Source: Future Source

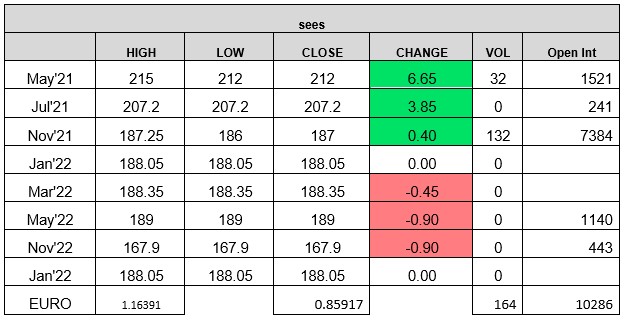

Two anticipated reports released today, but May21 London wheat was more the spectacle. Trading up 9.95 to 215.00, albeit on relatively thin volume. We still have a 1,500 lot OI on the May21 position with only 7 days left until expiry.

US wheat ending stocks came in higher than expectations for old crop and new, but with global ending stocks slightly lower there wasn’t much change in the picture.

US soybean 20/21 S+D was left unchanged from April, continuing with the 2.6% stocks to use ratio. The 21/22 figure wasn’t much better with the stock to use ratio pegged at 3.2%. The market remains in a steep uptrend.

US corn 21/22 ending stocks at 1.507 billion bushels vs trade estimates of 1.327 billion bushels gave the report a bearish sentiment, but with the USDA using a record yield a weather story could quickly change this. USDA pegged the Brazillian crop at 102mmt, below avg estimates of 103.4mmt. Some still feel that with the lack of rain this could be a fair bit lower.

Brazil’s CONAB issued their 20/21 corn crop forecast, seen at 106.413 mmt vs 108.966 in April. Some were worried about a number closer to 90 mmt.

Contact the ADMISI Grains and Oilseeds Derivatives Brokerage team

Hanne Bell & Ryan Easterbrook

Phone: +44 (0)20 7716 8477 or +44 (0)20 7716 8140 Email: intl.grains@admisi.com

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice. ADM Investor Services International Limited, registered in England No. 2547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG. A subsidiary of Archer Daniels Midland Company.

© 2021 ADM Investor Services International Limited

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice.

ADM Investor Services International Limited, registered in England No. 2547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG.

A subsidiary of Archer Daniels Midland Company.

© 2021 ADM Investor Services International Limited.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.