ADMISI London Wheat Report for 17 August

- August 18, 2023

- ADMISI Grains Team

- Follow us on Twitter @TradeADMIS

London Wheat Report

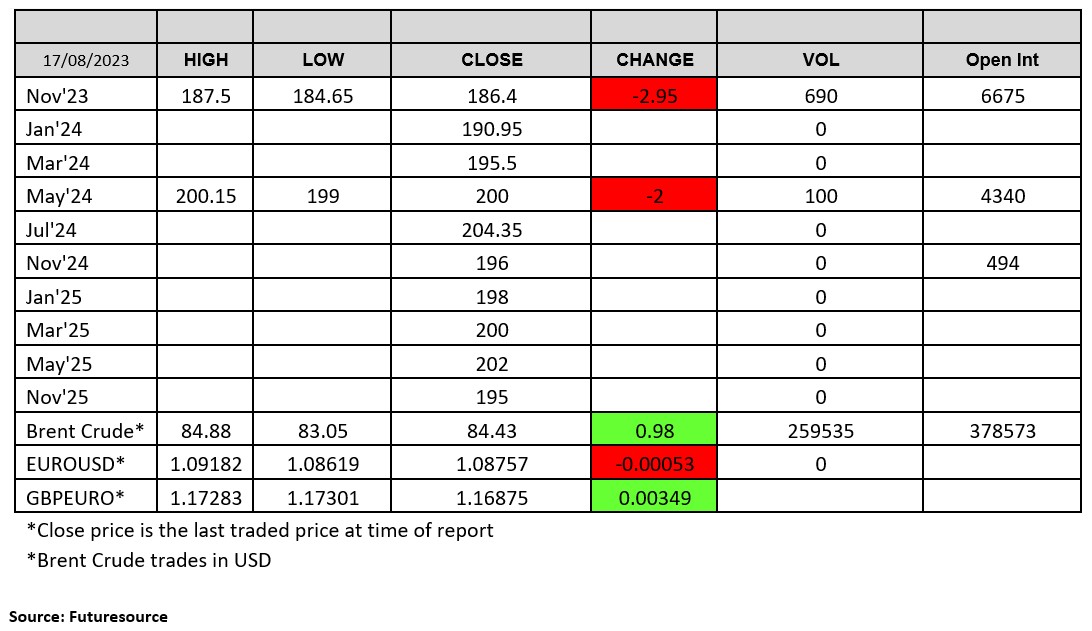

Source: FutureSource

Things kicking off in Pakistan after rioting around the Christian settlement areas heats up. China are selling USD to purchase Yuan as the currency depreciates. Russian ruble strengthens back towards 90 to the dollar, with 80 – 90 bracket being seen as satisfactory in current conditions for the Kremlin. Reports that currency controls are not on the cards as of yet, nor the rumored announcements for Russian companies to be made to exchange their foreign currency or domestic. British Museum has realised that one of their curators had woolly fingers as artefacts have been going walkies slowly from the vaults ….. First container ship that has been stuck in Odessa since the outbreak of the war set sail yesterday in Ukraine’s humanitarian corridor with more expected to follow.

Wheat markets pretty bearish today in both the US and Europe. Rumour mill carries on about India doing a deal on Russian wheat to try and quell domestic prices which are surging – figures being thrown around are up to 5-6Mmt of Russian wheat at discount. No issues with the vols they are having. US weekly wheat sales fell 37% to 359,500t with exports declining 35%. Rouen’s wheat exports are up 63% on week as Morocco are back again for more French wheat, especially with the increased competitiveness on Black Sea. Chicago wheat was trading lower with Sep-23 trading down 6 cents at time of writing and Matif Sep-23 settling down €1.75 on yesterday at €228/t. London wheat continued to plateau down, sitting around the £185/£186 level on Nov-23 for most of the afternoon. Volumes were pretty thin. UK physical side mixed as prices drop, farmers remain disengaged.

Oilseed complex remained supported. Plenty of additional rumours flying around the circuit that China are back in again for beans and that US beans hit the spot although nothing officially reported. US bean sales for the new season 23/24 have hit a reported 1.4Mmt for new crop. GASC bought 39.5kt of sunoil in their latest tender. Ukraine rapeseed exports continue to flow. Matif rapeseed was well supported with Nov-23 settling up €8.25 on yesterday at €468.25/t.

Contact the ADMISI Grains and Oilseeds Derivatives Brokerage team

Hanne Bell, Ryan Easterbrook, Dominic Enston and Aaron Stockley-Isted

Phone: +44 (0)20 7716 8477 or +44 (0)20 7716 8140 Email: intl.grains@admisi.com

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice. ADM Investor Services International Limited, registered in England No. 2547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG. A subsidiary of Archer Daniels Midland Company.

© 2023 ADM Investor Services International Limited3

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice.

ADM Investor Services International Limited, registered in England No. 2547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG.

A subsidiary of Archer Daniels Midland Company.

© 2021 ADM Investor Services International Limited.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.