Source: Future Source

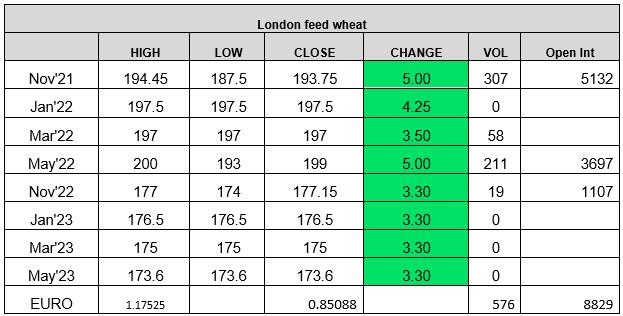

Wheat markets turned bullish today after yesterday’s fall back. European markets rallied while US markets were only marginally higher. Matif milling wheat SEP-21 surged up, with the last traded price being €9.25/t up on yesterday’s settlement price at €255.00/t. London wheat followed Matif with the last traded price for NOV-21 being £5.25/t up on yesterday’s settlement price at £194.00/t. The gains in the European markets are on the back of two large tenders which were finalised this week, Egypt and Algeria. Algeria’s state agency OAIC purchased around 230,000 tonnes of milling wheat in an international tender. OAIC also apparently indicated a willingness to accept wheat with the test weight quality of 76 against the usual 77 to 78. Traders expect the wheat to be sourced largely from Germany, Poland and the Baltic states. Egypt’s state grain buyer GASC said today that it has bought around 180,000 tonnes of wheat on tender to be source in Romania and Ukraine. 120,000 tonnes would be sourced from Romania and 60,000 tonnes from Ukraine.

Ukraine is likely to see grain exports increase to 57Mmt in the 2021/22 June-July season from 45.5Mmt in the 2020/21 season thanks to a bigger harvest, analyst APK-Inform said today. Kazakhstan expects its 2021 grain crop to fall by 24% to 15.3Mmt after drought hit the main producing regions according to the Agriculture Minister, Yerbol Karashkoyev. It is expecting to import around 8Mmt from neighbour Russia to make up the shortfall. Kazakhstan has a customs free zone with Russia and supplies are not subject to Russia’s export tax. Domestic Russian wheat supplies have hit new highs of Rbl18,000/t in a seeming desire to obtain nearby wheat supplies in view of an anticipated rapid increase in the export tax in the coming few weeks.

Rapeseed remains bullish with North American drought continuing to support global rapeseed value and domestic values. Today’s last traded price for Matif NOV-21 was down €0.75/t on yesterday’s settlement price at €574.00/t, remaining at record highs (AHDB). With statistics Canada production data not expected until 30 August meaning that this WASDE was the first insight into the drought damage.

Contact the ADMISI Grains and Oilseeds Derivatives Brokerage team

Hanne Bell & Ryan Easterbrook

Phone: +44 (0)20 7716 8477 or +44 (0)20 7716 8140 Email: intl.grains@admisi.com

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice. ADM Investor Services International Limited, registered in England No. 2547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG. A subsidiary of Archer Daniels Midland Company.

© 2021 ADM Investor Services International Limited

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice.

ADM Investor Services International Limited, registered in England No. 2547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG.

A subsidiary of Archer Daniels Midland Company.

© 2021 ADM Investor Services International Limited.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.