London Wheat Report

Well the ARM listing in New York is filling headlines this afternoon as indicated to open well above its initial valuation on Nasdaq. ECB raised interest rates to a record high as it continues to battle with inflationary pressures, hitting an unprecedented 4% in the most aggressive cycle of interest rate rises in its history. BOE anticipated to raise rates again next week. USD hit new highs on the back of the ECB’s interest rate rises.

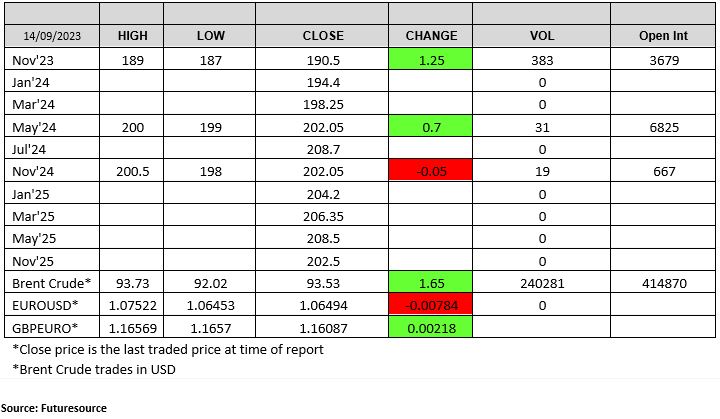

Wheat markets mixed today with Chicago marginally down while Matif was supported on some strong export data. Rouen total weekly exports surged to 225kt, up 276% W-O-W. US weekly wheat sales climbed 18% to 437,900t with exports rising 30%. Iran reportedly bought 240kt of Russian wheat in the past week and Japan bought 118,490t of wheat in its regular weekly tender. Russian what exports continue to be stable with Black Sea ports maintaining high shipping vols. So far this marketing year, 11.6Mmt has been shipped, up 72%. UK lack of farmer selling does have the trade head scratching over the true crop size and availability of surplus. Quite day on physical markets today. Matif was supported into the close, trading above the €241 levels with strong volumes seen on December, over 55k contracts traded. London wheat had a steady day, although trade was seen across Nov 23, May 24 and Nov 24.

Oilseed complex was supported today on both sides of the pond. US weekly soybean export sales dropped to 703,900t for marketing year 23/24. US weekly corn net sales totaled 753,300t, within trade estimates. Showers are to benefit Brazilian corn and soybean sowing. Ukraine’s weekly oilseed exports up 21% with 312kt declared. Matif rapeseed had a strong day trading with Nov-23 settling up €15 on yesterday at €446.25/t.

Contact the ADMISI Grains and Oilseeds Derivatives Brokerage team

Hanne Bell, Ryan Easterbrook, Dominic Enston and Aaron Stockley-Isted

Phone: +44 (0)20 7716 8477 or +44 (0)20 7716 8140 Email: intl.grains@admisi.com

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice. ADM Investor Services International Limited, registered in England No. 2547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG. A subsidiary of Archer Daniels Midland Company.

© 2023 ADM Investor Services International Limited3

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice.

ADM Investor Services International Limited, registered in England No. 2547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG.

A subsidiary of Archer Daniels Midland Company.

© 2021 ADM Investor Services International Limited.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.