ADMISI London Wheat Report for 15 March

- March 16, 2023

- ADMISI Grains Team

- Follow us on Twitter @TradeADMIS

London Wheat Report

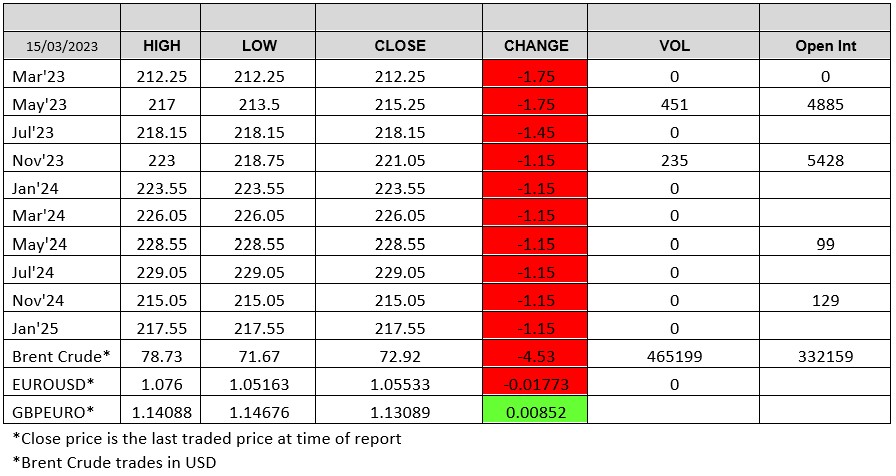

Source: FutureSource

Macro events were the story of the day today. Shares of European bank Credit Suisse plunged over 25% at their lows following news their largest shareholder wouldn’t increase its investment in the bank as it would trigger regulatory rules. Saudi National Bank is the largest shareholder with a 9.9% stake. Wheat Markets were well and truly turbulent today. Up down Up down was the theme of the day. Chicago overnight was up 9 cents, early morning was down 4 cents then at the time of writing back up 6 cents. Matif and London had a similar trend. London couldn’t quite bounce back up into the positive but found some late support to take it off its bottom.

Grain corridor chat continued today after yesterday’s announcement it was being extended for a further 60 days although some reports today say it wasn’t actually agreed, a sense of deja vu. Today, the middle man – Turkey has begun talks to extend the deal for a total 120 days. The Turkish minister Hulusi Akar said today “We started negotiations in line with the initial version of the deal. The continuation of the deal is important. We will continue our contacts (regarding its extension for) 120 days instead of two months,”

Ukraine’s grain exports for the 2022/23 season stood at 34.7 million tonnes as of March 15, hit by a smaller harvest and logistical difficulties caused by Russia’s invasion, agriculture ministry data showed on Wednesday. The ministry gave no comparative data for the same date in 2022. It said Ukraine had exported 44.8 million tonnes of grain as of March 27, 2022.

Jordan’s state grain buyer has issued an international tender to buy up to 120,000 tonnes of milling wheat, which can be sourced from optional origins with a deadline of March 21st.

FranceAgriMer on Wednesday kept its monthly forecast of French soft wheat exports outside the European Union in the 2022/23 season unchanged at 10.45 million tonnes. In a supply and demand outlook for major cereal crops, the office slightly cut its forecast for 2022/23 French soft wheat exports within the 27-member bloc to 6.51 million tonnes from 6.59 million previously.

Contact the ADMISI Grains and Oilseeds Derivatives Brokerage team

Hanne Bell, Ryan Easterbrook, Dominic Enston and Aaron Stockley-Isted

Phone: +44 (0)20 7716 8477 or +44 (0)20 7716 8140 Email: intl.grains@admisi.com

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice. ADM Investor Services International Limited, registered in England No. 2547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG. A subsidiary of Archer Daniels Midland Company.

© 2023 ADM Investor Services International Limited3

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice.

ADM Investor Services International Limited, registered in England No. 2547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG.

A subsidiary of Archer Daniels Midland Company.

© 2021 ADM Investor Services International Limited.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.