Source: Future Source

US and European Ag markets continued from where they left off yesterday, pushing higher again in today’s trading. Following yesterday’s StatsCan report, Canada will be harvesting their smallest spring wheat crop since 2007 with the all-wheat crop implying exports of not more than 16 Mmt, some 10mmt below last year. US Gulf is coming back into life with Cargill Westwego and Reserve with Westwego back loading barges and Westwego now having the power to assess and repair structural damage. ADM and Louis Dreyfus have been back in action for several days now. Chicago Dec-21 was trading up 10 cents and Kansas Dec-21 was up 12 cents at time of writing.

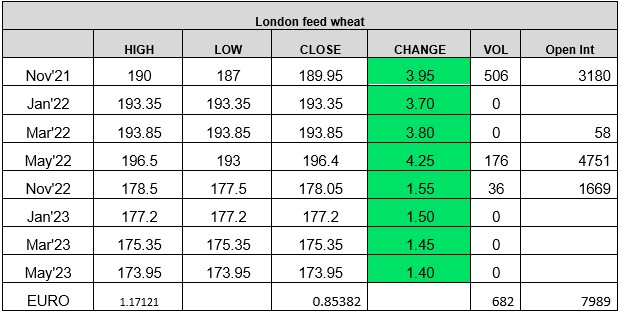

Matif wheat followed the US markets, Dec-21 settled up €5.50/t on yesterday at €248.50/t. Shipments of EU wheat continue with the total now running 45% above last year, with over 50% having come out of the Balkans and going to feed wheat destinations. Today brings the final French quality update from FAM, with expectations of just 25% making the Euronext milling wheat spec (9Mmt milling wheat). After Saudi and Algeria lowered their specs to 76kg, market rumours indicated that China had negotiated their French wheat purchases down to 75kg. Black Sea offers remain varied, with Ukraine discounting to clear export elevators ahead of the corn harvest. London futures followed Paris, settling up £3.95/t on yesterday at £189.95/t.

Argentina’s corn crop could grow to a record 55Mmt in the 21/22 season according to Buenos Aires grains exchange, booming an expanded planting area at the expense of 21/22 soyabeans. USDA announced cancelation of bean sales this morning, cancelling the 132kt sale to China and the 196kt sale to an unknown destination. Market news reported that China had snapped up quick ship purchases of Brazilian beans with Gulf issues delaying US shipments. Soybeans continue to extend on yesterday’s gains with Chicago Nov-21 soybeans up 9 cents on yesterday at the time of writing.

Contact the ADMISI Grains and Oilseeds Derivatives Brokerage team

Hanne Bell & Ryan Easterbrook

Phone: +44 (0)20 7716 8477 or +44 (0)20 7716 8140 Email: intl.grains@admisi.com

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice. ADM Investor Services International Limited, registered in England No. 2547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG. A subsidiary of Archer Daniels Midland Company.

© 2021 ADM Investor Services International Limited

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice.

ADM Investor Services International Limited, registered in England No. 2547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG.

A subsidiary of Archer Daniels Midland Company.

© 2021 ADM Investor Services International Limited.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.