ADMISI London Wheat Report for 20 June

- June 21, 2023

- ADMISI Grains Team

- Follow us on Twitter @TradeADMIS

London Wheat Report

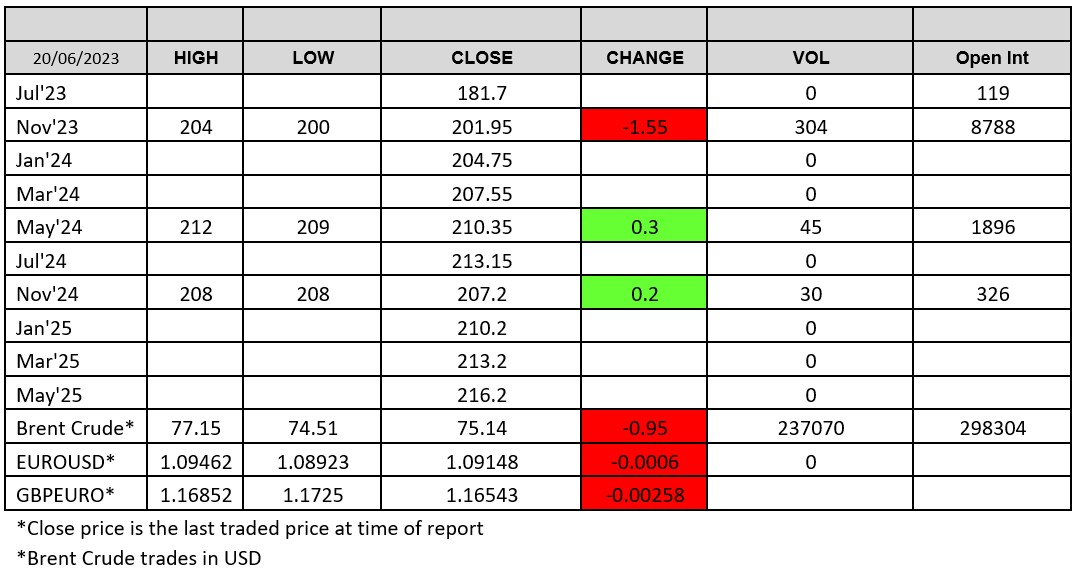

Source: FutureSource

Well plenty of political chatter in the headlines from Bojo’s special entry ban to Hunter Biden to pleading guilty to tax crimes but reached a deal on gun charge. Trumpy is still obviously carrying on the numerous trials. Titanic tourist sub still missing which is turning into quite a worrying rescue operation. US returns after the long weekend. China bump start fails to materialise as they continue to cut rates.

Weather excitement continues. Trade as a range in ideas for where we are going which is demonstrated. Majority of managed funds are bearish grains due to the lacklustre US exports and concern following global demand which I would say is the longer term market sentiment really. But, in the near term, a bit of exciting stress weather headlines affecting US corn and soybean crops are stressed, especially in the central belt. Rain is next forecast for next Tuesday so market’s eyes are peeled on forecasts. Expectations are for further USDA crop rating droppings later on this eve.

Algeria purchased a reported 630kt of wheat which will most probably be Russian due to keen price of $261.50/t c&f. Taiwan are tendering to buy 63kt of con and Japan is seeking 92kt of wheat in the latest tender. EU weekly wheat exports totalled 191kt led by Poland in week ending 19th June. Chicago wheat was jumping around and was kas trading back to unchanged at time of writing. Matif wheat was trading lower for most of the day with volumes stronger. London wheat Nov-23 hit a trading low of £200/t, but didn’t break through the £200 barrier.

China was hoovering up Brazilian beans, importing a reported 10.94Mt in May, 40% Y-O-Y while US shipments fell by 45.5%. Eyes on are the late planted soybeans with next Tuesday been quite a reckoner with crop ratings expected to fall by 2% to 3% in the ratings later on. Matif rapeseed was trading marginally lower on yesterday after Aug-23 dropped under €460/t earlier on in the day.

Contact the ADMISI Grains and Oilseeds Derivatives Brokerage team

Hanne Bell, Ryan Easterbrook, Dominic Enston and Aaron Stockley-Isted

Phone: +44 (0)20 7716 8477 or +44 (0)20 7716 8140 Email: intl.grains@admisi.com

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice. ADM Investor Services International Limited, registered in England No. 2547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG. A subsidiary of Archer Daniels Midland Company.

© 2023 ADM Investor Services International Limited3

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice.

ADM Investor Services International Limited, registered in England No. 2547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG.

A subsidiary of Archer Daniels Midland Company.

© 2021 ADM Investor Services International Limited.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.