ADMISI London Wheat Report for 19 April

- April 20, 2023

- ADMISI Grains Team

- Follow us on Twitter @TradeADMIS

London Wheat Report

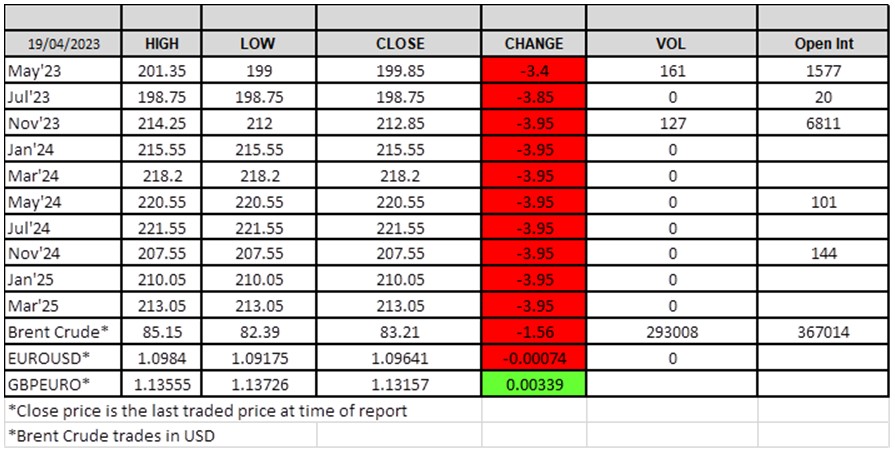

Source: FutureSource

Global wheat markets returned to the red after a two day hiatus at the start of the week. Unsurprisingly after the market remembered just how much wheat was out there, the Kremlin’s chatter around the grain deal was quickly forgotten.

As the market fell today, Russia continued its bullish propaganda and on Wednesday accused Ukraine of sabotaging the Black Sea grain deal by demanding bribes from ship owners to register new vessels and carry out inspections under the cover of a deal the United Nations hopes could ease a global food crisis. Inspections of ships carrying Ukrainian grain from the Black Sea resumed on Wednesday under a U.N.-brokered deal, but Kyiv said more time was needed to secure an extension of the initiative. Ukrainian Deputy Prime Minister Oleksandr Kubrakov wrote on Facebook that “ship inspections are being resumed, despite the RF’s (Russian Federation’s) attempts to disrupt the agreement”. Russia will probably harvest 123 million tonnes of grain in 2023, including 78 million tonnes of wheat, Agriculture Minister Dmitry Patrushev told a government meeting on Wednesday.

Poland agreed on Tuesday to lift a ban on the transit of Ukrainian grain and food products, but Ukraine said the wartime deal allowing it to safely ship grain from Black Sea ports was still under threat. Further to this, Reuters reported on Wednesday The European Union is preparing 100 million euros in compensation for farmers in five countries bordering Ukraine and plans to introduce restrictions on imports of Ukrainian grains. Bottlenecks led to the grain becoming trapped, forcing local farmers to compete with an influx of cheap Ukrainian imports they said lowered the value of their own crops.

Germany’s 2023 wheat crop of all types will fall 1.6 % on the year to 22.15 million tonnes, the country’s association of farm cooperatives said in its latest harvest estimate on Wednesday, repeating its earlier forecast of smaller harvests this year.

London May 23 open interest is declining but at a very small rate, the OI fell by just 50 odd lots overnight. 1577 lots remain open (not including today’s trade) although volumes today were nothing to shout about so don’t expect the number to fall by many tomorrow. This leads us to believe a large number of lots will be going to tender when the tender period opens on 25/04. May23/ Nov23 spread trading around £13 which is surprising many, a week ago the spread was trading at £20 and some believed it would continue and hit the £30 mark.

Contact the ADMISI Grains and Oilseeds Derivatives Brokerage team

Hanne Bell, Ryan Easterbrook, Dominic Enston and Aaron Stockley-Isted

Phone: +44 (0)20 7716 8477 or +44 (0)20 7716 8140 Email: intl.grains@admisi.com

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice. ADM Investor Services International Limited, registered in England No. 2547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG. A subsidiary of Archer Daniels Midland Company.

© 2023 ADM Investor Services International Limited3

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice.

ADM Investor Services International Limited, registered in England No. 2547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG.

A subsidiary of Archer Daniels Midland Company.

© 2021 ADM Investor Services International Limited.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.