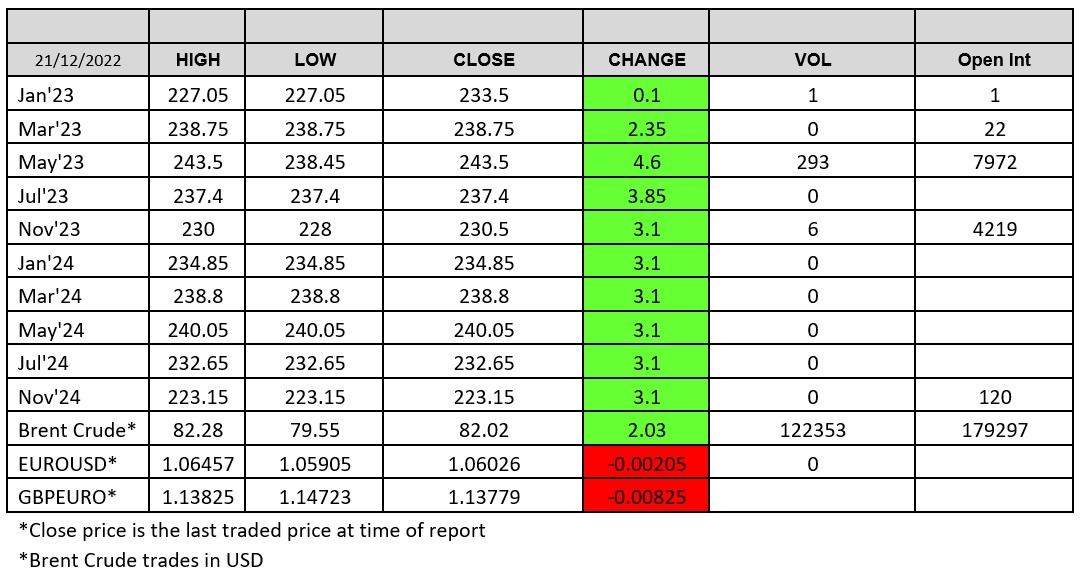

Source: FutureSource

Wheat markets globally were on the up today! Chicago wheat saw its highest gains since the start of December. There was little new news and the re-hashed story line of ‘’unfavourable Argentinian weather and crop doubts’’, along with ‘’unfavourable US weather’’ lead to firming of Wheat contacts. In Argentina according to the Hightower report “Planting is well behind, with only 50.6% completed as of Dec. 15. Conditions are reported at 19% good/excellent versus 85% last year. Some areas that would normally require replanting may be abandoned for this year.” Temperatures in the US are below freezing in the great planes and many question how much damage this will give to the wheat crop. Commodity funds were net buyers of CBOT soybeans, soyoil, corn, wheat and soymeal futures contracts on Tuesday, traders said. French wheat futures were up across the board. March Milling wheat was supercharged trading up to EUR 305.25/ Tonne +8.75 on the day.

Iraq were believed to have bought 150,000 tonnes of Australian wheat today, a larger amount than expected. The purchase was believed to involve around 100,000 tonnes bought at an estimated $461 a tonne and 50,000 tonnes bought at around $496 a tonne. Ukrainian grain traders union (UGA) have asked the government to give priority of electricity supplies to the grain silos in order to prevent damage to harvests. Production processing at grain storage facilities had become almost impossible due to Russia’s targeting of Ukraine’s energy infrastructure with missile and drone strikes since October, the UGA was quoted as saying in the 13 December report. With about 10M tonnes of grain storage capacity lost due to the ongoing conflict with Russia, the association said Ukraine could not “afford to lose the harvest that was collected with incredible efforts”. Just what the Ukrainian government will do off the back of this will be answered in the coming days/ weeks.

Another slow day on the London wheat market with around 250 lots traded across the board. Majority of the volume traded was on the May 23 contract with just over 200 lots. January 23 traded today for 1 lot @ 227.05 the last time January traded was 12th October 2022 at a price of £287.25/ Tonne. March 23 also saw a market quoted on screen. Although nothing was done, it shows some appetite to grow the 22 lots of open interest on this contract.

2…..days…..to……go…..

Contact the ADMISI Grains and Oilseeds Derivatives Brokerage team

Hanne Bell, Ryan Easterbrook, Dominic Enston and Aaron Stockley-Isted

Phone: +44 (0)20 7716 8477 or +44 (0)20 7716 8140 Email: intl.grains@admisi.com

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice. ADM Investor Services International Limited, registered in England No. 2547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG. A subsidiary of Archer Daniels Midland Company.

© 2022 ADM Investor Services International Limited

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice.

ADM Investor Services International Limited, registered in England No. 2547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG.

A subsidiary of Archer Daniels Midland Company.

© 2021 ADM Investor Services International Limited.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.