ADMISI London Wheat Report for 2 August

- August 3, 2023

- ADMISI Grains Team

- Follow us on Twitter @TradeADMIS

London Wheat Report

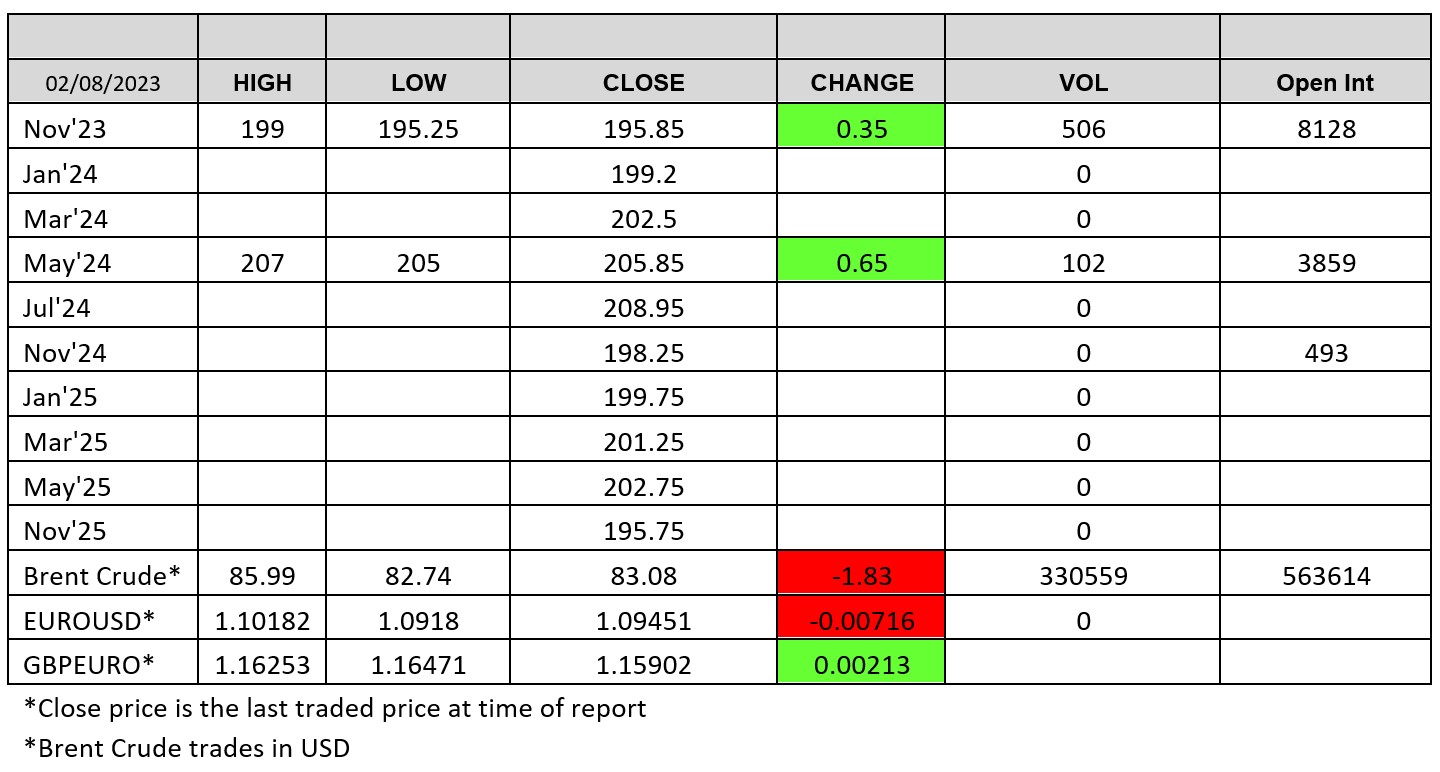

Source: FutureSource

Well, the Donald was charged yesterday afternoon which creates even more excitement on the US political scene. Fitch downgraded the US to AA+ from AAA yesterday evening, citing fiscal deterioration over the next three years and repeated down-to-the-wire debt ceiling negotiations that threaten the government’s ability to pay its bills. Brent was pushing lower and USD was higher.

A bit more pyro from the Kremlin this morning as a few more salvos hit some of the Danube ports although this, once again, appears to be more for show than ‘Operation Rolling Thunder’. Wheat markets bounced up on the back of this on the open, shooting up but quickly coming off again later in the morning. Chicago hit a trading high earlier on, Sep-23 hitting 684 before pulling back, trading around the 646 level later this afternoon at time of writing. Chicago market chatter is now focused very much on the prevailing rains in the states. Matif was also on the same trajectory, with Sep-23 hitting at trading high of €241/t before settling down €2.25 on yesterday at €233.75/t. Traded vols were good today. London followed the pattern but didn’t pull back as much as Chicago or Matif with the Nov-23 sitting around the £196/t level into the close.

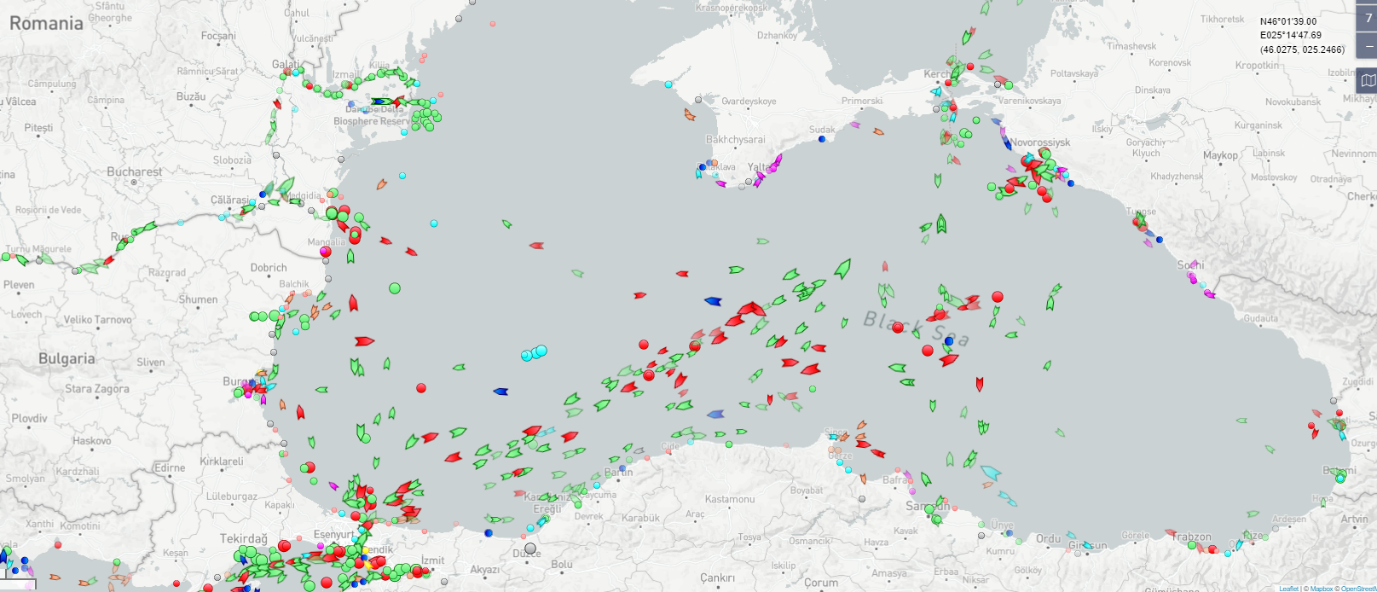

No matter what headlines we see about Black Sea grains stopping and not moving, I’ve always rolled my eyes at this – below is a screenshot from shipping tracker on the Black Sea, sent in by avid reader and ship tracking enthusiast Jeremey @ ADM Milling. As can be seen below, Danube line up and Novorossiysk lineup is pretty strong.

Tenders are incoming now and may be why the pyro has kicked up again, get that $250/t FOB Russian Black Sea prices up ….. I only speculate. Algeria have reported to have bought circa 700-800kt of all Russian/Balkan wheat at around $276 C&F. GASC have hit the market today for a large tender. Lowest offer apparently $250/t FOB Russian. Russia continues to be a very competitive seller and something we are going to see continuing throughout the season.

UK forecast is pretty dire until the weekend when we should supposedly get some sun, lodging is becoming more apparent and no doubt plenty of harvest students itching to turn on those twin beacons and roll some trailers.

China continues to buy US soybean cargoes. Brazil’s estimated soybean crop to reach a record 163.5Mmt for 2023/24 according to Stone. Oilseeds continue to flow out of the Danube as well as grains even though there are some market fears that this could become somewhat suppressed. Matif rapeseed had some gains today with Nov-23 kicking up, settling up €3.75 on yesterday at €444.50/t.

Contact the ADMISI Grains and Oilseeds Derivatives Brokerage team

Hanne Bell, Ryan Easterbrook, Dominic Enston and Aaron Stockley-Isted

Phone: +44 (0)20 7716 8477 or +44 (0)20 7716 8140 Email: intl.grains@admisi.com

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice. ADM Investor Services International Limited, registered in England No. 2547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG. A subsidiary of Archer Daniels Midland Company.

© 2023 ADM Investor Services International Limited3

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice.

ADM Investor Services International Limited, registered in England No. 2547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG.

A subsidiary of Archer Daniels Midland Company.

© 2021 ADM Investor Services International Limited.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.