Source: FutureSource

US government and banks are closed today for Colombus Day with USDA inspections and crop progress report will be out tomorrow alongside the October WASDE figures. US ag markets remain mixed, awaiting tomorrow evening’s USDA S/D figures where the expectations are that the USDA will trim US corn yield but raise US stocks, according to a poll by Refinitiv. US and global wheat stocks are expected to be cut. Japan’s agricultural ministry has booked in a total of 131kt of US, Canadian and Australian wheat after concluding a tender, price tbc. Chicago Dec-21 was trading UP a quarter of a cent and Kansas Dec-21 was trading down 2 cents at time of writing. The below chart is taken from Friday’s CFTC report.

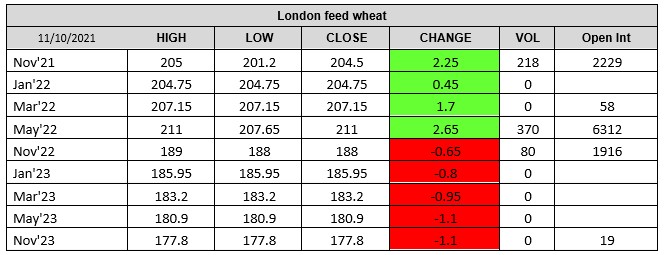

European wheat prices rose last week which in turn pushed up London feed wheat. Speculation surrounding the Russian export curbs and tenders from the importing countries helped keep prices buoyant. Russian wheat export tax will rise $0.90/t to $58.70/t this week according the Agricultural Ministry. Defra have released their figures today for the 2021 UK wheat crop at 14Mmt, substantially up from last year’s 9.7Mmt but below the trade expected figure which is around 15Mmt. This differs from industry information and the AHDB’s harvest reports. UK barley crop is provisionally 7.1Mmt, down from 8.1Mmt harvested last year. Matif Dec-21 settled down €0.50 on Friday at €268.50/t and May-22 settled down €0.25 on Friday at €259.50/t. London Nov-21 settled up £2.25 on Friday at £204.50/t and May-22 settled up £2.65 on Friday at £211/t. Full spec bread wheat (13% protein, 250s & 76kg/hl) delivered to the North West Nov-21 was quoted at £255.50/t (AHDB).

Soybean continues to be under pressure. US harvest has been a key pressuring factor for prices in recent weeks. As of 3rd October, US soybean harvest was 34% complete and this week’s crop progress report will be released tomorrow. Pre-WASDE trade estimates are for increased stocks of soyabeans on the month at both US and world level. Matif rapeseed continued to fall back with Nov-21 settling down €17.00 on Friday at €650.50/t and May-22 settled down €18.50 at €630.75/t. Still strong prices.

Contact the ADMISI Grains and Oilseeds Derivatives Brokerage team

Hanne Bell, Ryan Easterbrook, Dominic Enston, Aaron Stockley-Isted

Phone: +44 (0)20 7716 8477 or +44 (0)20 7716 8140 Email: intl.grains@admisi.com

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice. ADM Investor Services International Limited, registered in England No. 2547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG. A subsidiary of Archer Daniels Midland Company.

© 2021 ADM Investor Services International Limited

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice.

ADM Investor Services International Limited, registered in England No. 2547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG.

A subsidiary of Archer Daniels Midland Company.

© 2021 ADM Investor Services International Limited.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.