ADMISI London Wheat Report for 15 November

- November 15, 2021

- ADMISI Grains Team

- Follow us on Twitter @TradeADMIS

London Wheat Report

Source: FutureSource

After last week’s gains in the global grains markets, today’s wheat markets have been mixed. Underlying fundamentals are still strong and prices remain at unprecedented highs although little fresh news to push higher. Tight global S/D and the Russian Ministry of Ag export curbs are keeping wheat markets alert. Will Russian farmers sell more prior to additional measures? Australian harvest has slowed due to rains across Queensland, NSW and WA but weather maps are showing a drier start to this week which should allow our friends down under to get the combines rolling. Tenders continue. Algeria announced a 50kt tender where they are also apparently changing the quality specs regarding bug damage which will definitely favour Black Sea wheat. Taiwan’s flour association has also issued a tender for 48kt of US wheat. Brazil has given the ok for Argentine GM flour but not GM wheat. Biden and President Xi are meeting at a virtual summit today. Trade believes that Xi will run rings around him regarding Ag related features and the phase 1 deal, China are nowhere near the purchasing quantities agreed and realistically will not achieve them. Chicago Dec-21 was trading up … and Kansas Dec-21 was trading down .. at time of writing.

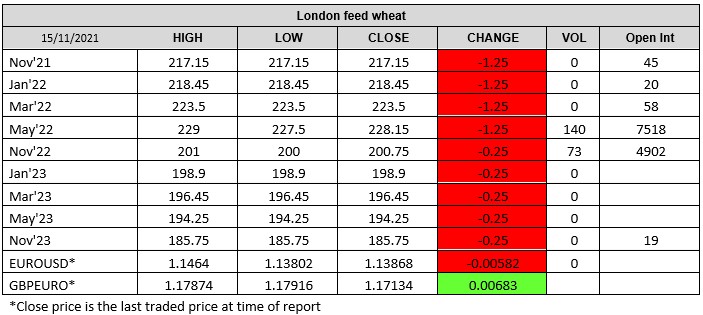

Matif futures pulled back in today’s trading with Dec-21 settling down €2.50 on Friday at €294.75 and Mar-22 settlles unchanged at €294.00. Russia chat has been the primary driving force sending Matif wheat to new records last week. With tax changes and export quota setting in from 15th Feb 2022, demand is anticipated to continue to keep European prices buoyant. London wheat followed Paris, with both May-22 and Nov-22 cooling off. Prices remain strong with Nov-22 still pushing over £200/t. Milling wheat premiums continue to rise, North West bread wheat (feb-22 delivery) gained another £5.00/t, averaging £292.50/t on Friday (AHDB).

US corn was down in today’s trading while Matif corn remained supported, much of this being currency related with the dollar hitting highs not seen since July 2020. Ukrainian corn exports are on par to last year, sat at circa 3.5Mmt so far this season with harvest 73% complete. Average yield so far for 61% of harvested area is 6.8t/ha, a record high for Ukrainian corn. Total average yield is anticipated to surpass the USDA’s expected 7t/ha. Turkey has reportedly purchased 325kt of corn for Dec-Feb delivery and the USDA announced 198kt of corn to Mexico. US weekly corn inspections exceeded expectations with 855,698t exported in the week ending 11th Nov, up 32% on prior week.

Contact the ADMISI Grains and Oilseeds Derivatives Brokerage team

Hanne Bell, Ryan Easterbrook, Dominic Enston, Aaron Stockley-Isted

Phone: +44 (0)20 7716 8477 or +44 (0)20 7716 8140 Email: intl.grains@admisi.com

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice. ADM Investor Services International Limited, registered in England No. 2547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG. A subsidiary of Archer Daniels Midland Company.

© 2021 ADM Investor Services International Limited

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice.

ADM Investor Services International Limited, registered in England No. 2547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG.

A subsidiary of Archer Daniels Midland Company.

© 2021 ADM Investor Services International Limited.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.