Source: Future Source

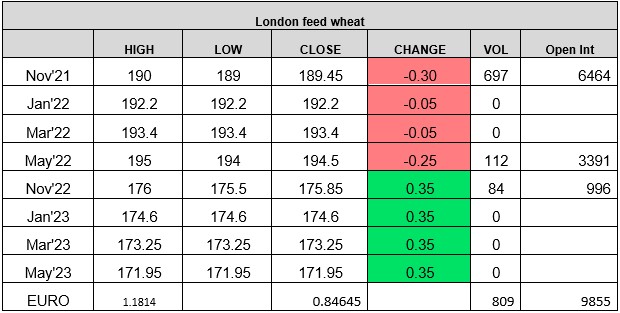

London wheat experienced a buoyant day’s trading, with 233 lots trading at £190/t in this morning’s trading and 809 lots trade across the board. Trading either side of unchanged, we managed tosettle a touch lower on the day despite the last trade at 190.00. Continued rain and cool temperatures in France alongside the tight domestic supply pre harvest has supported prices. Matif milling wheat opened a touch lower but this didn’t last long, and was soon setting new contract highs again, despite softer Chicago wheat. Chicago wheat cooled as focus turns to tomorrow’s USDA world crop report. A rally in the dollar to a four-month high against the euro has capped gains in Chicago while lending additional support to Matif prices.

Strong Russian cash prices and the and the downgrading of the 2021 wheat crop forecast further have continued to support Black Sea Wheat. IKAR cut its forecast for the 2021 wheat crop to 77Mmt from 78.5Mmt due to lower estimates in the central, Volga and Ural regions. Sovecon has also announced a cut to its forecast from the previous figure of 76.4Mmt, rumored to be around 75Mmt, but is yet to confirm. Ukraine expects a record grains harvest of 75.8Mmt according the Agrarian Policy and Food Ministry with anticipated exports of 21Mmt of wheat and 31Mmt of corn.

Rapeseed prices continue to be bullish, both on the EU and Canadian markets. Matif rapeseed Nov-21 was up by €7.00/t on yesterday’s settlement price to €553.00/t. This season has started with a relatively tight supply situation with European and Black sea harvest experiencing delays. There is also no hiding from the Canadian situation which has supported 2021 rapeseed prices. UK delivered OSR prices have reached historic highs in recent weeks with delivered OSR into Erith quoted £458.50/t, £119.00/t higher than Aug 2020 and £130.90/t higher than the 5-year average (AHDB).

The immediate outlook is all about tomorrow’s USDA WASDE report, and what may and may not be adjusted

Contact the ADMISI Grains and Oilseeds Derivatives Brokerage team

Hanne Bell & Ryan Easterbrook

Phone: +44 (0)20 7716 8477 or +44 (0)20 7716 8140 Email: intl.grains@admisi.com

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice. ADM Investor Services International Limited, registered in England No. 2547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG. A subsidiary of Archer Daniels Midland Company.

© 2021 ADM Investor Services International Limited

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice.

ADM Investor Services International Limited, registered in England No. 2547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG.

A subsidiary of Archer Daniels Midland Company.

© 2021 ADM Investor Services International Limited.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.